[ad_1]

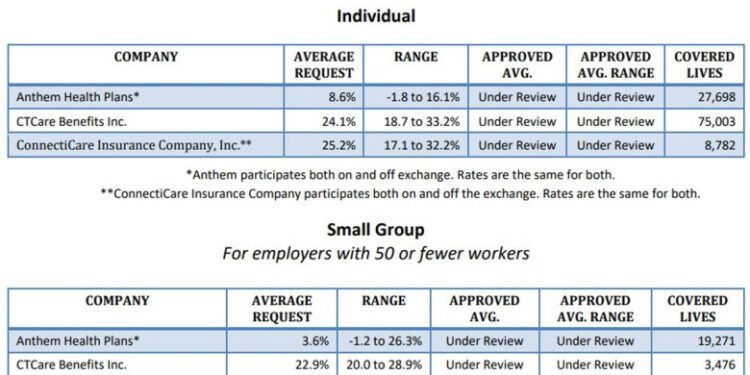

Nine insurance companies have asked the state Insurance Department to approve double-digit rate hikes for individual and small business health insurance plans that start in 2023. The proposed average individual rate request is a 20.4% increase compared to 8.6% in 2022.

The department “has received 13 rate filings from nine health insurers for plans that will be offered on the individual and small group market, both on and off the state-sponsored exchange, Access Health CT,” Insurance Department Commissioner Andrew Mais said. “Working within the authority granted to this department, we will closely examine these filings to make sure the requested rates are consistent with state law.”

ConnectiCare Benefits is proposing an average 24.1% increase for its individual plans offered on the exchange.

The company argues it’s because the demand for services has increased. That factor is expected to have a projected impact of 12.1% on the insurer’s claims costs, according to their filing. They also point out the subsidies offered under the American Rescue Plan Act put in place in 2021 are expected to go away in 2023. They say they expect fewer customers to be qualified for the advanced premium tax credit and they expect consumers will leave the individual marketplace.

As a result of the departure of customers, the insurance company expects the average morbidity of the risk pool to go up and lead to an unfavorable impact on the 2023 rates.

More than 75,000 individuals are now covered by that plan. The company is also requesting a 23.6% increase for its individual plans marketed outside the exchange. The company is also requesting a 22.9% increase for its on-exchange small business plans and a 24.5% increase for small group plans marketed outside Access Health CT.

Anthem Health Benefits, the other insurer that offers plans on Connecticut’s exchange, is asking for an average 8.6% increase for its on-exchange individual plans.

The company says about 9.2% of that increase can be attributed to medical cost inflation, provider contracting changes, and an increase in demand for those medical services. The plan currently covers about 27,698 individuals.

Anthem is requesting an average increase of 3.6% on small group health plans for employers with 50 or fewer workers.

Cigna Health and Life Insurance Company filed a request to increase rates an average of 19.64% on small group policies. Oxford Health Insurance requested a 13.4% increase for health plans used by 50 or fewer workers and a 15.7% increase for HMO plans used by 50 or fewer workers.

UnitedHealthCare Insurance company requested an average rate increase of 13.9% for small group plans. And Aetna Life Insurance Co. submitted a rate filing for an increase of 14.1% for small group indemnity plans that provide major medical and prescription drug coverage for employers with 50 or fewer workers.

Harvard Pilgrim Health Care and HPHC both decided to leave the Connecticut market and will no longer offer new business small group health plans. They will only renew existing plans through the end of their appropriate plan years.

Sen. Matt Lesser, co-chair of the Insurance and Real Estate Committee, said these proposals are “jaw dropping.” He said they will have a serious impact on small businesses and individuals and he wants to make sure the Attorney General and the Healthcare Advocate are involved in the rate review process.

Attorney General William Tong is requesting a formal hearing on the rate proposals because they exceed 10%.

“Healthcare costs and insurance premiums are already unaffordable for many Connecticut families, businesses and individuals, and these double-digit rate hikes demand rigorous scrutiny,” Tong said. “The Department of Insurance has previously agreed to hold public rate hearings on any rate increase exceeding 10 percent, and that transparency is certainly needed now. We cannot simply allow insurers to assert costs and claims without our own independent analysis and review.”

Lesser agreed.

“They owe the public an explanation and they should provide one if they want to get any rate increase,” Lesser said.

As far as solutions go, the Connecticut General Assembly offered few if any answers this session about how to solve the problem of escalating health care costs.

Republicans blamed Democrats for not taking action.

“These proposed rate increases are staggering and infuriating,” Senate Republican Leader Kevin Kelly and Sen. Tony Hwang, said. “They show not only the growing damage of inflation, but also the damage of CT Democrats repeated refusal to address rising health care costs. We knew this day was coming, we warned it was coming, and that’s why CT Republicans offered solutions to prevent it – solutions Democrats repeatedly rejected.”

They added: “”This year, Senate Republicans once again proposed a plan to rein in out-of-control health care costs. Access Health CT’s own estimates show our plan reduces premiums by $6,475 per year, or $540 per month for the average family. But leading Democrats on the state’s Insurance Committee refused to even hold a vote on that plan.”

Democrats in turn blamed Republicans.

“These rate requests show that my colleagues, including almost every Republican, who believed the industry that reform wasn’t needed and who fought the Public Option were hoodwinked,” he said.

“The system is fundamentally broken,” Lesser said. “The rate increases they’re proposing today is proof positive the market isn’t working.”

He added: “This outrageous proposal is proof they need to be rescued from themselves.”

Healthcare Advocate Ted Doolittle said he’s also calling for a formal hearing the rate hikes.

“The Office of the Healthcare Advocate believes that any premium rate request based on excessive medical costs is itself by definition excessive,” Doolittle said.

He said they need to “explain and justify the internationally abnormal, inflation-fueling prices underlying these massive rate requests.”

The Insurance Department will review the proposals and make a final decision — likely in September — for rates that will take effect on Jan. 1. There is a 30-day public comment period that starts today.

Click here for the rate proposals and to comment on them.

[ad_2]

Source link