[ad_1]

Inflation has been so hot that many Gen Xers and those younger have never seen prices climb so fast. The Federal Reserve is on course this summer and later to keep driving up interest rates to try to cool things down.

Borrowers are ending up paying more for home mortgages, car loans and other loans. But savers? They’re left grumbling that the interest rates they’re getting paid on savings remain stuck in a ditch. Why aren’t savers seeing much higher rates, too?

The average one-year yield on a certificate of deposit is 0.26% now, up from 0.17% a year ago, according to Bankrate.com.

Sure, that’s up nearly 53%. But such low rates mean that on a $10,000 CD, you’d make about $26 in interest in a year — not even enough to cover a tank of gas. That’s an extra $9 from what you’d make with a 0.17% rate a year ago.

Why CDs aren’t keeping up

Savings accounts and short-term CDs may be great low-risk spots for parking money to cover unexpected events like a big car repair or even a short-term job loss. But they’re incredibly uninspiring for keeping up with inflation when the consumer price index shot up 8.3% for the 12 months ending in April.

Why is there such a disconnect?

“During the pandemic, deposit rates had fallen to all-time lows,” said Ken Tumin, founder of DepositAccounts, which is part of LendingTree and tracks and compares bank rates.

That was driven by the Federal Reserve’s policy to cut short term interest rates to 0% at the beginning of the COVID-19 pandemic in March 2020 to combat the economic slowdown.

Now the Fed is moving rates higher to fight inflation. But savings rates, including those on short-term CDs, have a long way to go to even hit 1% or 2% in many cases.

The overall yield on savings accounts tracked by DepositAccounts — including mostly brick-and-mortar banks — rose only to 0.13% from 0.12% in the past six months, Tumin said.

Tumin, a senior industry analyst at LendingTree, said big banks are often slow to raise rates on deposits, especially when deposit levels remain high.

“Brick-and-mortar banks, especially the large banks, have been the slowest to respond to rising rates,” Tumin said.

“On the other hand, online banks have started to respond much more aggressively in the last couple of months.”

CD yields don’t just reflect the interest rate environment but also whether a bank actually needs to attract more deposits, according to Greg McBride, chief financial analyst for Bankrate.com, which lists rates on various products, including CDs.

“Most banks are pretty flush with deposits right now, particularly bigger banks, and will be even slower than usual to increase deposit payouts,” McBride said.

More:Why savers are rushing to buy I Bonds in the last days of April

More:Metro Detroit rents have gone up 8.8% over past 2 years as inflation sizzles

Savers who want to find higher rates will need to look for spots, McBride said, where their “money will be welcomed with open arms and higher yields — online banks, smaller local banks and credit unions.”

Best CD rates often less than 2%

Just letting money sit at low rates doesn’t build much wealth. It can pay to shop around to find better than average rates.

The average one-year CD yield offered by online banks has shot up in the last two months — rising from 0.74% to 1.49% — for savers, Tumin said.

“And I expect the rise to continue,” he said.

It is possible, he noted, that one-year CDs offered in the future by online banks could ultimately go higher and reach 3% by the end of this year.

Synchrony Bank, an online bank, is offering a yield of 1.5% with no minimum deposit on a one-year CD, for example. Some other banks are offering yields of 1.4% to 1.7% on one-year CDs with minimum deposit requirements ranging from $500 to $1,000.

Ally Bank, an online only bank that’s part of Detroit-based Ally Financial, has a 12-month CD with an annual percentage yield of 1.4%. No minimum balance is required. Ally has a 9-month CD at 1%.

As of June 1, Marcus By Goldman Sachs, an online only bank, had a CD yield of 1.4% on a one-year CD with a minimum deposit of $500. Marcus highlights a 10-day CD rate guarantee with a promise that if the rate on your selected CD term goes up during this time, you would get that rate automatically.

Auburn Hills-based Genisys Credit Union has a 13-month savings certificate with a yield of 1.4%. Minimum balance: $500.

We’re likely to see interest rates in general move higher in 2022, as the Federal Reserve moves to raise short term interest rates to cool down demand and fight high inflation.

The Federal Reserve’s next policy committee meeting is June 14 and June 15 when the Fed is expected to raise short term rates by another half of a percentage point.

A potential half-point rate hike in June — which would be the third hike in 2022 — would drive the federal funds rate to a new target range of 1.25% to 1.5%.

Another Fed meeting is set for July 26 and July 27, where some say the Fed is likely to raise rates again by a half-point.

What’s ahead for savers

CD rates should climb higher in the future, as the Fed raises rates again.

As long as the Fed keeps raising rates, Tumin said, it makes sense to hold off putting all of one’s savings in CDs.

While you might be tempted to chase a slightly higher rate on a five-year CD, for example, you could be missing out on locking up an even higher rate in the months ahead.

Many times, you want to stagger your CD savings to take advantage of new, higher rates in the future.

McBride said banks and others offering one-year CDs that are 1.75% currently could be offering new one-year CDs at 2.75% by fall.

“I’d wait before locking in multi-year CDs because yields haven’t peaked yet,” McBride said.

Why many are giving I Bonds a look

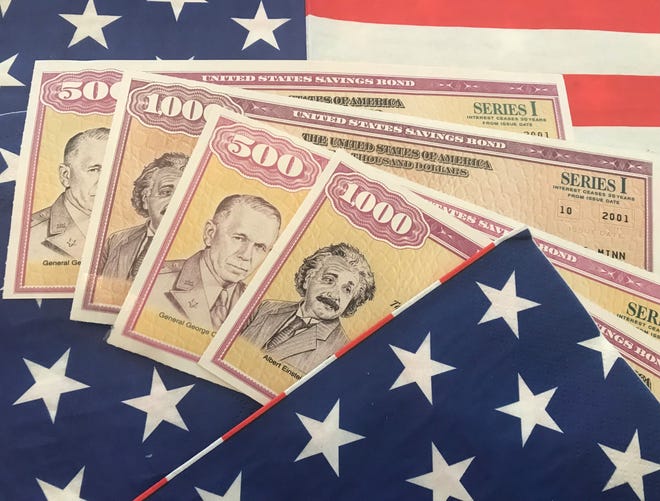

Today’s pitiful CD rates, though, give savers more reason to put a chunk of their savings into inflation-adjusted U.S. savings bonds or I Bonds.

I Bonds bought from May through October are paying an annualized rate of 9.62% for a six-month period. Interest is compounded semi-annually.

The high rate applies to the first six months. After that, another inflation-adjusted rate would apply to the bond, based on whether inflation is heating up or cooling down.

The annual purchase limit for I Bonds is $10,000 per person. I Bonds can be bought online at TreasuryDirect.gov.

Some savers might be able add an additional $5,000 in a year if they choose to direct a federal income tax refund toward I Bonds. But you need to do so when you’re filing a tax return and you’d file Form 8888 with the return.

So it is possible for some to buy up to $15,000 a year.

High rates that reflect the uptick of inflation started building interest in I Bonds in 2021 and, again, in 2022.

For example, savers who bought I Bonds from Nov. 1, 2021, through April 30, 2022, will receive a 7.12% annualized rate that applies to the first six months. Then, the latest annualized rate of 9.62% kicks in for the next six months.

The result: The average rate would end up being 8.37% over 12 months. On $10,000 in savings for this I Bond scenario, the interest for the first year would add up to at least $837 if you hold onto the bond at least 15 months.

The limitations: I Bonds cannot be cashed at all in the first 12 months. If you cash them before the five year mark, you’d lose the most recent 3 months of interest. If inflation were super low, you’d lose a minimal amount of interest.

If you only plan to hold a bond for a short time, you might want to wait at least 15 months to avoid losing three months of interest at that current ultra-high rate, according to Daniel Pederson, a Monroe-based savings bond expert and founder of www.BondHelper.com.

I Bonds proved to be one hot product in April as savers tried to lock in those two sets of high rates.

About $4.26 billion in I Bonds were issued in April alone — up from $211 million in April 2021, according to the Treasury’s Monthly Statement of Public Debt. That’s roughly 20 times last year’s sales in April alone.

More than $10.4 billion went into I Bonds from January through April this year.

What if you still haven’t bought I Bonds?

Even if you didn’t lock in a rate buying in April or earlier, it could still make sense to buy I Bonds from May through October, according to Pederson.

We don’t know yet what the new inflation-adjusted rate would be from November through April 30, 2023. So you don’t know what return you’d get over 12 months.

If the inflation rate dropped to 0 — and that’s not expected — the overall return for 12 months would still be 4.81% for the year for those buying from May through November, Pederson said.

“When compared to CDs, money markets and savings accounts, you’re still going to trounce them,” he said.

If inflation continues, as many expect, you’d add an inflation-adjusted rate onto the savings bond that would drive up the 12-month return above 5% and possibly higher.

Pederson said it can make sense to keep some emergency savings in accounts that are easily accessed, such as a savings account. But other savings, which can be used for bigger emergencies, can be set aside in I Bonds, too, if that money won’t be needed for 12 months.

It’s important to note that you can withdraw money early from a one-year CD but you’d typically forfeit 3 months of interest if withdrawing early from a CD with a maturity of 1-year or less.

For younger savers who are still in school or starting in their careers, I Bonds offer a good way to lock in a higher rate with as little as $25 in savings when you buy directly online.

Someone who has built up more savings over the years and has money just sitting in checking or savings obviously can get a better return now on a portion of that savings, up to $10,000 per person a year with I Bonds.

Plenty of people are recognizing the opportunity for higher rates — and we’re likely to hear more grumbling about savings rates and more conversations about I Bonds.

ContactSusan Tompor via stompor@freepress.com. Follow her on Twitter@tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

[ad_2]

Source link