[ad_1]

Dilok Klaisataporn/iStock via Getty Images

Originally posted on May 3, 2022.

By Victor Haghani and James White1

Investors can be forgiven for feeling like 2022 has been a pretty bad year so far. Interest rates and consumer prices have spiked up, and stock prices are sharply down.

But, in terms of what really matters, many investors are better off than they were at the end of 2021. We’re not going to argue that having less wealth is actually good for you,2 and it’s not a case of “seeing the cup as half full rather than half empty” either. Rather, it’s about measuring what’s in the cup correctly.3

We can blame our financial institutions and media for leading us astray when it comes to measuring our financial well-being. At some point over the past 150 years, we decided to measure our financial condition in terms of the current, present value of our wealth, rather than as the annual flow of income it can provide. Our forebears knew that what matters is not wealth per se, but rather how much we are able to spend on our needs, wants and gifts to others over the years of our lives.

Any time we want to, we can log on to our financial accounts and get the up-to-date value of all our investments, and how much they’ve gone up or down to the nearest 0.01%4 – but there is simply no easy way to get a periodic mark-to-market of our wealth expressed as an annual real income stream for the rest of our lives. There’s a little more math involved, and a few personal details and market assumptions are needed too, but any financial institution that serves us could easily do the necessary calculation.

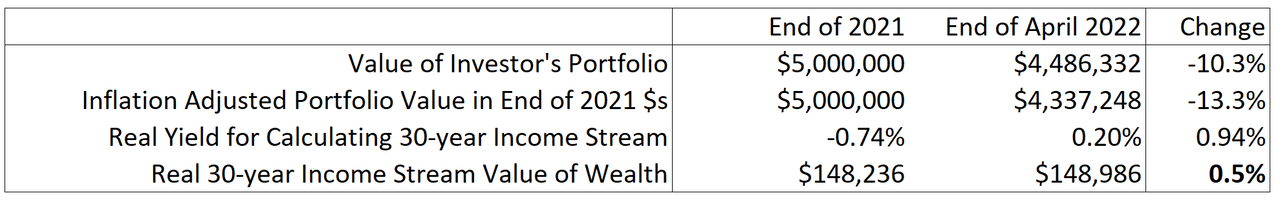

Measuring wealth in real income stream terms would look like what you see in the table below, assuming a sixty-year-old single woman with five million dollars invested in a diversified stock and bond portfolio. In practice, the discount rate we should use for calculating the real income stream equivalent of her wealth would be the risk-adjusted expected return on her portfolio, but for simplicity, we will use the relevant long-term TIPS real yield (see footnote for more details):5

Change In Real Income Stream Value of Wealth In 2022

Because of the 0.94% increase in the long-term real interest rate, the real income stream equivalent of her wealth actually increased by 0.5% over the past four months, even though the real present value of her wealth declined by 13.3%. She is better off, and even though it’s just by a tiny amount in absolute terms, she’s hugely better off relative to the brokerage account headline figure of -10.3%. There is no financial legerdemain or alchemy going on here – just household finance done as it should be.

- This not is not an offer or solicitation to invest, nor should this be construed in any way as tax advice. Past returns are not indicative of future performance.

- Although we’ve seen a few investors that seem to be acting as if it is.

- It’s a topic we’ve written about several times before, most recently two years ago in “Back to the Future: Reviving a 19th Century Perspective on Financial Well-Being.”

- For liquid investments, at least.

- Assumptions: 60% allocated to a broadly diversified global stock market ETF (Vanguard’s VT), 25% to a broad bond index fund (Vanguard’s BND) and 15% to short-term bank deposits (State Street’s BIL). Other assumptions: no taxes, CPI represents the investor’s consumption basket, no bequest desire, no longevity risk, the investor wants a level real income stream. The 30-Year Real Annuity Rate is approximated as the average of the 10-year and 30-year US TIPS yields. A fuller analysis would use the real expected risk-adjusted return of the investor’s portfolio, which would depend on the investor’s estimates of the expected return and risk of each asset class at the start and end of the period, and the investor’s personal level of risk-aversion. Our estimate of the result from such an analysis is that the real income stream value of the investor’s wealth would have declined by about 1.5%, rather than the small increase we see based on using only the risk-free real rate, but still much less than the 13.3% decline in the real present value of wealth.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link