[ad_1]

Technology vendors in the default management space are working to offer faster, less siloed systems to address the resumption of activity in this area as forbearance ends and loss mitigation activity with compliance sensitivities resumes.

Brace, a fintech that automates loss mitigation using artificial intelligence, on Thursday released a new default management platform coded to accommodate collaborative rather than sequential workflow, which tracks workflow for compliance purposes and aims to eliminate delays between tasks.

Separately, servicing systems provider Sagent said Thursday that it is working to achieve faster processing through the creation of integration layers that combine disparate systems and serve as a bridge to an all-in-one system its building, which has a base set of compliance-related data organized behind it.

And in another recent development in this space, technology-enabled mortgage services provider Covius has begun working with Net Director’s cloud–based default servicing integration platform to order products like title and property reports.

“From a compliance perspective, it’s a much more attractive kind of value proposition,” said Brace CEO Eric Rachmel in an interview of the need for real-time default systems with improved workflow and trackable data. “Everything in servicing is related to compliance issues.”

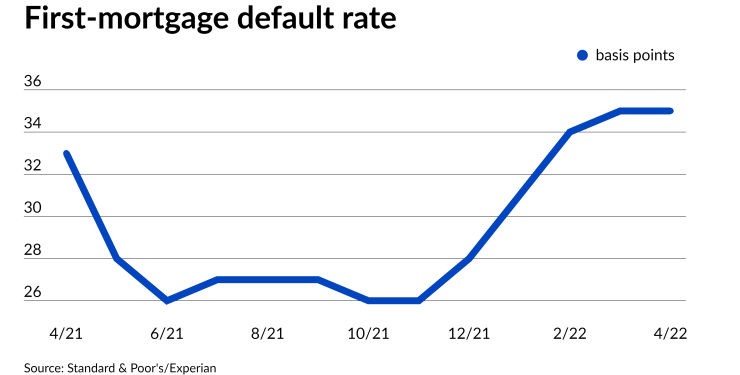

Compliance in default management is particularly prominent now because of the emergence from COVID-related forbearance. While first-mortgage default activity has leveled off a little, it’s still higher than it has been in roughly a year, according to indices produced by Standard & Poor’s and Experian.

Automation can reduce the amount of time servicers spend on activities like changes to Federal Housing Administration rules around the waterfall of decisions that go into determining whether or not a consumer is eligible for modified loan terms due to a reduction in income.

“A really large pain point in this industry is it takes weeks to stand those up,” said Rachmel. “It took us less than 24 hours to build a brand new waterfall for a modification.”

Some servicers have nearly 30 disparate systems for workflow so creating a more cohesive environment to work in has been a priority, said Courtney Thompson, chief product officer at Sagent. These could include technology that handles telephony, mortgage notes, digital and paper documents, underwriting, and integrations with fulfillment providers that produce modification documents, she said.

“They’ll have all of these systems that the individual servicing operator needs to sign into to achieve their goal. That’s why we’re delivering an end-to-end tool,” said Thompson.

[ad_2]

Source link