[ad_1]

The U.S. economy is continuing to expand, though moderately, in most regions, according to regional surveys conducted by the Federal Reserve Board released on Wednesday.

The “beige book” paints a portrait of an economy facing the headwinds of high inflation, supply chain issues and a general uncertainty about the future.

“All twelve Federal Reserve Districts have reported continued economic growth since the prior beige book period, with a majority indicating slight or modest growth,” the national summary stated. “Four Districts indicated moderate growth. Four Districts explicitly noted that the pace of growth had slowed since the prior period.”

While most reported continued expansion in the manufacturing sector, some regions reported weakness in housing and retail as the bite of inflation and rising interest rates takes effect.

“Contacts tended to cite labor market difficulties as their greatest challenge, followed by supply chain disruptions,” the summary continued. “Rising interest rates, general inflation, the Russian invasion of Ukraine, and disruptions from COVID-19 cases (especially in the Northeast) round out the key concerns impacting household and business plans.”

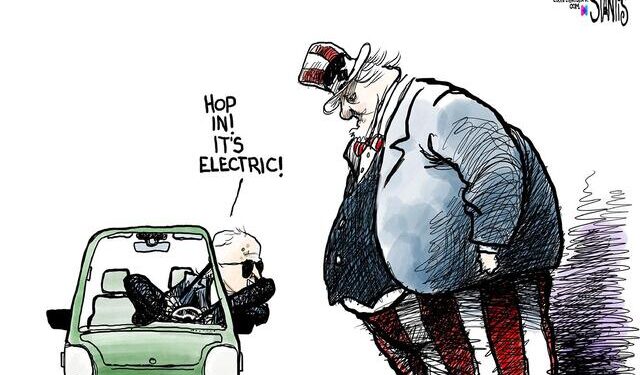

Political Cartoons on the Economy

Notably eight of the 12 districts “reported that expectations of future growth among their contacts had diminished; contacts in three Districts specifically expressed concerns about a recession.”

The report comes as the Fed begins its previously announced plan to remove about $1 trillion of securities it holds on its balance sheet. The holdings swelled to $9 trillion during the coronavirus pandemic and were instrumental in keeping interest rates at record lows.

In May, the Fed raised interest rates by 50 basis points along with announcing the asset sales, known as quantitative tightening or QT, as a way to reduce economic demand and raise the cost of borrowing in an effort to tame inflation that has been running at more than 8% annually.

There are already signs that the higher rates are curbing some demand, especially in the housing market where sales of new homes have fallen sharply amid rising mortgage rates. But some worry that the Fed is entering into uncharted waters with its planned reductions of its balance sheet. Much of that will be accomplished by the Fed choosing not to roll over securities that expire, but it may also require outright sales of bonds.

JP Morgan CEO Jamie Dimon, one of the financial world’s preeminent leaders, scared markets on Wednesday when he said at a conference that the global bank was preparing for an uncertain few months. He noted that the Fed’s policy of quantitative easing, wherein it makes monetary policy more loose, had its own issues.

“Right now, it’s kind of sunny, things are doing fine, everyone thinks the Fed can handle this,” Biden said, according to CNBC. “That hurricane is right out there, down the road, coming our way.”

“We’ve never had QT like this, so you’re looking at something you could be writing history books on for 50 years,” Dimon said. Several aspects of quantitative easing programs “backfired,” including negative rates, which he called a “huge mistake.”

Central banks “don’t have a choice because there’s too much liquidity in the system,” Dimon said, referring to the tightening actions. “They have to remove some of the liquidity to stop the speculation, reduce home prices and stuff like that.”

The Fed and others, such as Treasury Secretary Janet Yellen, have acknowledged that the central bank waited too long to begin pulling back on the immense amount of monetary stimulus it added to the economy during the coronavirus pandemic. That is now widely accepted as having pushed interest rates too low, sparking a boom in housing and stock prices. Now, Fed officials are preaching the gospel of monetary hawkishness.

“I support tightening policy by another 50 basis points for several meetings,” Fed board member Christopher Waller said in a speech in Germany on Monday. “In particular, I am not taking 50 basis-point hikes off the table until I see inflation coming down closer to our 2 percent target.”

“And, by the end of this year, I support having the policy rate at a level above neutral so that it is reducing demand for products and labor, bringing it more in line with supply and thus helping rein in inflation,” Waller added.

San Francisco Fed president Mary Daly added to the chorus on Wednesday, telling CNBC she favors an aggressive round of interest rate hikes.

“I don’t meet anyone – contacts, consumers, anyone – who thinks the economy needs help from the Fed right now,” Daly said. “I certainly am comfortable to do what it takes to get inflation trending down to the level we need it to be. I really think these inflation numbers have been going on too long, and consumers, businesses and everyday Americans are depending on us to get inflation back down and bridling it.”

Runaway inflation is a leading concern at the White House, as well, where President Joe Biden met with Federal Reserve Chairman Jerome Powell on Tuesday. It was part of a broad-based campaign by the administration to tout its economic policies and the fight against inflation that included an opinion piece in The Wall Street Journal penned by the president.

“My plan to address inflation starts with (a) simple proposition: Respect the Fed, respect the Fed’s independence,” Biden said at the meeting with Powell.

“Right now, the economy is running too hot, with too much inflation and too little unemployment,” says Dan North, senior economist at credit insurer Allianz Trade North America. “The Fed needs to balance things out, bringing inflation down and unemployment up. To do so, the Fed is raising the policy rate and shrinking the balance sheet to slow the economy and increase unemployment.”

[ad_2]

Source link