[ad_1]

By CELIA LLOPIS-JEPSEN

Kansas News Service

One Topeka engineering firm does what it can to fight the ballooning cost of health care for its workers.

Bartlett & West — owned by its 350 employees across seven states — is trying a slew of approaches.

It

has a wellness program. It tries to make preventive care easy to get.

It pays its employees’ medical bills itself, rather than buying coverage

from insurance companies.

And yet, year after year, its premiums climb.

“My

fear is that the company will not be able to continue to absorb as much

of that cost,” Bartlett & West’s head of human resources, Kim

Walker, said at a forum this month on employers and health care, hosted

by the Kansas Health Institute.

“I envision that, unfortunately,

we’re going to have to reduce benefits,” she said, “and most especially

pass on more costs to our employee-owners and their families.”

Employers in Kansas struggle to offer affordable health insurance. It gets harder and harder.

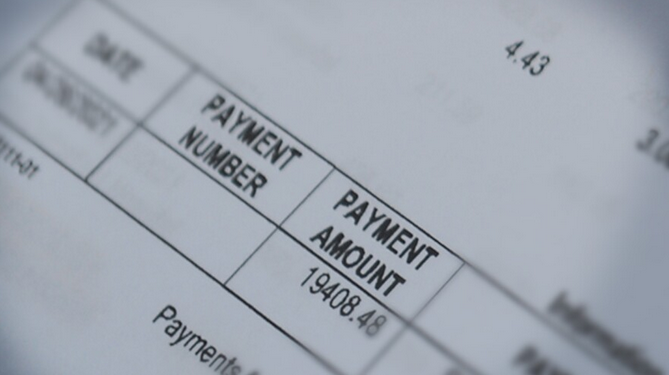

A new report

finds premiums for health plans through private-sector jobs rose nearly

40% from 2010 to 2020. That’s twice as fast as general inflation.

Average

yearly premiums in the state were nearly $12,000 as of 2020, the Kansas

Health Institute report says. That’s typical across the country, but it

takes a bigger bite out of paychecks here, where wages run below the

national average.

(The institute receives funding from the Kansas Health Foundation, a funder of the Kansas News Service.)

Workers

now shoulder a bigger share of their premiums than they did a decade

ago, too. Fewer are even bothering to enroll in their employer’s health

plans.

Phillip Steiner, a senior analyst at the institute, said premiums

could rise even faster now that we’ve moved out of a low-inflation

economy.

“If anything, it’s going up faster,” he said. “Now we’re in a very high-inflation environment.”

The more employees spend on premiums, the less they can sock away from their paychecks or put toward out-of-pocket costs.

A recent Commonwealth report ranks Kansas and Missouri in the five states where people with work-based insurance face combined premiums and deductibles that top $9,000 a year on average.

The

growing costs facing Kansas employers and employees illustrate the

stakes in U.S. health care, where annual spending grows much faster than

broader economic inflation.

Research pins much of the blame on plain old hikes in the prices that doctors, hospitals, labs and the pharmaceutical supply chain charge for their services.

Those

hikes mean the health care sector consumes an ever bigger slice of

America’s economic pie. Public and private employers alike struggle to

get much leverage against the industry.

In 1980, U.S. health spending was 9% of gross domestic national product. By 2000, it hit 13%. In 2018, it was nearly 18%.

The upshot often comes in the form of higher deductibles.

Just this year, Bartlett & West added a high-deductible health plan with a health savings account, Walker said.

Currently, it’s just one choice

available to employees. But the goal is to help them get familiar with

the plan design — because high deductibles may soon become the only option.

“We

think that that could be a future for all of our employees,” Walker

said. “And we don’t want to have to implement a type of plan like that

and not prepare them for what that is and what that would involve.”

Celia Llopis-Jepsen is a reporter for the Kansas News Service. You

can follow her on Twitter @celia_LJ or email her at [email protected]

[ad_2]

Source link