[ad_1]

The chief UK financial regulator will gain new powers to ensure that banks and building societies continue to provide access to cash, the government will announce on Thursday.

New legislation will enable the Financial Conduct Authority to intervene to ensure communities are not cut off from banking services as ministers seek to address the impact of the disappearance of branches from the high street over the past decade.

The government promised to set out “its expectations for a reasonable distance” for people to travel to deposit and withdraw cash “in due course” as part of the proposed changes.

“Millions of people across the UK still rely on cash, particularly those in vulnerable groups,” said economic secretary John Glen. “We are delivering on our promise to ensure that access to cash is protected in communities across the country.”

The extra FCA powers will be legislated for as part of the financial services and markets bill, announced in the Queen’s Speech last Tuesday, and includes provisions to improve the competitiveness of the UK’s capital markets and better support for victims of fraud.

“There are 10mn people in the UK who rely on cash, which is why we welcome today’s news that the government is committing to introducing legislation to protect it within this parliament,” said John Howells, chief executive of Link, which operates the country’s largest ATM network.

While the Covid pandemic has accelerated a move to digital-first banking, lenders have been closing down their expensive branch network for years. Some 226 closures out of fewer than 7,000 remaining physical banks have been announced in the year to date.

Nevertheless, rural communities, vulnerable groups and the elderly who are more reliant on bank branches risk being forced to travel significant distances to access cash services. It remains the second most frequently used method of payment in the UK.

When HSBC announced in March that it was closing 69 of its 510 branches, it said customers would have to travel an average of four miles for an in-person service.

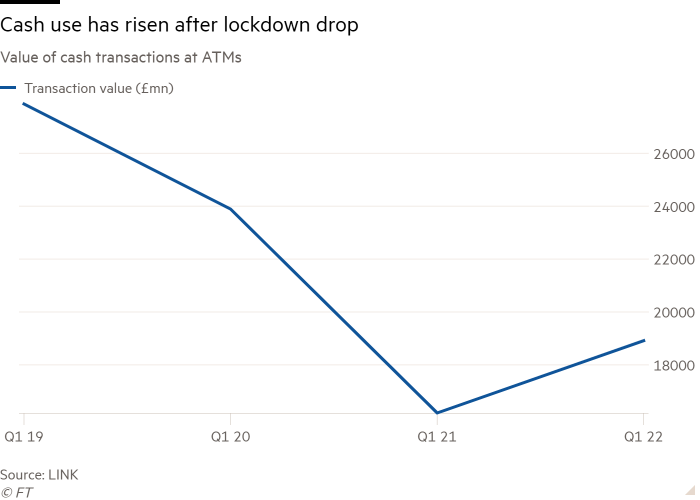

Data from Link shows that while cash transactions declined notably during lockdown, cash use remained significant. In the first quarter, Link’s ATMs registered £18.9mn in cash transactions, a drop from £29.2mn in the same period in 2019.

In December, the Post Office and the big lenders announced a new initiative to maintain access to cash across the country. Link has been given the role of assessing the needs of affected communities.

Its proposals include creating “bank hubs”, following successful pilots in Rochford, Essex, and Cambuslang, outside Glasgow. These are run jointly by the Post Office and a revolving group of bankers from the lenders involved in the scheme.

[ad_2]

Source link