[ad_1]

Interest rate rises maybe too little, too late

Ian Francis, the manager of CQS New City High Yield Fund (NCYF), has observed the marked shifts in central banks’ policy towards raising interest rates this year. He feels that, while recent rises are a move in the right direction, central banks’ caution – driven by concerns regarding the fragility of the global economy and the risk of repeating previous policy mistakes of tightening monetary policy into a slowdown – is leading to a very serious risk of inflation taking hold. He thinks inflation could become embedded at a potentially unsustainable level and that the UK economy is more vulnerable than those of Europe and the US. Reflecting this, financials and real assets account form a large part of NCYF’s portfolio. Ian has also been adding to NCYF’s overseas exposure at the margin and has been gradually edging up the portfolio’s exposure to equities.

High-dividend yield and potential for capital growth

NCYF aims to provide investors with a high-dividend yield and the potential for capital growth by investing mainly in high-yielding fixed interest securities. These include, but are not limited to, preference shares, loan stocks, corporate bonds (convertible and/or redeemable) and government stocks. The company also invests in equities and other income-yielding securities. The manager has a strong focus on capital preservation and is conservative in his approach to growing NCYF’s capital.

Manager’s view – central banks’ rate rises are dangerously behind the inflation curve

Since the beginning of the year, central bankers in major developed markets have, in the face of rapidly rising inflation, been reversing their positions on the outlook for raising interest rates.

Following a significant increase in energy costs and household expenses more generally, The Bank of England’s MPC has raised its key rate three times from 0.25% to 0.5%, 0.75% and now 1%. The UK’s February move was followed shortly by announcement from the ECB of a sharp turnaround in its policy that would see its deposit rate raised to -0.25%, from -0.5% (a record low) by the end of the 2022 (the ECB having previously said there would not be a rate rise until at least 2023).

The US Fed then weighed in on 16 March 2022, increasing the funds rate by a quarter point to a range of between 0.25% and 0.5% – the first such increase since 2018, which was followed by a 50bp hike in May 2022, taking the rate to between 0.75% and 1%. The Fed has also indicated that it has earmarked a further five increases by the end of the year which, if it comes to pass, will be the fastest pace of tightening for in more than 15 years – in fact, Federal Reserve officials, including Jerome Powell and James Bullard, have continued to call for more aggressive hikes to curb inflation since the March hike.

Ian has long felt that central bankers would likely be behind the curve when it came to raising interest rates. A massive amount of stimulus has been injected into the global economy in an attempt to stave off the worse of the pandemic and, as restrictions eased, he thinks that it was inevitable that the effects of that stimulus would show up in inflation figures, even if central banks removed liquidity by ramping up quantitative tightening (QT). Comments from central bankers suggest that QT now seems more likely, although there is still a question mark over how quickly this might take place.

Ian feels that, with the global economy still precariously balanced in the aftermath of the pandemic, raising rates was always likely to be a challenge as central bankers would not wish to be responsible for choking off a nascent recovery. He says that there seems to be little appetite for repeating the 2011 policy mistake of Jean-Claude Trichet (then-ECB president and a well-known inflation hawk) who hiked interest rates for two consecutive quarters in the run up to the sovereign debt crisis (he also hiked rates in the run up to the GFC). This policy error ultimately served to accelerate the slow-down in the European economy and led to Trichet’s successor, Mario Draghi, making his “whatever it takes” speech. Ian thinks that central bankers’ cautious approach risks allowing inflation to take hold and become embedded. He thinks that further rises will be required to get the situation under control.

Ian notes that the lockdowns being imposed in China may take some of the froth out of the economy in the short-term, but these might only have a temporary effect.

Not a sterling bull – higher UK inflation a significant risk

Ian says that whilst he is happy to hold sterling credits, if they offer an appropriate risk-return ratio, he would not describe himself as being a sterling bull, at the current time. He thinks that, while the situation in Ukraine appears to have healed a lot of our divisions with the EU, the political situation in the UK is very uncertain and that with many transition agreements having come to an end, Brexit is now hurting a lot of UK businesses. He also thinks that, against this backdrop, inflation could be more damaging to the UK economy than in Europe and the US.

Ian points out that the UK has a tight labour market, which creates the potential for wages to move up quickly, feeding back into higher inflation through the wage-price spiral. However, Ian thinks that the labour market could tighten further from here. The pandemic has caused many workers to reassess their work-life balance and Ian thinks that the threat of restrictions has finally receded, workers will increasingly seek out jobs that they enjoy, rather than focusing primarily on wages. Some will choose to exit the labour market altogether, but others will look to alternatives, which he thinks has the potential to create some disruption in almost all industries and particularly those where the hours or working conditions are anti-social.

Ian observes that the big hauliers have had to rack up their wage rates and comments that the same is true of those in the care home sector. He thinks that we are also seeing this with pubs, hotels and restaurants, but believes that a much bigger reset may be due here – much of this is discretionary spend and could quickly come under pressure in an inflationary environment (as people try to control their costs) plus, post-COVID, people also seem happier to eat at home. Ian thinks that this is leading to significant inflation in business overheads for specific sectors, but this will almost certainly have an impact in other areas. As noted above, Ian believes that the Bank of England is being too cautious in raising interest rates and is now running a serious risk of allowing inflation to become entrenched.

Inflation sustainable in the 3-5% range

Inflation is a serious consideration for a fixed income fund as it can quickly eat into investors’ ‘real’ returns. However, NCYF’s manager comments that NCYF’s focus on the high-yield space offers some protection. He says that, in an inflationary environment, investment-grade bonds and gilts tend to get hit first and suffer the most, as interest rates rise. He acknowledges that higher-yielding issues are also impacted but says that this is generally to a lesser extent as they are paying a higher rate of interest to begin with, providing more of a buffer. Furthermore, against a backdrop of anaemic growth in recent years, he says that rising inflation suggests an overall improvement in economic activity, and so there may be a silver lining.

Ian thinks that inflation in the range of three to five per cent is probably sustainable, but thinks the economy is at serious risk if it gets much higher. Reflecting this, financials and real assets account for a large part of NCYF’s portfolio (see Figure 5 on page 6) and he has been gradually edging up NCYF’s exposure to equities. NCYF is permitted to invest up to 20% in equities and, with current exposure of about 16%, there is some headroom to expand this. He has recently added the ordinary shares of M&G and Phoenix Assurance to NCYF’s portfolio and is already sitting on capital gains for both. Ian is also increasingly tilting the portfolio towards floating rate securities.

Refilling the hopper

We have previously reported Ian’s comments on the availability and quality of new issues coming to market, as well as those available in the secondary market. This is important for NCYF because as issues amortise and mature, they will need to be replaced with issues that offer both an appropriate credit quality and yield to be suitable for inclusion within NCYF’s portfolio. Similarly, where issues are called, the manager needs to redeploy the returning capital.

The pipeline of opportunities varies over time and, at present, Ian says that the environment has improved recently and there are quite a lot of issues with good yields coming through that are of the appropriate quality. Nonetheless it remains important to be selective and Ian continues to take around one in 20 of the issues that he is offered.

In the current environment of rising interest rates and inflation, Ian expects to see current issues of AT1 bonds called and replaced with lower cost issues (Additional Tier 1 bonds, or AT1bonds, are a type of perpetual debt instrument issued by banks to contribute to the total level of capital they are required to hold by regulators to comply with Basel III).

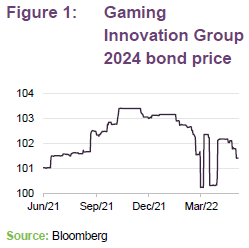

Ian also expects to see more tech/growth companies seeking to raise capital from debt markets. He thinks that it will be harder for them to raise equity in a more inflationary/higher interest rate environment, and he expects to see them paying decent coupons. For example, NCYF has recently invested in an FRN issued by Swedish gaming company Gaming Innovation Group, which pays quarterly interest at a rate of three-month STIBOR + 850bp. Ian considers the issuer to be a world class gaming company yet, with an issue size of SEK550m issue (around £45m), it is too small for many of NCYF’s competitors.

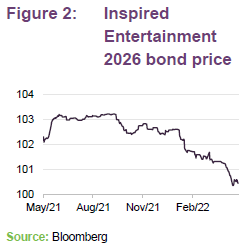

Ian has also added Inspired Entertainment’s 7.785% first lien 2026 bond. He comments that, while it is not an FRN, it is of a good size and offers a decent yield. It could also potentially be called at 104 in 2024, which would provide NCYF with a decent capital uplift. Inspired is a large gaming provider that operates in around 35 jurisdictions globally. The company supplies gaming systems with associated terminals and content for approximately 50,000 gaming machines located in betting shops, pubs, gaming halls and other route operations. It also supplies virtual sports products through more than 32,000 retail venues and various websites. Ian says that the company has a strong market position and a sticky user base and so is well positioned to pass on rising costs to the end customer.

Asset allocation

As at 31 March 2022, NCYF’s portfolio had exposure to 83 issues (down from the 111 issues it had exposure to as at 30 September 2021) and, as illustrated in

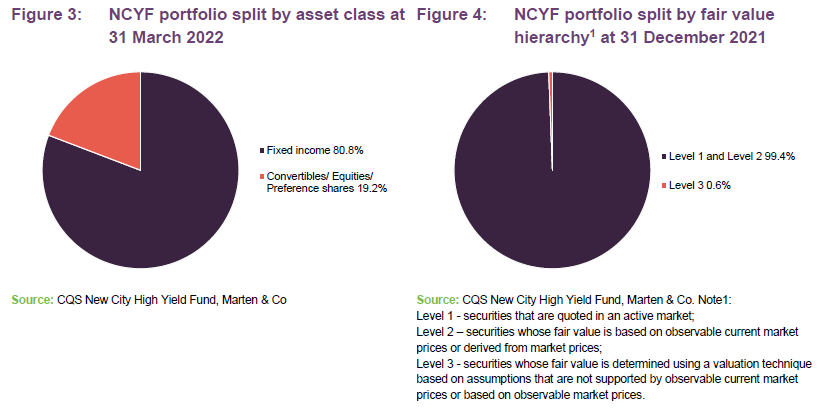

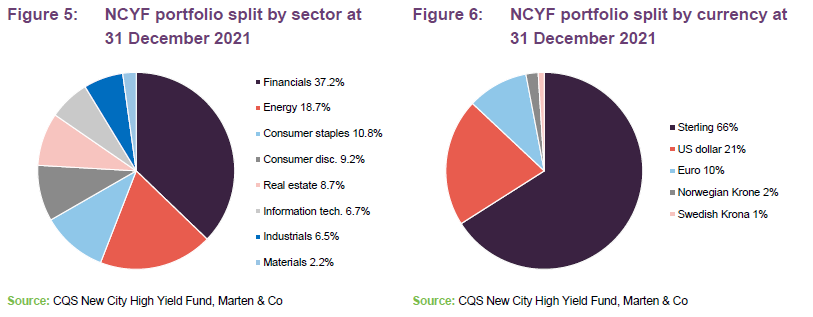

Figure 7, the top 10 issues accounted for 42.6% of the portfolio (a modest reduction from September 2021’s 42.0%). Figures 1 to 4 show various splits of the portfolio (asset class, quotation, sector and currency), with the data provided being the most recent data that is publicly available.

Figures 3 to 6 show various splits of the portfolio (asset class, quotation, sector and currency), with the data provided being the most recent data that is publicly available. As is illustrated in Figure 5, NCYF’s portfolio does not have any exposure to utilities. This is because Ian has some concerns as to how safe their dividends might be.

In terms of changes to NCYF’s currency exposures, these have been modest, and the manager says that these have been driven by recent call activity and the opportunities that have been available to replace these. In fact, most of the turnover in the portfolio has been due to issues being called, but as discussed on page 5, the manager says that there are plenty of good opportunities in the market, so this has not been a problem.

Figures 3 to 6 continue to illustrate a number of themes:

- The portfolio is overwhelmingly invested in pure fixed income securities.

- All but a tiny percentage of the portfolio is quoted on a recognised exchange (although around 70% trades OTC and so will tend to be relatively illiquid, even in normal market conditions).

- The portfolio has exposure to issues from companies in a diverse range of sectors, with a heavy concentration in financials that reflects the manager’s views on bank and insurance issues (these benefit from an environment of moderate inflation and interest rates).

- The portfolio is predominantly exposed to sterling (around 65%), but also has a significant US-dollar exposure (around 20%).

- NCYF’s investments are generally located in jurisdictions that are developed and are being supportive of businesses in the current climate.

- Financials and real assets account for a large part of the portfolio.

Top 10 holdings

Figure 5 shows NCYF’s top 10 holdings as at 31 March 2022 and how these have changed since over the six months from 30 September 2021. Reflecting the manager’s long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular followers of NCYF’s portfolio announcements and our notes on the company.

New entrants to the top 10 are Stonegate Pub 8.25% 20-31/07/2025, Diversified Energy Company Plc and Albion Financing 2 8.75% 21-15/04/2027. Names that have slipped out of the top 10 are OneSavings Bank 17-31/12/2059 FRN, Raven Russia 12% 09-31/12/2059 and Bracken Midco 8.875% 18-15/10/2023.

The OneSavings Bank 2059 notes were called, as were Just Group’s 2059 notes (a previous top 10 holding that we have regularly commented on). The manager has trimmed NCYF’s holding in Just Group’s 2029 notes due to their strong price (some were sold around the 127 and 130 levels). Ian says that the running yield had fallen to the mid-sixes and the yield to redemption was around 4%. He comments that he is not in the business of converting capital to income and if the bonds were held to maturity, the investment will lose 27 points of capital over the next seven years. Punch Taverns 7.75% 2025 bonds, which have also frequently made an appearance in NCYF’s top 10 holdings, have also been called.

We discuss some of the more interesting developments in the next few pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been discussed previously (see page 25 of this note). We have also included some commentary on Boparan Finance 7.625% 20-30/11/2025 and Mangrove Luxco 7.775% 19-09/10/2025, which we have not discussed previously.

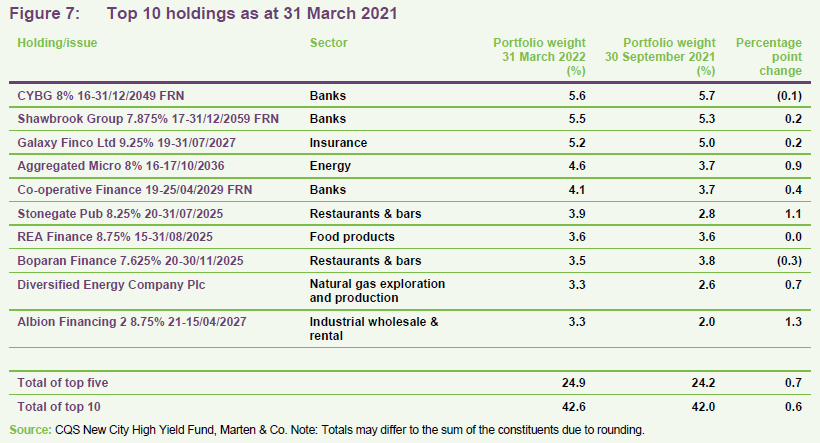

Stonegate Pub Co 8.25% 20-31/07/2025 – significant asset backing

The Stonegate Group (www.stonegategroup.co.uk) is the UK’s largest pub company. The company was originally formed in 2010 with 333 pubs and, following 12 major acquisitions, it now operates around 4,800 managed, leased and tenanted pubs. It is owned by the British private equity group TDR Capital and its brands include: Scream, Slug & Lettuce, Tattershall Castle, Henry’s Café Bar, Yates’s, Missoula, Social Squirrel, Flares & Reflex, Popworld, The Living Room, Retro Sports Bar & Grill, Walkabout, Be at One and Fever Bars.

Ian says that Stonegate has huge asset backing, with its extensive property portfolio, which gives it a decent degree of inflation protection. As discussed on

page 4, Ian does see the potential for a further reset in the hospitality sector but says that Stonegate is the kind of large operator that is well positioned to secure finance, should this be needed, and would likely strengthen its market position in such an environment as smaller players are forced to exit the market.

In terms of market dynamics, Ian feels that Stonegate’s massive scale should give it bargaining power with its suppliers, which is an advantage over its smaller competitors and should help it keep a rein on costs in a more inflationary environment. Its end markets are competitive (there is rarely a shortage of pubs and restaurants, and customers can quite easily choose an alternate venue), but Ian says that it has quite a loyal customer base (people frequently have a ‘local’, or restaurants that they tend to frequent). The market has barriers to entry (it takes time to secure licences and, where necessary, change of use for a building) so that while it could experience greater competition in a particular locale, Ian says that it would take a competitor many years to establish a similar estate, and this would likely have to be achieved through a buy and build strategy, acquiring smaller operators along the way. Otherwise, Ian says that you are clipping a decent coupon and, with a sector that’s recovering, there’s potential for capital appreciation as credit quality improves and the sector re-rates.

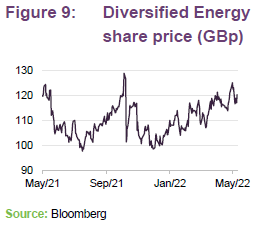

Diversified Energy Company – highly cash generative with a low cost of production

We last discussed Diversified Energy (www.div.energy – formerly known as Diversified Gas & Oil) in detail in our June 2020 note (see pages 6 and 7 of that note). To summarise, the company operates natural gas & oil wells that are primarily located in the Appalachian Basin in the United States, where it describes itself as being one of the largest independent conventional producers. It has grown its output in recent years, both through acquisition and by enhancing the efficiency of its existing operations. Its assets typically have predictable production rates, long-lives (40 to 50+ years), and relatively low rates of decline in output. Ian describes it as a very sensible holding that pays around a 10-11% yield.

The company has a low cost of production, which means that it was well positioned to weather the previously low oil price environment (its geographical focus affords it economies of scale), but should also well positioned to benefit from the current higher oil price environment. The company has previously said that, where the commodity pricing environment is favourable, it can activate a low-risk development program that ensures a quick return on its investment. Ian observes that Diversified Energy is very cash-generative and its significant land bank offers it the opportunity to grow organically through infill drilling. He comments that, as a recognised player, it benefits from good deal flow and its efforts are concentrated in resource rich locations that are well known to the company, meaning that its operations tend to be reasonably low-risk.

In terms of the competitive environment in which it operates, its output is highly commoditised, but is essential so tends to be reasonably price inelastic, at least in the short-term. In terms of its inputs, it has been able to act as a consolidator and has been acquiring assets from industry players who have been refocussing their businesses on shale production and, with its considerable scale in the region, has a competitive advantage when bidding for plots. It also benefits from economies of scale when purchasing capital equipment due to its size. Ultimately, oil faces substitution as the world decarbonises but Diversified Energy’s low cost of production means that its assets should remain economic at much lower prices and so could remain producing for longer.

Albion Financing 2 8.75% 21-15/04/2027 – well positioned to benefit from energy transition

The Albion Financing bonds provide financing to Aggreko (www.aggreko.com/en), a leading global supplier of temporary power generation, heating, cooling and dehumidification equipment that is headquartered in Glasgow. Its business is affectively renting shipping container-sized power generators and temperature control units to its customers or supplying power, from temporary power stations, which it constructs by connecting together multiple power generators. Aggreko provides these services on an emergency, short-term or medium-term basis.

Aggreko was previously LSE listed and a FTSE250 constituent but delisted in August 2021 following a £2.32bn acquisition by the private equity firms TDR Capital and I Squared Capital. Albion Acquisitions Ltd was originally formed to provide financing for the acquisition but is also being used to finance the development of the company. These bonds, which are senior unsecured and US dollar denominated, are rated B3 by Moody’s, B by S&P and BB- by Fitch. The US$450m issue was undertaken as a private placement in October 2021.

Ian acknowledges that Aggreko had faced some challenges in the decade up to the takeover, but he thinks that it is world-class operation, with strong management and strong support from its private-equity backers, that puts it in a strong position to manage and benefit from the transition to a low carbon world.

Ian believes that Aggreko can leverage its market leading position, scale and brand to take advantage of the opportunities the transition will throw up and observes that it is already offering fully integrated, plug-and-play industrial-scale battery storage solutions that are designed to ensure maximum system effectiveness and efficiency. While the energy transition will inevitably reduce demand for its traditional generators, Ian thinks that the growing intermittency caused by renewable sources should more than make up for this.

Competition in the space would appear to be relatively limited. The global rental market is highly fragmented, and Aggreko is believed to have around a 25% market share. Similarly, the temporary power supply market has a limited number of players – Aggreko is believed to have around 40% of the temporary utility power supply market and 25% of the temporary industrial power supply market. These should place Aggreko in a relatively strong position with both customers and suppliers, although it will likely face competition from utilities for battery components as this part of the market develops. Hydrogen based technologies are another potential threat, but could also offer the company opportunities as the technology and market develops. Similarly, there is a potential risk from substitution as other energy storage technologies develop, but Aggreko could be similarly well positioned to integrate these into its portfolio, as well as to roll out portable low carbon generation solutions.

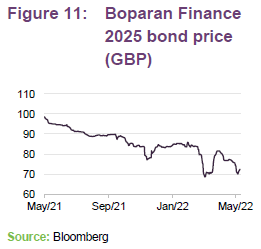

Boparan Finance 7.625% 20-30/11/2025 – backing the “Chicken King”

A subsidiary of Boparan Holdings, Boparan Finance was established to provide finance to its parent, which owns a range of food production and restaurant businesses in the UK. The parent company, Boparan Holdings, is owned by Ranjit Singh Boparan (known colloquially as the “Chicken King”) and his wife Baljinder Kaur Boparan. Via its 2 Sisters Food Group subsidiary (www.2sfg.com), the company supplies around 75% of the UK’s chickens and has agreements with the full spectrum of retailers from Aldi to John Lewis. The company also owns Northern Foods, FishWorks, Harry Ramsden’s, Cinnamon Collection, Grove Farm Turkey, Giraffe Collection, Bernard Matthews, Ed’s Easy Diner and its most recent acquisition was the purchase of Carluccio’s brand and restaurants from the administrators. Its restaurant interests are held with the Boparan Restaurant Group (boparanrestaurantgroup.co.uk).

Ian says that the 2 Sisters business faced difficulties in the run up to Christmas due to staff shortages but is now said to be recovering. A large proportion of the businesses revenues are derived from staples, which should give it resilience in difficult times and, with such a high proportion of the UK chicken market, some bargaining power to push costs onto the end retailers. Like Matalan, the business is family-owned, with the Boparans having the overwhelming majority of their wealth tied up in it. As such, Ian says that they are strongly incentivised to meet their debt obligations so as to avoid being diluted within the business. Ian says that he will likely add to this position in the future. Despite the challenges that the hospitality sector faces (as discussed in the manager’s view section), Ian thinks that this part of the business is well positioned to weather the storm and believes that there is very strong potential for yield compression and a recovery in the capital value of the bonds.

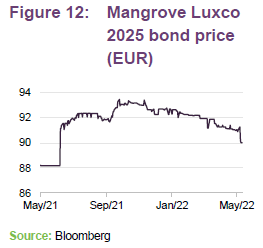

Mangrove Luxco 7.775% 19-09/10/2025 – exposed to long-term structural growth in cooling applications

Mangrove Luxco (www.mangrove-investor-relations.com) was incorporated in 2019 as a holding company that holds two operating companies – Kelvion (www.kelvion.com) and Enexio (www.enexio.com) – which operate in related industries (they both specialise in cooling).

Kelvion is a global manufacturer of industrial heat exchangers for a highly diversified range of market segments. Kelvion supplies plate heat exchangers, shell and tube heat exchangers, finned-tube heat exchangers, modular cooling tower systems, and refrigeration heat exchangers. It services customers in the energy; data centre, chemical industries; oil and gas; marine applications; HVAC and refrigeration; environmental applications as well as the food and beverage industries.

Enexio specialises is the former power cooling division of GEA Group. It specialises in power plant cooling systems and also offers water and waste water treatment systems. Its cooling products include both wet and dry systems products – for example, air cooled condensers, wet cooling towers. Its water and air treatment products include trickling filters, sedimentation tanks, gas scrubbers and bioscrubbers.

Ian observes that Mangrove Luxco’s subsidiaries are both operating in growth markets. For example, according to Research and Markets, the global heat exchanger market is expected forecast to grow from US$16.4bn in 2020 to US$22.1bn in 2026 – a CAGR of 5.2% – with Europe dominating market growth “driven by stringent regulations and ambitious plans to conserve energy and reduce carbon emissions”. Similarly, according to Global Market Insights, the global cooling tower market is projected to grow at a CAGR of over 5% between 2021 and 2028, driven by manufacturing growth in the US; increasing use of cogeneration technologies in Europe; robust industrial growth and growing investments in power generation in Asia; and changing climatic conditions in the Middle East and Africa.

Both of the underlying sectors in which Kelvion and Enexio operate are competitive, but Ian says that these are both well established businesses with strong reputations, relatively sticky customer bases and they both benefit from many years of R&D and the associated IP. Their products could also be key to their customers operations and difficult to substitute.

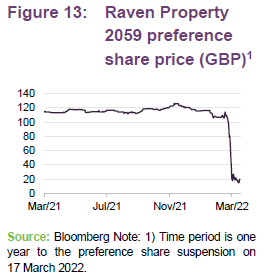

Raven Property 12% 09-31/12/2059 preference shares – meeting the prefs obligations will be the company’s principal focus

Raven Property Group (www.theravenpropertygroup.com) was founded in 2005 to build and acquire an investment portfolio of Class “A” warehouse complexes in Russia. Its ordinary shares and preference shares are listed on the main market of the LSE (it was formerly a FTSE 250 constituent). As is illustrated in Figure 13, in common with its ordinary shares, Raven Property’s preference share price has fallen dramatically in the aftermath of the Russian invasion of Ukraine, reflecting a variety of concerns from sanctions to the potential for asset seizures, as well as increased negative sentiment towards Russia. For valuation purposes, NCYF initially continued to hold the investment at its (much reduced) market price. However, since Raven announced plans to delist on 17 March 2022 (the shares were suspended from trading on the same day), the investment is held at nil value in NCYF’s NAV (consequently there is no further potential downside in NCYF’s NAV from this investment).

It should be noted that NCYF has been a very long-term investor in Raven Property (over 12 years) and it is the fund’s only exposure to Russia (Ian has never been interested in investing in the likes of Gazprom, despite the high yields on offer, because of the serious corporate governance concerns that he perceives). While Ian did not have any concerns about the underlying businesses prospects and its ability to grow and meet its financial obligations, he agrees with Raven Property’s board that it was impractical for the business to continue in its current form. That board has put forward a set of proposals to try and address the current situation.

The proposed transaction – structured as a put option

The board announced on 17 March that it had entered into an arrangement to allow it to divest itself of its Russian business to Prestino Investments Ltd, a Cypriot company, to be owned and controlled by Raven’s Russian management team, led by Igor Bogorodov. The proposed transaction is structured as a put option, which will allow Raven Property to dispose of the entire issued ordinary share capital of Raven Russia (Holdings) Cyprus Limited (RRHCL), for a nominal cost, to its Russian management team. RRHCL is the existing owner of all of the group’s Russian assets and related debt. The transaction is conditional on the cancellation of the London listing of its ordinary shares and the board has said that it is preparing circulars and will be convening the necessary meetings to ask shareholders to approve the cancellation of the London listings of both share classes. The company says that it has discussed the de-listings in detail with its major shareholders and it expects to receive their support at the relevant class meetings.

Future economic interest will be via existing unsecured loans and new preference shares

It should be noted that there is no binding obligation on Raven Property to exercise the put option but, if it is exercised, the company would retain an economic interest in RRHCL via existing unsecured loans of £41m and RUB1.1bn to RHHCL and non-voting preference shares of £678m, attracting a coupon of 8%, 15% and 10% per annum respectively and with a term of ten years until maturity. The preference shares are not convertible and will be issued to the company as part of a restructuring of RRHCL’s balance sheet, converting the total of its existing share premium account to preference shares by way of a bonus issue.

Following the exercise of the put option Raven Property will hold the loan and preference share assets detailed above, along with any cash balances. Its principal commitment will be to meeting the obligations of its own preference shares.

Performance

The performance of NCYF and its peers (and for almost all asset classes for that matter) appears to have been impacted in the short term by market volatility in the aftermath of the invasion of Ukraine and, more recently, as market concerns have increased regarding the lockdowns associated with China’s zero-COVID policy and the impact this is having on global supply chains at a time when inflation is already climbing.

As noted above, NCYF’s NAV has been impacted by the write down to zero of Raven Property Group, an owner of Russian logistics properties (see page 12) but it has benefitted during the last 12 months as some positions have regained ground that was lost during the pandemic in 2020, while its financial holdings have also benefitted as inflation has increased, raising the prospect of further interest rate rises.

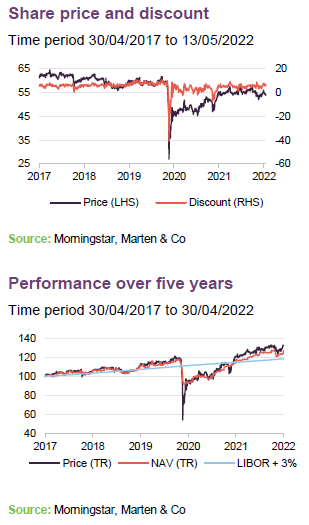

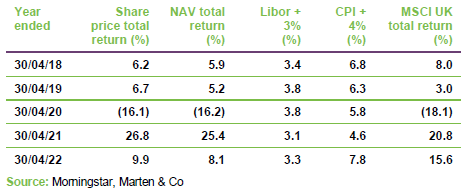

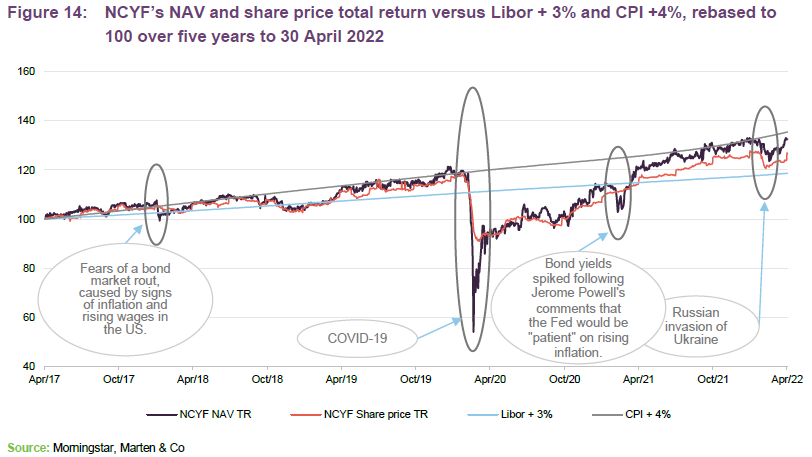

Looking at Figure 14, it is clear that prior to the COVID-related market crash of March 2020, NCYF’s NAV and share price total returns were comfortably ahead of our chosen benchmark of Libor + 3% and its NAV and share price returns were broadly in line with our other chosen benchmark of CPI +4%. Since the collapse, the broad trend has been one of strong outperformance by NCYF’s NAV and share price of our chosen benchmarks so that, even after the setback caused by Jerome Powell’s comments in February 2021 that the Fed would be patient with inflation (this caused bond yields to spike across the board, hurting the capital value of most bonds), NCYF’s share price had caught back up with the greater of the two benchmarks (CPI+4%), while the NAV had not yet completely closed the gap. The developments in Ukraine have hurt most asset classes and NCYF’s NAV and share price have seen a modest drop. Furthermore, these seem to have benefitted recently from a flight to safety, possibly as restrictions in China, driven by its zero-COVID policy, have started to bite, and as global monetary authorities continue to signpost that there are further interest rate rises to come.

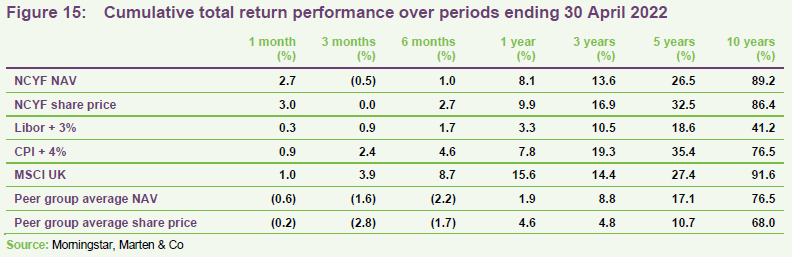

As illustrated in Figure 15, NCYF has provided NAV and share price total returns that, over the longer-term, are ahead of both, Libor + 3% and CPI + 4% – all by some margin. It has also outperformed its peer group averages, for both NAV and share price, over all of the periods provided, with NCYF’s strong relative performance over the last 12 months having helped in this regard. Whilst all of NCYF’s peers are fixed-income-focused, most do not have the same emphasis on generating high income. The figures might suggest that this focus on income generation does not appear to have been at the expense of overall performance.

In a slight change of fortunes, NCYF has mildly underperformed UK equities (as represented by the MSCI UK Index), whereas the trend was previously one of modest outperformance. This may reflect the strong relative performance of UK equities during the last twelve months.

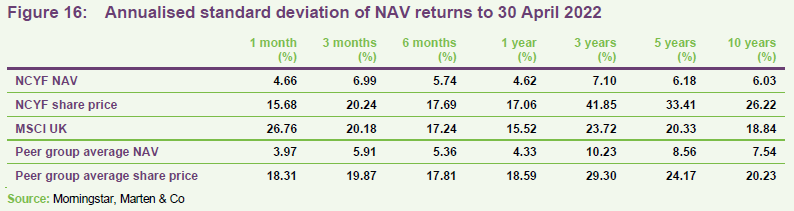

A comparison of Figure 15 and 16 shows that, despite its longer-term record of NAV outperformance of the various comparators in Figure 16, this has not come at the expense of higher volatility over the longer-term. Specifically, NCYF’s NAV volatility is below that of the peer group NAV and that of the MSCI UK Index over the longer-term three-, five- and 10-year periods, but has been above that of the peer group average for periods up to one year. With regards to share price, this has tended to be more volatile than that of the peer group average.

Peer group

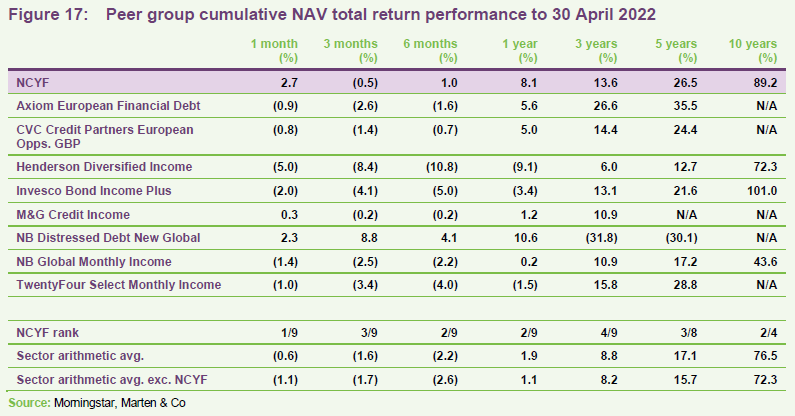

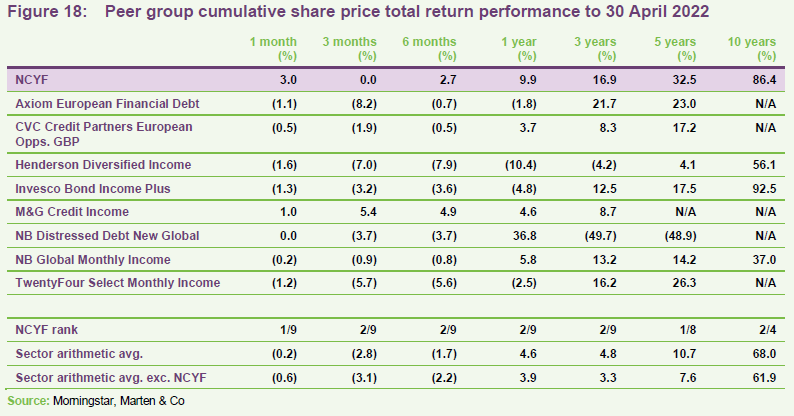

NCYF is a member of the AIC’s Debt – Loans & Bonds sector, which comprises nine members. All of these are illustrated in Figures 17 through 19. As noted in the performance section above, NCYF’s is distinctly different from the rest of its peers in that the peer group has less focus on generating high levels of income than NCYF.

Members of Debt – Loans & Bonds will typically:

- have over 80% invested in general debt instruments such as secured loans and bonds and syndicated lending; and

- an investment objective/policy to invest in general debt instruments such as secured loans and bonds and syndicated lending.

As we have discussed previously, NCYF with its higher-yield focus, suffered more heavily than the peer group average during the COVID-related market rout of March 2020, but appears to have benefitted strongly as economies have re-opened and perhaps as the tensions on its underlying holdings have eased significantly.

The manager had expected that, with limited exceptions, most of the credits impacted by COVID in NCYF’s portfolio should pull to par over time. This has largely come to pass, which was reflected in NCYF’s NAV performance during 2021, although, more recently, its NAV has suffered due to its holding in Raven Property, which owns logistics properties in Russia (this long-term holding is discussed in greater detail on page 12). Raven Property Group accounted for 3.3% of NCYF’s portfolio at the end of January and it lost around 65% during February. Consequently, this has impacted NCYF’s performance versus peers over the short term. To illustrate the point, as at the end of January 2022, NCYF ranked first over one-month, three-month, six-month and one-year periods in terms of its NAV performance versus its peers. Looking at the same periods to 31 March 2022, it had slipped to seventh, fourth, third and second places respectively, as is illustrated it in Figure 17 below.

During the last 12 months, NCYF has benefitted as some positions have regained previously lost ground and the financial holdings have also benefitted as inflation has increased, raising the prospect of further interest rate rises.

It is perhaps noteworthy that NCYF’s focus on high yield doesn’t appear to be at the expense of long-term performance as it has tended to rank in the top half of its peer group for its NAV total returns for all of the periods provided in Figure 17.

Comparing Figure 17 (NAV total returns) and Figure 18 (share price total returns) shows that longer-term NAV and share price total returns are reasonably comparable, reflecting the fact that NCYF has for some time tended to trade around par or at a sensible premium. As we have discussed in previous notes, and is illustrated in Figure 21 on page 22, there was some disruption to this following the onset of COVID, but NCYF is once again trading at levels close to its five-year average premium, despite recent market difficulties.

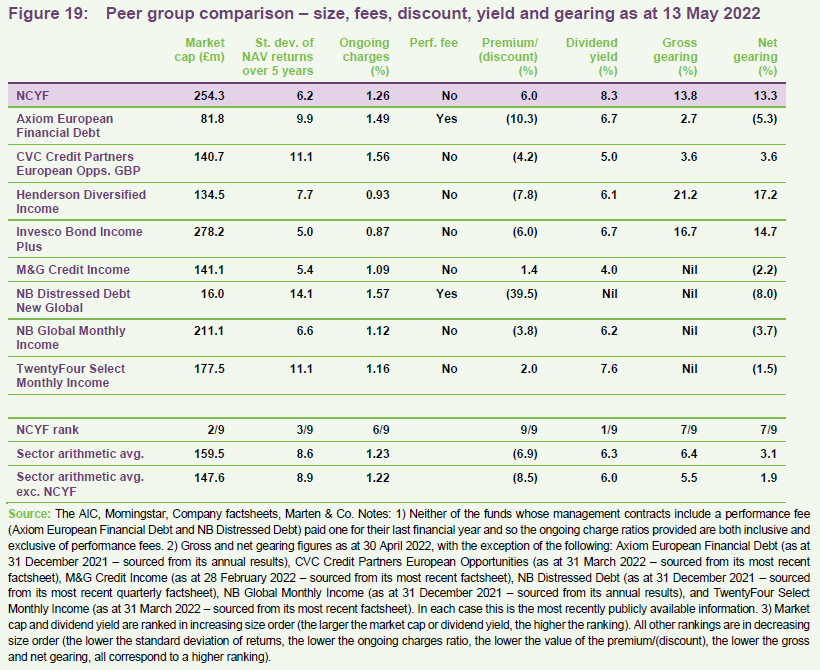

NCYF remains one the largest funds in the peer group – it is the second-largest in terms of market capitalisation. When we last published, NCYF was a little smaller than CVC Credit Partners European Opportunities when its two share classes (sterling and Euro) were combined. However, asset growth and share issuance has seen NCYF overtake the combined total of the CVC fund. Despite this, NCYF remains in second place, but is now behind Invesco Bond Income Plus (BIPS), which was formed by the merger of City Merchants High Yield and Invesco Enhanced Income in May 2021. When we last published, City Merchants High Yield was the fourth largest fund in the Debt – loans and bonds peer group (behind a combined CVC Credit Opportunities and were both in this peer group, NCYF and NB Global Monthly Income), while Invesco Enhanced Income was the eighth largest (out of 10). Following the scheme of reconstruction that facilitated the merger, BIPS received £130.2m of assets from Invesco Enhanced Income, pushing it into the top spot. However, while NCYF has been in demand and has been issuing shares, BIPS has not made any issuances since the merger and so, if these current trends continue, NCYF may grow to once again be the largest fund in the sector.

NCYF has the highest rating in the sector, by a significant margin. During February, NCYF’s share price fell by 1.5%, while its NAV fell by 2.9% (so its premium actually expanded) but, as can be seen by comparing figures 17 and 18, this largely reversed in March (its NAV fell by 0.2% but its share price fell by 1.5%). In comparison, the sector average NAV (excluding NCYF) fell by 1.2% in February and a further 0.1% in March, while the average share price fell by 1.3% in February and a further 0.7% in March. April saw more of the same – NCYF’s NAV gained 2.7%, while its share price gained 3.0%. In comparison, the peer group average (excluding NCYF) was a fall of 1.1% in NAV and a fall of 0.6% in share price.

NCYF’s ongoing charges ratio is close to the sector average for the peer group (1.26% versus an average of 1.22% for the peer group excluding NCYF) but should continue to fall as it grows its asset base. Most ongoing charges ratios within this subsector have ticked up during 2021, reflecting the fact that asset values dropped last year, which meant that fixed costs were spread over a smaller asset base, but this should correct itself if asset values continue on their path of recovery.

NCYF has recently been trading at a premium in the five to six per cent range and has been issuing stock (we have previously noted that NCYF tends to issue stock when its premium is in excess of five to six per cent). It seems reasonable that if this rating persists, NCYF could continue to expand and this should, all things being equal, continue to exert downward pressure on NCYF’s ongoing charges ratio (the reverse is also true). NCYF, like most of the funds in this peer group, does not pay a performance fee. Gearing is another consideration and this can be more of a concern for investors when markets are at more elevated levels. It appears that most of NCYF’s peers continue to be running net cash positions and are therefore less exposed in the event that markets fall back but will suffer more heavily from cash drag if markets continue to progress.

Optically, Henderson Diversified (HDIV) appears to be running a higher level of gearing then NCYF, but the bulk of this is achieved by using credit derivatives (both long and short) on the Markit iTraxx European Crossover Index, and so HDIV may not be as exposed to the market as it appears.

The volatility of NCYF’s NAV returns continues to be the third-lowest in the peer group and markedly below the sector average. This might suggest that the extra yield does not come at the expense of higher volatility.

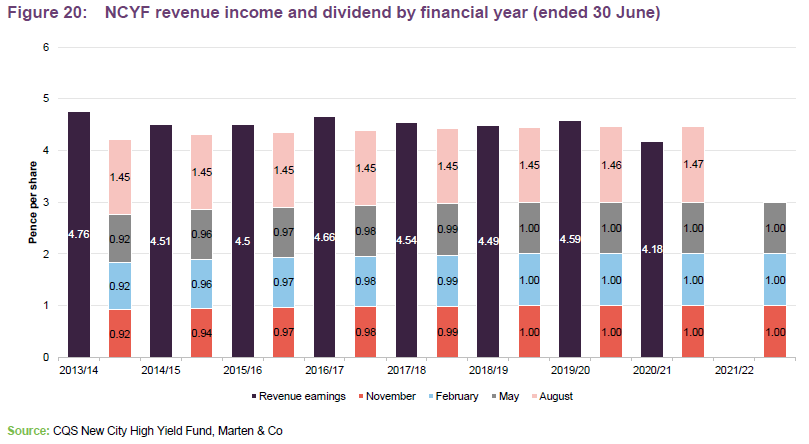

Quarterly dividend payments

Subject to market conditions and the company’s performance, financial position and financial outlook, the board intends to pay an attractive level of dividend income to shareholders on a quarterly basis. The company intends to pay all dividends as interim dividends.

For a given financial year, the first interim dividend is paid in November (2021: 1.00p) with the second, third and fourth interims paid in February, May and August. As illustrated in Figure 20 below, the quarterly dividend rate paid for the first quarter has been maintained for the second and third interims in February and May, which is followed by a larger ‘balloon payment’ for the fourth quarter. Although not a formal aspect of NCYF’s dividend policy, the total annual dividend has increased every year since launch.

During the last twelve months, NCYF has paid a total dividend of 4.47p per share, which is a yield of 8.3% on its share price of 54.00p per share as at 13 May 2022.

With rising inflation and particularly rising energy costs, there are increasing concerns about how this will affect western economies and the businesses that operate within them. However, NCYF’s manager says that he is confident that the businesses whose credits are held within NCYF’s portfolio are well positioned to pass on cost increases and to therefore meet their financial obligations. In the absence of a serious deterioration of the situation in Ukraine, the manager is not expecting to see a significant impact on NCYF’s revenue account at the current time.

85% of one year’s worth of dividends in reserve

As Figure 20 shows, with the exception of the financial year ended 30 June 2021, which bore the brunt of COVID, NCYF’s revenue income has exceeded its dividend in recent years allowing the company to build on its revenue reserve. As at 30 June 2020, NCYF had a revenue reserve of 4.15p per share (30 June 2019: 4.09p), which gave it plenty of scope to maintain and, in fact, fractionally increase its dividend for the year ended 30 June 2021. This was in line with the guidance that was provided in the interim results announcement on 26 February 2021, when NCYF’s board said that, in the absence of unforeseen circumstances, it expected to follow the same pattern of dividend payments as declared the previous year and to maintain or slightly increase the total level of dividends for the year.

As at 30 June 2021, NCYF had a revenue reserve of 3.78p per share, which is equivalent to 85% of the total dividend paid for that financial year. This provides the board with plenty of scope to maintain or even modestly increase the dividend in the future, by utilising the reserves, should it be necessary to do so. However, if the global economy continues to re-open, the companies in which NCYF is invested should have greater capacity to service their debts and, in the limited cases where these are in arrears, there could be better capacity for these to be made good. In addition, NCYF has significant exposure to financials and real assets, which could benefit from higher interest rates if the trend towards higher inflation continues. Ian says that, in the absence of further significant restrictions, which he thinks is increasingly unlikely, the outlook for NCYF’s revenue account should be positive. This could allow NCYF to start to expand its revenue reserves again.

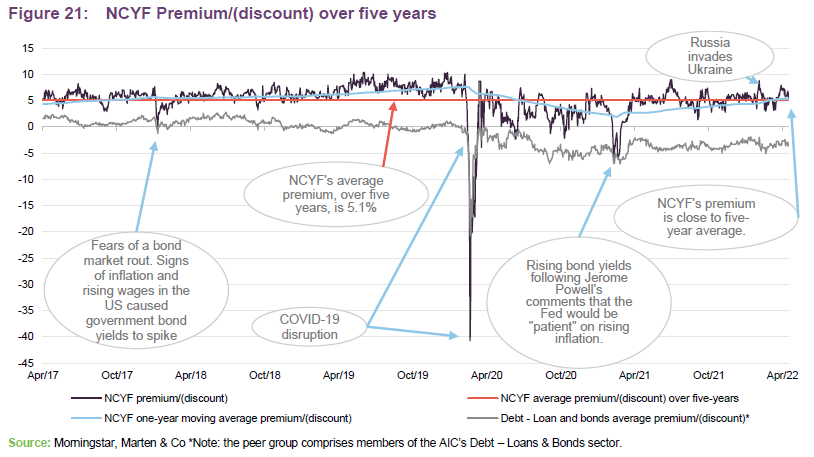

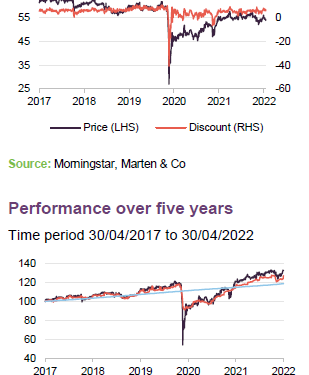

Premium/(discount)

As illustrated in Figure 21, NCYF has predominantly traded at a premium during the last five years. As we have previously discussed, there was some disruption to this with the advent of COVID. NCYF’s discount spiked to unprecedented levels in March 2020 but recovered swiftly, albeit for the following 12 months it tended to trade at premium in the zero to five per cent range rather than the typical five to 10 per cent premium that it had traded at in the years prior to the outbreak. More recently, NCYF has returned to trading at a premium that is more in line with its longer-term five-year average and at the narrower end of its pre-covid range.

As events have unfolded in Eastern Europe, NCYF has experienced a modest fall in its NAV, which has not been matched by a commensurate fall in its share price, so NCYF’s premium has expanded a little. This goes against the general trend, as most London-listed investment companies have experienced a modest discount widening since the Russian offensive began.

As we have discussed elsewhere in this note, NCYF’s only direct exposure to Russia was its investment in Raven Property Group (see page 12), which is valued at zero in NCYF’s NAV. This means that there is no further downside to that investment and the potential for some upside should the situation improve.

Share issuance continues

NCYF’s premium has reflected strong underlying demand as for its strategy, which has allowed an ongoing programme of share issuance. Despite trading at a tighter premium following COVID, NCYF was still able to issue stock and grow (following the market rout, NCYF was able to issue stock as soon as 28 May 2020); however, the pace of equity issuance has picked up during the last 12 months as the premium has strengthened. By way of illustration, during 2020 NCYF issued 9.7m shares (or 2.27% of its issued share capital at the beginning of the year), while 2021 saw the issuance of 27.35m shares (or 6.27% of its issued share capital of the beginning of the year). NCYF has tended to issue stock when its premium is in excess of five to six per cent. The manager and board say that they did look to repurchase stock when the discount was elevated in 2020 but there was negligeable liquidity at the prevailing prices and so this proved to be impossible. So far this year, NCYF has issued 7.30m shares at around a 5% premium to NAV.

As we discussed on page 21, NCYF has tended to trade at a marked premium to the Debt – Loans and bonds sector average, and this continues to be the case (the COVID-related market collapse in March 2020 being the one obvious exception, although this was relatively short lived). Figure 21 illustrates two situations were NCYF’s premium over the sector has narrowed significantly. One instance was at the beginning of February 2018 when early signs of inflation in the US (as economic growth accelerated), coupled with signs of rising wages (which had stagnated for a number of years) led to fears of an increase in interest rates and concerns that this would lead to a bond market rout. The second was in early March 2021, when markets were initially concerned by the prospect of a steepening yield curve, which was exacerbated by comments from Jerome Powell (the chairman of the Federal Reserve) that the Fed would be “patient” on rising inflation.

More recently, inflation has been on the rise again (in many instances this has been driven by supply constraints that have not eased as quickly as demand has returned as the global economy has continued to re-open), with US inflation reaching 7% in December (the highest rate seen for decades) and inflation in the UK hitting a similar level recently. However, as illustrated in Figure 21, the impact on NCYF’s discount appears to have been muted at best.

Premium/(discount) control

NCYF has the authority to issue up to 10% of its issued share capital and repurchase up to 14.99% of its issued share capital, which gives it mechanisms through which it can moderate its premium or discount. The board says that it monitors the level of the company’s discount or premium to NAV, although there is no formal target for either and there is no formal discount control mechanism in place.

As we have discussed previously, NCYF’s manager is keen to see the fund grow in a measured way. Considerable care is taken not to dilute the revenue account, and the manager wants to be sure that any new issuance can cover itself in terms of revenue income generated until the next ex-dividend date. It would appear that the board is open to providing liquidity to the market at the 5% to 6% premium level, although this is by no means guaranteed. However, issuing new shares at a premium to NAV is accretive to existing shareholders and, all things being equal, share issuance should continue to put downward pressure on NCYF’s ongoing charges ratio (by spreading its fixed costs over a larger asset base) and increase liquidity in NCYF’s shares, to the benefit of all shareholders.

Fund profile

A predominantly higher-yielding fixed income exposure

NCYF’s aim is to provide a high level of quarterly income, with the prospect of capital growth, through investment in a portfolio of predominantly higher-yielding fixed income securities, with the flexibility to invest in equities and equity-related securities.

Investments are typically made in securities which the manager has identified as undervalued by the market and which it believes will generate above-average income returns relative to their risk, thereby also generating the scope for capital appreciation. The manager seeks to exploit opportunities presented by the fluctuating yield base of the market and from redemptions, conversions, reconstructions and take-overs to generate capital growth.

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been NCYF’s investment manager since its launch in March 2007. NCIM also managed NCYF’s immediate predecessor (NCYT) from 2004 until its assets were rolled over into NCYF in March 2007. On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies with AUM of US$20.7bn as at 31 March 2022.

Ian “Franco” Francis – “not ready to throttle back just yet”

Ian, a partner at CQS and Head of New City, has day-to-day responsibility for managing NCYF’s portfolio. Ian joined NCIM in 2007. He has well over 35 years’ investment experience, primarily in the fixed interest and convertible spheres, having worked for Collins Stewart, West LB Panmure, James Capel and Hoare Govett. Ian is able to draw on the expertise of a 23-strong credit analysis team at CQS.

In past notes we have commented on Ian’s ongoing commitment to the fund. He recently reiterated this. In his own words, he continues to enjoy what he’s doing, has no plans to retire and is “not ready to throttle back just yet”.

Constructed without reference to a benchmark

Reflecting its fixed income focus, the manager’s absolute return mindset and the diversity of its holdings, NCYF’s portfolio is not constructed with reference to any benchmark index. NCYF uses the FTSE 100 index for performance comparison purposes in its reports, but its board explicitly says that this is used in the absence of a meaningful benchmark index. We have included comparisons against the MSCI UK index in this report. We have also included comparisons against Libor + 3% and CPI + 4% but we would stress that these are not formal benchmarks for NCYF.

Comprehensive five stage ESG investment process

NCYF’s manager, CQS, operates a five-stage process that specifically looks at ESG factors in its sector research process. This includes modelling and internal ratings with ESG methodologies applied to both public and private debt. Discussion and debate is encouraged during the ESG internal analysis, both within the CQS research team and with portfolio managers.

This is followed by an evaluation. Portfolio Managers are required to consider (to an appropriate degree having regard to their investment strategy) ESG risks as part of their investment decision-making. This includes, but is not limited to:

- Environmental: Climate Change, Water Stress, Biodiversity and Land Use, Toxic Emissions and Waste and Environment Opportunities.

- Social: Labour management, Health and Safety, Privacy and Data Security, Stakeholder Opposition and Social Opportunities, Mobility and Diversity.

- Governance: Corporate Governance and Corporate Behaviour including Ethics, Corruption, Instability, Diversity and Remuneration.

CQS is either a signatory or supporter of:

- United Nations: Principles for Responsible Investment (UN PRI)

- Task Force on Climate-Related Financial Disclosures (TCFD)

- CDP (“CDP”, formerly Carbon Disclosure Project)

- Standards Board for Alternative Investments (SBAI, formerly HFSB)

- Climate Action 100+

CQS also plans to become a signatory of the UK Stewardship Code.

The five-stage ESG investment process is made up as follows:

- Incorporate – incorporation of third-party ESG metrics into CQS’s systems.

- Evaluate – evaluation of ESG factors in the sector research process. This includes modelling, analysis, internal ratings and deployment into the manager’s front office systems. CQS makes it clear to investee companies that it is serious about ESG considerations.

- Decide – portfolio managers consider ESG analysis as part of their investment decision-making.

- Engage – engage with companies on ESG matters. This may involve proxy voting, influence or control positions. It could also lead to a decision not to trade, change exposure or exit a position.

- Monitor – periodically re-assess the ESG research on companies. Portfolio managers receive weekly, proprietary fund-level ESG risk reporting for portfolio management and research teams. There is also a watching brief across newswires for developing ESG issues.

At the time that NCYF’s annual report for the year ended 30 June 2021 was written, 30% of its portfolio was covered by the MSCI’s ESG rating service. It is not unusual for fixed income portfolios to have a low level of ESG ratings coverage. Reflecting this, CSQ has been researching alternative metrics, including the Weighted Average Carbon Intensity (WACI), which is a measure of the portfolio’s exposure to carbon-intensive companies, expressed in tonnes of CO2 per million US$ of revenue. WACI follows the MSCI methodology, taking the carbon intensity of a company where available, and where carbon intensity is not available for a given company, the average carbon intensity for the corresponding GICS Sub Industry is taken. For NCYF’s portfolio, the WACI for its portfolio was 238 compared to the broader credit universe, which is 250.

Previous publications

Readers interested in further information about NCYF, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note A short-term opportunity?, published on 15 April 2021, as well as our previous update note and our initiation note (details are provided in Figure 22 below). You can read the notes by clicking on them in Figure 22.

| Figure 22: QuotedData’s previously published notes on NCYF

Source: Marten & Co |

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on CQS New City High Yield Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

[ad_2]

Source link

![Early detection saved her life. A new CT measure mandates expanded insurance coverage of breast cancer diagnosis, treatment. [Hartford Courant]](https://mortgageinsurancecenter.com/wp-content/uploads/2022/05/Early-detection-saved-her-life-A-new-CT-measure-mandates-75x75.jpg)