[ad_1]

Lenders saw much of what was left of their refinancing business evaporate as rates climbed to their highest levels in nearly 13 years.

As mortgage rates continued to climb to their highest levels in nearly 13 years last month, many would-be homebuyers gritted their teeth and locked in a rate. But lenders saw much of what was left of their refinancing business evaporate, according to data released Monday by mortgage data aggregator Black Knight.

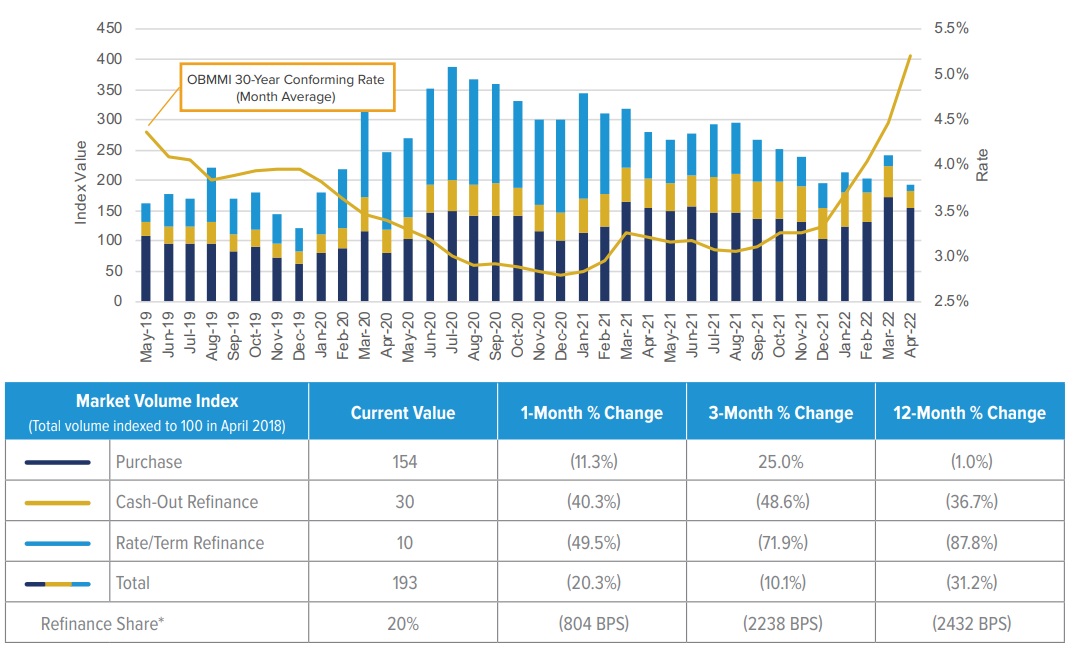

Black Knight’s monthly Originations Market Monitor showed rates on 30-year fixed-rate mortgages rising more than six-tenths of a percentage point in April, to 5.42 percent.

The result was a 49.5 percent month-over-month drop in rate locks for rate-and-term refinancings, in which homeowners are typically seeking a better rate. But cash-out refinancings — in which homeowners cash out some of their home equity — also fell 40.3 percent from March.

But there was good news for those hoping that higher mortgage rates won’t derail the spring homebuying season. While purchase loan rate locks were also down by 11.3 percent from March, they were still at pretty much the same level as a year ago, according to daily rate lock tracking data pulled from Black Knight’s Optimal Blue PPE (product and pricing engine).

Scott Happ

“Seen in the light of such quick and sharp rises in 30-year rates, April’s declines in rate lock activity – though bracing – are hardly surprising,” said Optimal Blue President Scott Happ, in a statement. “That’s particularly true of refinance locks when half of all mortgage holders have current first lien rates below 3.5 percent. That being said, while purchase locks were down somewhat from March, they remained flat from last April, reflecting consistent and resilient demand from homebuyers.”

Mortgage demand by loan purpose

Source: Black Knight April 2022 Originations Market Monitor.

All told, refinancings accounted for just 20 percent of April rate locks — the lowest share on record since Optimal Blue began tracking that metric in 2018. In the last year, demand for rate-and-term refinancing is down 87.8 percent, while cash-out refi rate locks are down 36.7 percent, Black Knight reports.

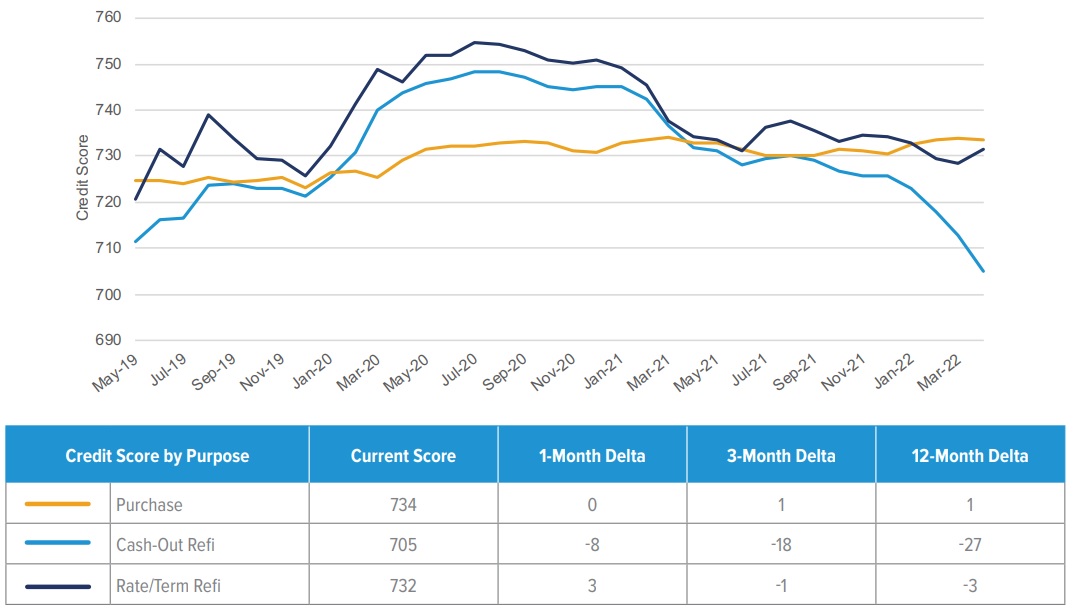

Mortgage lenders — many of whom have been laying off employees — are eager to shore up their declining originations. But for the most part, they’re still focused on making loans to borrowers with good credit scores.

Average credit score by loan purpose

Source: Black Knight April 2022 Originations Market Monitor.

Average credit scores for borrowers seeking cash-out refinancing, however, have deteriorated since last fall.

While the average credit score for homebuyers seeking purchase loans has stayed relatively constant at 734, the average credit score for borrowers seeking cash-out refinancing has dropped 27 points from a year ago, to 705.

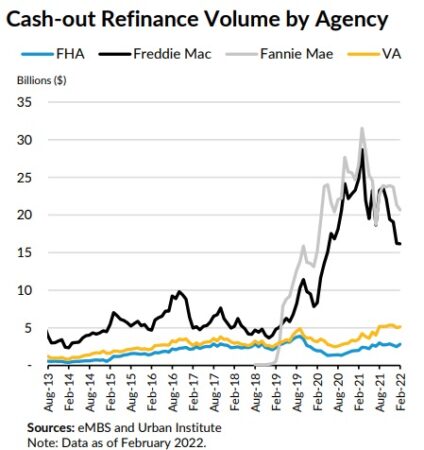

According to monthly statistics compiled by the Urban Insitute, cash-out refinancing accounted for 70 percent of all conventional mortgages refinanced in March.

When mortgage rates are high, “the cash-out refinance share is higher since the rate reduction incentive is gone and the only reason to refinance is to take out equity,” Urban Insitute researchers said in an April 29 report. “Despite the increase in the cash-out share, the absolute volume of cash-out refinances has come down sharply since the spring of 2021, when mortgage rates began to rise.”

When mortgage rates are high, “the cash-out refinance share is higher since the rate reduction incentive is gone and the only reason to refinance is to take out equity,” Urban Insitute researchers said in an April 29 report. “Despite the increase in the cash-out share, the absolute volume of cash-out refinances has come down sharply since the spring of 2021, when mortgage rates began to rise.”

Mortgage rates may level off

Mortgage rates could be set to plateau now that the Federal Reserve has laid out plans to trim its $9 trillion balance sheet. While some Fed critics want the central bank to quickly unwind the $2.7 trillion in mortgage debt it’s taken on to help the economy weather the pandemic and the 2007-09 recession, the plan unveiled by the Fed last week takes a more measured approach.

The Fed’s $9 trillion balance sheet

Assets held by the Federal Reserve through quantitative easing purchases now include $5.76 trillion in long-term Treasurys and $2.7 trillion in mortgage-backed securities. Source: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis.

To help keep interest rates low, during much of the pandemic the Fed was buying up $80 billion in Treasurys and $40 billion in mortgage-backed securities each month. That “quantitative easing” — a strategy pioneered during the 2007-2009 recession — has left the Fed holding nearly $9 trillion in government bonds and mortgage debt.

In June, July and August, the Fed plans to reduce its mortgage debt holdings by no more than $17.5 billion a month. It will then increase the cap to $35 billion a month. The caps for Treasurys will be higher — $30 billion a month at first, increasing to $60 billion a month after three months.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

[ad_2]

Source link