[ad_1]

Policymakers around the world deployed significant support measures to mitigate the impact of the Covid-19 shock on the real economy (Baldwin and Weder di Mauro 2020). The introduction of mortgage payment holidays in the UK encouraged lenders to offer a full suspension of mortgage payments for a maximum of six months, without affecting households’ credit risk scores. Given the novelty of the policy, in a new paper we study whether these payment holidays have helped households, especially those more vulnerable, smooth their consumption during the pandemic (Albuquerque and Varadi 2022). Our main findings support the view that, by supporting consumption of liquidity-constrained households, payment holidays may have been instrumental in mitigating the negative aggregate shock on the real economy experienced during the pandemic.

Transaction-level data track mortgage payment holiday usage well

Mortgage payment holidays allow mortgagors to suspend their mortgage payments (principal and interest), without changing their credit risk score. The initial guidance on the policy’s implementation, issued by the Financial Conduct Authority (FCA) early in 2020, encouraged lenders to offer mortgage payment deferrals for a maximum period of three months. This was later extended in June and November 2020 to six months (FCA 2020). According to UK Finance (UK Finance 2020) and the FCA (FCA 2021), roughly one out of five mortgagors accessed payment holidays at some point during the pandemic.

We use daily data from Money Dashboard (MDB), a UK online personal budgeting application, to examine who accessed mortgage PH and how it affected mortgagors’ consumption behaviour. The MDB app allows users to link their current accounts, savings accounts, and credit cards on one platform. It then collates the financial transactions and groups them into nearly 290 buckets, such as mortgages, gas bills or groceries. Our final monthly sample consists of a panel of 13,220 users from January 2019 to November 2020.

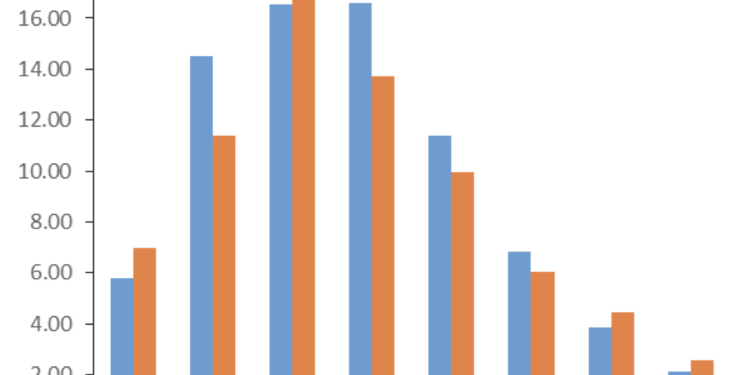

We assume a payment holiday was received if a household’s mortgage payment disappears from March 2020 onwards, and resumes within the following one to six months. Figure 1 shows that our data are able to track the proportion of payment holidays reported by UK Finance. At the peak, in May 2020, around 17% of all mortgages were on a payment holiday, with the proportion declining gradually to around 2.5% in October 2020.

Figure 1 Mortgage payment holiday usage in MDB versus aggregate data

Mortgage payment holidays were accessed by vulnerable and stronger households, including buy-to-let investors

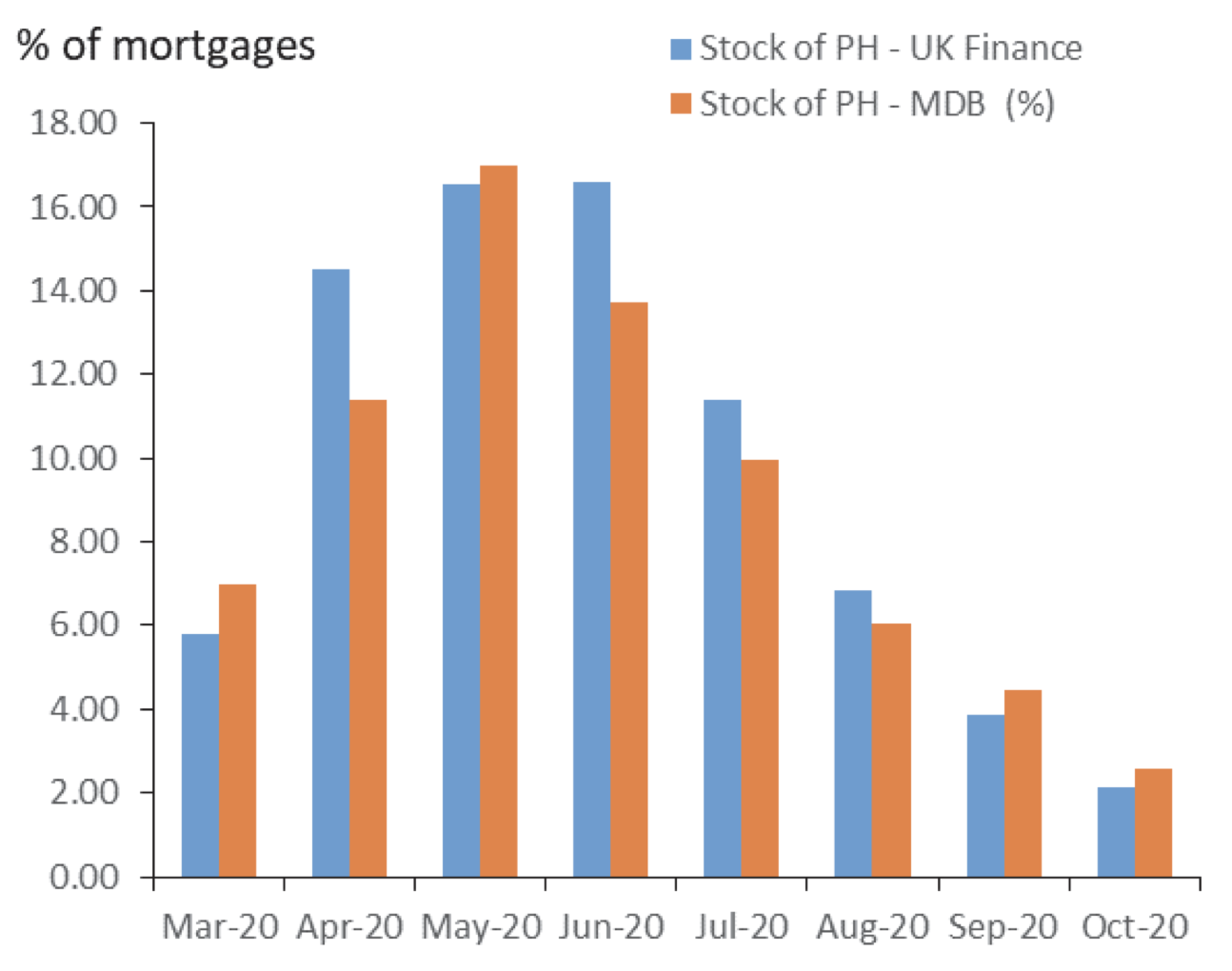

Using a Probit model across the sample of mortgagors, we estimate the probability of receiving a payment holiday conditional on a set of household characteristics. First, we find that payment holiday take-up was higher than average for more vulnerable households, such as those with low saving rates or those whose income decreased during the pandemic (Figure 2). Second, mortgagors with low debt-to-service ratios (DSR), i.e. those in the lowest quintile, were less likely to have a mortgage payment holiday compared to the most indebted mortgagors (DSRs in the top quintile). This is in line with the US evidence showing that forbearance rates were higher among households facing tighter credit constraints (Cherry et al. 2021, Haughwout et al. 2021).

Third, we find that payment holidays were also accessed by borrowers with stronger balance sheets, such as those with financial income or with multiple mortgage repayments per month, who are more likely to be property investors. Hence, some households may have accessed payment holidays for reasons other than financial constraints, such as precautionary reasons.

Figure 2 Estimated probability of mortgage payment holidays (among mortgagors) conditional on household characteristics

Identification of causal effects of mortgage payment holidays on household consumption

We next assess whether payment holidays were able to support consumption of mortgagors. Our main identification approach is based on quasi-experimental two-way fixed effects difference-in-differences (DiD) model. In our model, the treatment – i.e. the payment holiday – is temporary and lasts for a period between one and six months, and can occur anytime between March and November 2020.

We identify the causal effects of payment holidays on consumption by comparing their mortgagors’ behaviour against a control group formed of households not eligible for the policy, i.e. renters and outright owners (Albuquerque and Varadi 2022). This approach allows us to eliminate bias from unobserved factors across mortgagors, such as financial literacy, that may determine self-selection into the policy. We also show that pre-treatment trends in consumption were comparable between treated and non-treated households before March 2020, which provides validity to our DiD research design.

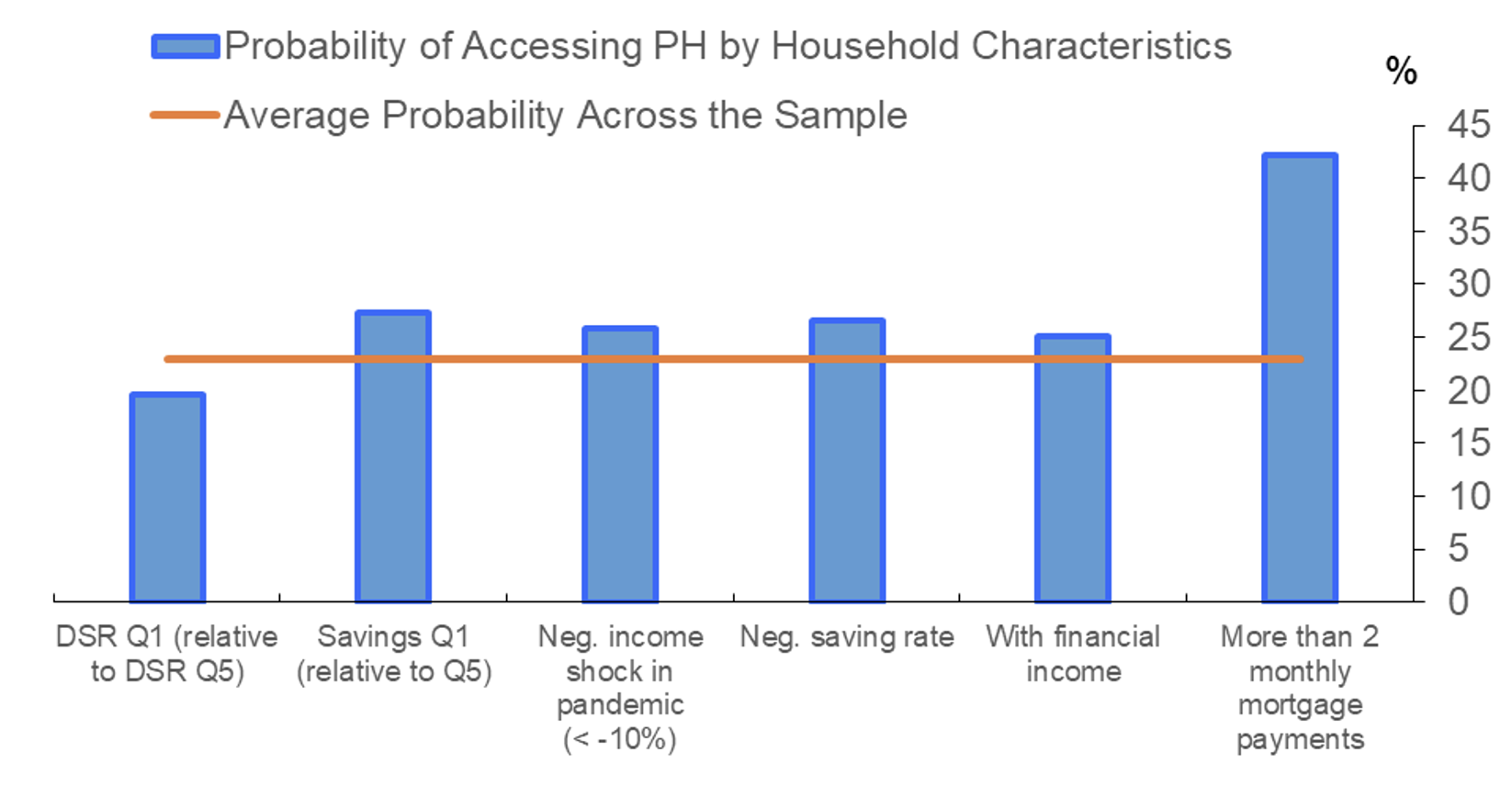

Our main finding points to an important role played by mortgage payment holidays in supporting consumption of liquidity-constrained households, defined as mortgagors with a very low or negative saving rate. Specifically, liquidity-constrained mortgagors had 22 percentage point higher year-on-year real consumption growth compared to similar liquidity-constrained households who were not eligible for the policy (Figure 3). Our results are robust to different measures of liquidity constraints. Our finding is in line with Ganong and Noel (2020), and Agarwal et al. (2015), who find that reductions in mortgage payments through maturity extensions as part of the 2009 US HAMP scheme had large effects on consumption and on the probability of defaulting.

By contrast, we do not find any statistical evidence that the average unconstrained household on a payment holiday changed its consumption relative to the control group. This suggests that these households may have taken a payment holiday for reasons other than financial constraints. Instead, we find that the average unconstrained household on a payment holiday uses the additional funds from to increase savings. Our results are robust to controlling for local and regional shocks, supporting our finding that the differential consumption behaviour of mortgagors on PH was most likely the result of the liquidity relief provided by the policy.

Figure 3 Marginal percentage point change in real non-housing consumption growth for mortgagors on a payment holiday relative to non-eligible for the policy

Notes: Asterisks, ***, denote statistical significance at the 1% level. The bars show the average percentage point difference in real non-housing consumption growth between mortgagors on PH and the control group over March – November 2020.

Our results also remain strongly consistent when using two alternative methods for identifying the impact of mortgage payment holidays on consumption. First, we use a synthetic control method, which computes the control group using a weighted combination of untreated units (Abadie et al. 2010). Second, we use propensity score matching, where households in the control group are chosen if their characteristics – such as income, savings, age, etc. – closely resemble those for mortgagors on a payment holiday.

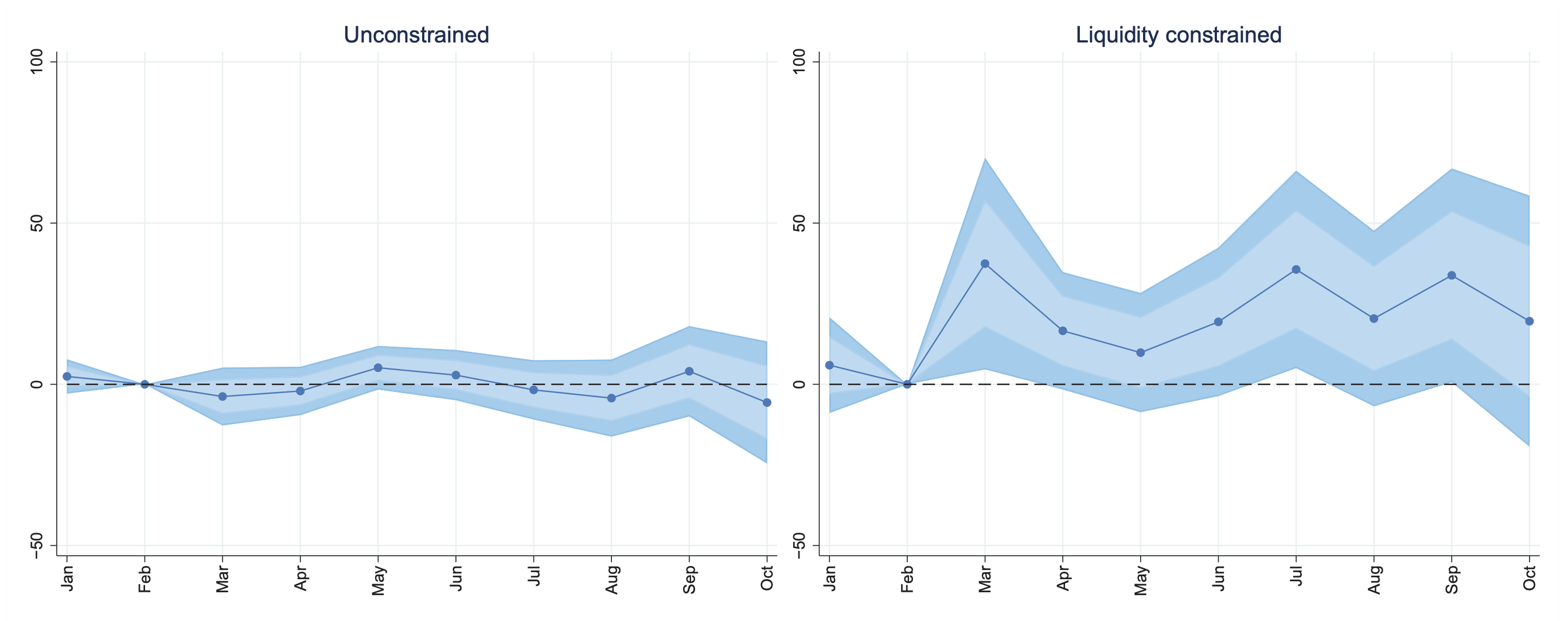

We also examine the monthly consumption response of mortgagors on a payment holiday relative to the control group (Figure 4). We do not find any statistically significant effect of mortgage payment holidays on consumption for unconstrained borrowers across any of the pandemic months. In contrast, the consumption response of liquidity-constrained mortgagors was mainly concentrated across two months: March and July 2020. These dates coincide with the introduction of the policy and to its first extension.

Figure 4 Monthly consumption response for households on a payment holiday vs non-eligible households

Notes: Response of year-on-year real non-housing consumption growth relative to February 2020 (base month) for households on PH relative to those not eligible for the policy (renters and outright owners). The blue areas refer to the 68% and 90% confidence bands.

Consumption effects when mortgage payment holidays expire

Mortgage payment holidays supported consumption of liquidity-constrained households while the policy was active. But it is also interesting to examine how consumption behaves when payment holidays expire and repayments resume. This could help policymakers understand if the temporary liquidity relief from a payment holiday increases consumption temporarily – while the policy is active – or if it has a longer-term effect on the consumption of financially constrained households.

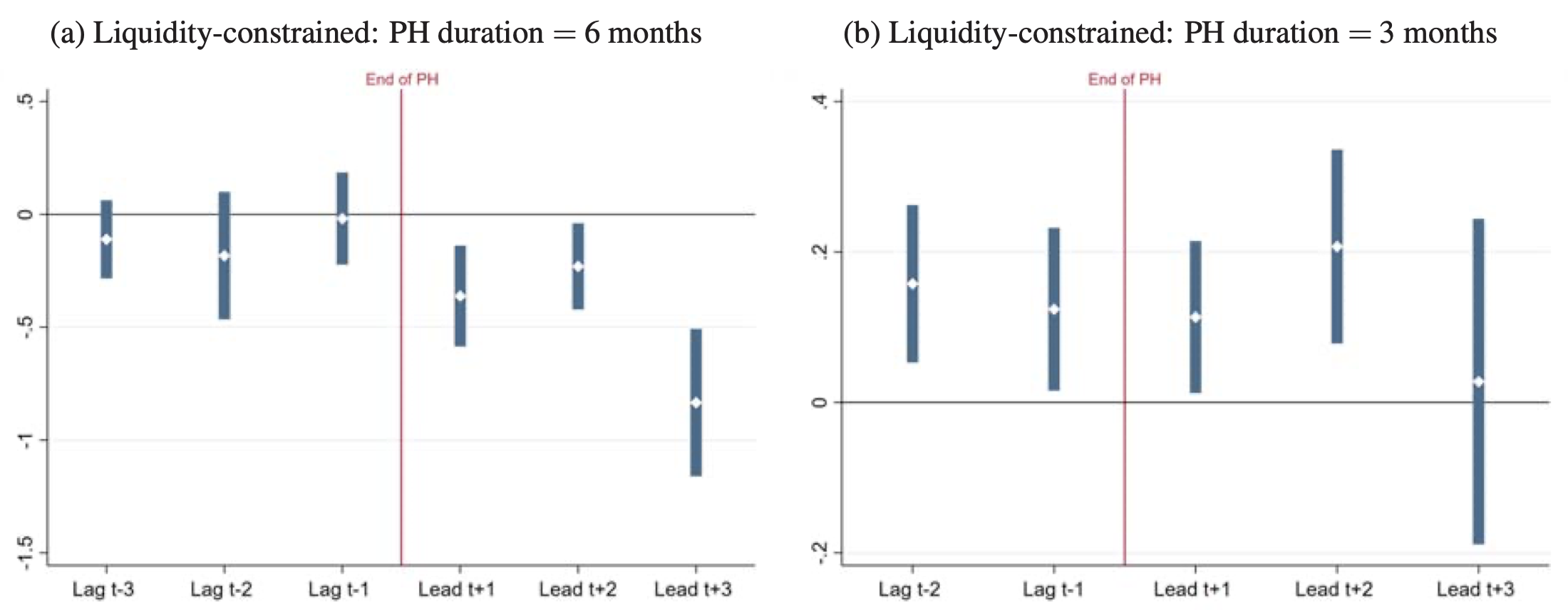

We find that liquidity-constrained households on a payment holiday for the maximum length allowed of six months decrease consumption when mortgage repayments resume (left panel of Figure 5). But this result is not present for liquidity-constrained households on a shorter payment holiday duration (right panel of Figure 5). These results suggest that the duration of a temporary liquidity relief policy could matter for consumption dynamics. While it remains untested, we believe that this result could be driven by households’ financial situation. For instance, negative income shocks are correlated with a longer payment holiday duration. As such, losses in income during the pandemic may have further tightened financial constraints for some mortgagors who were already liquidity constrained. These households would then have an incentive to take a mortgage payment holiday for longer to be able to cope with their mortgage commitments. Once policy expires, struggling households hit hardest by income shocks would need to adjust their consumption downwards to keep their mortgage payments current.

Figure 5 Consumption dynamics around expiration date by payment holiday duration

Note: The figures show the response of log real non-housing consumption relative to the last month of PH (base month) for mortgagors who accessed the policy relative to those not eligible for the policy (renters and outright owners). The dark blue bars refer to the 90% confidence bands. The regression includes controls, and user and time fixed effects. Standard errors clustered at the household level.

Conclusion

We show that mortgage payment holidays were effective in supporting consumption of more vulnerable households during a period of financial difficulty. Our work thus provides encouraging signs about the role that payment holidays may have had in helping to avoid the repetition of a 2007-09-type recession, when unemployment and arrears increased dramatically as a result of a collapse in aggregate demand. In contrast, arrears remained at historically low levels during the pandemic in the UK. This suggests that mortgage payment holidays, potentially together with other policy interventions during the Covid-19 pandemic such as the furlough scheme, may have helped in keeping households current on their mortgages.

But we have also shown that households with stronger balance sheets have used the policy to boost savings instead of consumption. Whether these extra savings will be used to bolster consumption in the aftermath of the pandemic remains an open question.

Authors’ note: The views expressed in this column represent only our own and should therefore not be reported as representing the views of the Bank of England, the International Monetary Fund, its Executive Board, or IMF management.

References

Abadie, A, A Diamond and J Hainmueller (2010), “Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program”, Journal of the American Statistical Association 105(490): 493–505.

Agarwal, S, G Amromin, I Ben-David, S Chomsisengphet, T Piskorski, and A Seru (2015), “Home Affordable Refinancing Program: Impact on borrowers”, VoxEU.org, 1 October.

Albuquerque, B and A Varadi (2022), “Consumption effects of mortgage payment holidays during the Covid-19 pandemic”, Bank of England Staff Working paper 963.

Baldwin, R and B Weder di Mauro (2020), Mitigating the COVID economic crisis: Act fast and do whatever it takes, CEPR Press.

Cherry, S F, E X Jiang, G Matvos, T Piskorski and A Seru (2021), “Government and Private Household Debt Relief during COVID-19”, NBER Working Paper 28357.

FCA – Financial Conduct Authority (2020), “Finalised Guidance on Mortgages and Coronavirus: Payment Deferral Guidance”, November 2020.

FCA (2021), “Financial Lives 2020 survey: the impact of coronavirus”, February 2021.

Haughwout, A, D Lee, J Scally and W van der Klaauw (2021), “What’s Next for Forborne Borrowers?”, Liberty Street Economics, 19 May.

Ganong, P and P Noel (2020), “Liquidity versus Wealth in Household Debt Obligations: Evidence from Housing Policy in the Great Recession”, American Economic Review 110(10): 3100–3138.

UK Finance (2020), “Household Finance Review – Q4 2020”.

[ad_2]

Source link