[ad_1]

“Forget everything you know about insurance,” was the brash tagline on a banner adorning the New York Stock Exchange when Lemonade went public in July 2020. The message captured the confidence that propelled the US insurance start-up and its peers, including Hippo and Root, on to the stock market at valuations far above those of more established peers.

The self-styled disrupters had a beguiling pitch to investors: our technology can track risks in real time; cut the number of insurance claims by anticipating incidents such as leaks; and speed up the processing of paperwork. The result, they said, was businesses that would ultimately outperform older rivals.

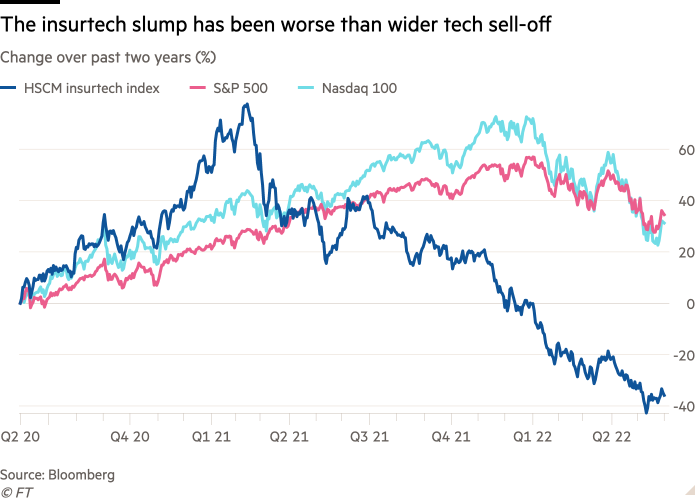

But two years on from its Wall Street debut, Lemonade, along with Hippo and Root, are among the biggest casualties of a brutal rout in tech stocks, as rising interest rates prompt investors to ditch high-growth companies in favour of those that generate reliable profits.

Within the sell-off, the wider fintech sector “got hit particularly hard, and then, within [that], I think insurtech got hit the hardest”, said Alex Timm, the chief executive of Root, a motor insurance specialist that had early backing from heavyweight tech investor Tiger Global.

Shares in Lemonade, which provides renters insurance and other personal cover, are down nearly 90 per cent since peaking last year and are now more than a quarter below their IPO price. Root, which went public shortly after Lemonade, has seen its stock fall more than 90 per cent, while home insurer Hippo is down more than 85 per cent since its listing in early 2021.

As the tech rally threatens to unravel further, the companies, commonly known as insurtechs, must now convince a far more sceptical market that their business models are worth sticking with.

Ruth Foxe Blader, a partner at London-based fintech investor Anthemis, said the insurtechs’ early valuations were driven by a “hype cycle” that has not withstood scrutiny.

At its peak, Lemonade was valued at around 100 times sales, according to Bloomberg data. By contrast, well-established and large US insurers such as Travelers and Chubb traded at between one and two times sales.

“There was a lot of goodwill, and the growth and the size of the accessible market had dollar signs in everybody’s eyes, but the fundamentals . . . really needed to be explored more deeply,” said Foxe Blader.

Despite a chastening past few months as a public company, Lemonade chief executive and co-founder Daniel Schreiber appears to show the same equanimity now as he did on an exuberant first day of trading, when the group’s shares closed up nearly 140 per cent.

In an interview with the FT, he pointed to a letter Lemonade published prior to its IPO in which the founders of the New York-based company stressed that they are “not interested in our share price on a day to day, week to week or month to month basis”.

“This is really something that we said on the way up, I’m saying it on the way down,” Schreiber insisted. “It’s one of those ‘he who laughs last’ kind of dynamics,” he said, referring to the need to take a long-term view.

In the run-up to its IPO, Lemonade, which counts SoftBank as an early backer, trumpeted its artificial intelligence-powered systems that allowed for lightning-speed processing of claim payments.

But as fears of a downturn in the US economy grow, it is the insurtechs’ core underwriting — the price at which they are prepared to underwrite customers’ risks — rather than their tech savvy that is under focus from analysts and investors.

Loss ratios, which measure claims incurred as a proportion of premiums sold, have remained stubbornly high, knocking earnings. According to Capital IQ, Root, Lemonade and Hippo booked $1.1bn in net losses between them in 2021, up from a combined $474mn two years earlier.

Timm urges patience. Loss ratios, he points out, will be higher with a brand-new customer base as insurers work out the right price at which to underwrite risk — while surging inflation in the price of claims has made the job even harder. All the insurtechs say that loss ratios will improve as their understanding of customers deepens.

Lemonade has said that forays into pet and home insurance “demonstrate higher loss ratios than our more mature, stable renters book”.

Schreiber argues that the group’s decision to sell directly to consumers instead of using agents means costs are heftier at the start. However, expected improvements in the loss ratio and return on that initial investment means “the arithmetic fixes itself”, he said.

It is an optimism shared by Julian Teicke, the chief executive of privately held German insurtech Wefox, who likens the challenge facing the listed early stage insurance companies to a “valley of death”.

After the initial hype, he said, companies struggle as the value from better technology, lower costs and more sophisticated underwriting is only crystallised once insurers have a substantial book of business.

Smaller insurers concentrated in one area are also more vulnerable to one-off events. Last year, Lemonade and Hippo were punished for their exposure to Texas as winter storm Uri drove up payouts.

“The results can only be really good, and influenced by the technology that has been built, if the book is really big, and that is going to take time,” Teicke said. Wefox operates a platform model that connects insurance providers, brokers and customers.

For some, time is a luxury the listed insurtechs do not have as losses eat away at cash piles raised in their IPOs.

“They are all going to need external capital in the next 24 months, and I don’t know how they get it,” said Ryan Tunis, an analyst at research house Autonomous.

According to Capital IQ, Lemonade had $211mn in net cash at the end of March having used up $40mn in the first quarter. Schrieber expects the group’s losses to peak this year.

Root has $644mn in net cash, burning through $51mn between January and March. Timm is confident that the business is “well past peak burn” and feels “very good without additional capital raises that we can execute on the strategic priorities that we have set for our business”.

Hippo, meanwhile, had $320mn in net cash and used up $59mn. Rick McCathron, the group’s president and chief executive, said it had “plenty of runway to get to the maturity to implement all of the things that we have already starting implementing”.

Lemonade and Hippo report a figure for their liquidity that combines gross cash and investments. By that measure, Lemonade had $1bn and Hippo $772mn at the end of March. Root says it had “unencumbered capital” of $736mn when the quarter ended.

Even as they sketch out a brighter future, the insurtechs cannot afford to stand still. Root, whose real-time underwriting uses in-car data to provide a constantly updating picture of a customer’s risk, has embarked on the most radical course to fatten its underwriting margins.

It fired a fifth of its workforce in January, is scaling back its marketing spend and raising prices for its policies.

Hippo, which is based in Silicon Valley, is rapidly diversifying beyond its heartlands of California and Texas while also tightening its underwriting guidelines. Lemonade is also focusing on those states that have proved most profitable.

With Timm acknowledging that being public “generates a lot of noise” as investors take bearish or bullish positions on the company’s future, the trio of insurtechs have enlisted more seasoned industry veterans.

Last year, Hippo poached Grace Hanson from Hiscox, a London-listed insurer, to be its chief claims officer. This month, it announced McCathron, its president since 2017, had also been appointed chief executive, highlighting his “extensive insurance expertise”.

Lemonade recruited Sean Burgess from San Antonio-based insurance group USAA to be its chief claims officer. In March, Root appointed a chief financial officer, Rob Bateman, whose CV includes stints at well-known insurance firms such as The Hartford.

There are signs of improvement. In its first-quarter results in May, Hippo reported its best gross loss ratio since listing, at 76 per cent, sending its shares up sharply. It expects this measure to come in below 100 per cent for the full year.

Sceptics such as Tunis at Autonomous recommend struggling insurtechs start scouting for buyers among the industry’s behemoths. “You want to be the one that gets bought,” he says.

But McCathron said the challenges of last year are “just a matter of growing up”, drawing a comparison with basketball legend Michael Jordan.

“When Michael Jordan was 5 years old, [he] showed promise, but he was 5, he had to mature.”

[ad_2]

Source link