[ad_1]

Douglas Rissing/iStock via Getty Images

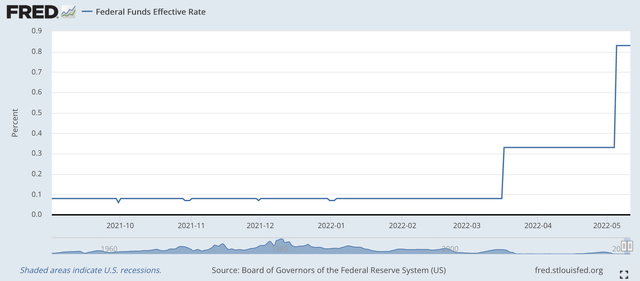

The effective Federal Funds rate remained at the new high of 83 basis points all week.

So the central bank got its 50 basis point increase in its policy rate of interest.

To achieve this rise, the Fed again counted upon removing reserves from the commercial banking system. But, it did not remove reserves from the banking system by selling securities it had purchased outright for its portfolio.

Over much of this year, the Fed has reduced the size of its balance sheet by removing reserves from the banking system by the Federal Government moving money from the commercial banking system to its deposit account at the Federal Reserve, and by the use of reverse repurchase agreement – selling securities under an agreement to repurchase them after a short amount of time.

Just in the past week, reserve balances at Federal Reserve Banks fell by $18.3 billion.

The primary reason for this fall was that reverse “repos” rose by $76.2 billion.

In the time since the March 16 meeting of the FOMC, the time that the Federal made its first move in its policy rate of interest this year, reserve balances at Federal Reserve banks dropped by almost $600 billion.

This has helped the Fed raise its policy rate of interest because of the pressure it puts on commercial banks. That is, the Fed is reducing the “excess reserves” in the commercial banking system.

Deposits of the U.S. Treasury into its General Account at the Fed resulted in deposits increasing by $297.8 billion.

Reverse “repos” rose by $310.2 billion.

Since the beginning of the year, reserve balances at Federal Reserve banks declined by $744.2 billion.

Over this time period, the U.S. Treasury Department moved $6356.3 billion from commercial bank deposits to deposits in the Treasury’s General Account at the Fed.

In addition, reverse “repos” at the Fed increased by $254.0 billion.

So, one can say that the Federal Reserve was tightening up monetary policy by reducing the reserve balances of commercial banks held at the Federal Reserve.

But, the Federal Reserve did not sell or let securities runoff from its securities so as to reduce the size of the securities portfolio.

Since March 16, the Federal Reserve shows that its securities portfolio went down by only $6.5 billion.

Note that the Fed acquired a lot of securities between December 29, 2021, and March 16, 2022, as securities bought outright rose by $213.9 billion.

So, the Federal Reserve did continue to taper its purchases in the first two-and-one-half months of the year.

But, the Fed neither bought nor sold, outright, any securities during the rest of the year up to the present time.

Fed’s Interest Rate Policy

So, it appears that the Federal Reserve is operating off of a pure interest rate target policy for the time being.

That is, the Fed is picking out the next level for its policy rate of interest, the Federal Funds rate, and then is manipulating its balance sheet to achieve the level of the Federal Funds rate it wants to achieve.

Looking at the statistics on the effective Federal Funds rate, it appears as if the Fed has been very successful.

Effective Federal Funds Rate (Federal Reserve)

The effective Federal Funds rate has not been this steady for a very long time.

The reason? The Federal Reserve was not operating on an interest rate target. like it now is.

So, this looks to be the policy tool for the near future.

As far as the Fed’s balance sheet is concerned, it is, more of a residual at this time.

The assumption is that the Federal Reserve will need to tighten up its balance sheet in order to achieve higher and higher levels of the effective Federal Funds rate. So, at some point, the securities portfolio of the Fed will have to be reduced.

Exactly how and when to reduce its balance sheet will depend upon several factors.

First, what amount of securities are maturing, and how the Fed wants to handle these maturities.

Second, how the Fed is going to reduce the amount of reverse repurchase agreements it has on its balance sheet.

Third, the amount of funds the U.S. Treasury is going to be bringing into and out of its General Account at the Fed.

How all of this will be done and coordinated will be the task. Federal Reserve officials are in for some challenging times.

This is the way the picture works itself out at this time, but the financial markets are so fragile right now that things may change as the Federal Reserve tightens up and further dislocations are generated in the banking system and in the financial markets.

Mr. Powell Re-Appointed

Yesterday, Mr. Powell’s nomination to be the Federal Reserve Chairman for a second term was approved by the U.S. Senate. Last week, Lael Brainard’s nomination as the Vice-Chairman was also approved.

Now, the Fed has its major leaders in place for the next four years.

Mr. Powell has gotten some good marks for his first term as the chair, but the kudos are not uniform.

Nick Timiraos, economics writer for the Wall Street Journal, writes very positively about Mr. Powell in his recent book “Trillion Dollar Triage.”

Others, like economist Larry Summers, have not been so generous.

My concern is that his “term” is not over yet.

Mr. Powell, I have felt and written about, has been one that has always erred on the side of monetary ease, and so he and his Fed have been very generous in providing money for the banking system and the financial markets.

His first term in this position was one where you could throw all the money you wanted at a problem and get away with it. Mr. Powell, it seemed, wanted to minimize the possibility that a market adjustment might create a sizeable financial collapse, one that would always be associated with his name.

He got away with it, and the pandemic and its subsequent economic recession were put into the past.

Now, Mr. Powell is facing the other side of the coin. Inflation is running out of hand.

So far, Mr. Powell has constantly downplayed inflation and the risk of it getting too serious. Last fall, the rise in inflation was just “temporary” and would fall back into place.

Yesterday, Mr. Powell spoke of the “pain” that fighting inflation cause people.

And, so we move on to the inflation fight.

More concern, however, is that the man that threw all kinds of “stuff” against the wall to fight a financial collapse, may not be able to keep his foot on the brake sufficiently to do the job at hand.

Mr. Powell has always appeared as if he was concerned about something “really bad” happening that will be blamed on him.

Well, making monetary policy excessively tight to remove all the reserves that were put into the banking system on the other side is going to be difficult and risky.

The question is, does Mr. Powell have what it takes to be as tight as he needs to be in order to get inflation under control?

Does Mr. Powell have the ability to keep things “tight” when the going gets tough?

Will Mr. Powell face comparison to Paul Volcker?

[ad_2]

Source link

![Early detection saved her life. A new CT measure mandates expanded insurance coverage of breast cancer diagnosis, treatment. [Hartford Courant]](https://mortgageinsurancecenter.com/wp-content/uploads/2022/05/Early-detection-saved-her-life-A-new-CT-measure-mandates-75x75.jpg)