[ad_1]

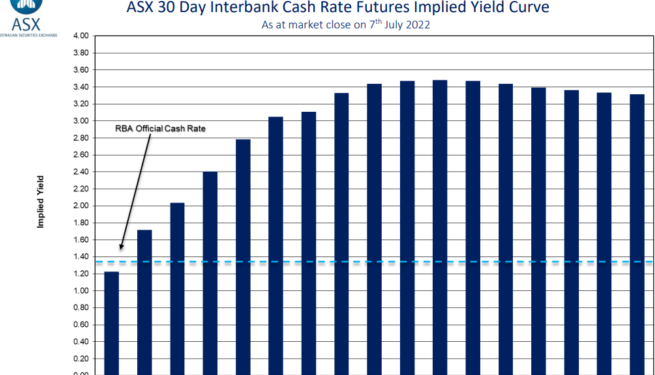

A week ago, the futures market had moderated its forecast of Australia’s official cash rate (OCR), tipping a rate of 3.0% in December and a peak of 3.5% in May 2023:

7 July: Futures market forecast a peak OCR of 3.5% in May 2023.

This forecast would have seen Australia’s average discount variable mortgage rate climb to 6.8% by May 2023, assuming increases in the OCR are passed onto mortgage holders. This would be nearly double the April pre-tightening level of 3.45%.

Following Thursday’s strong labour market data, which saw Australia’s unemployment rate collapse to a 48 year low 3.5%, the futures market hiked its OCR forecast. It now tips an OCR of 3.3% by December before peaking at around 3.75% in May 2023:

14 July 2022: Futures market forecast a peak OCR of 3.75% in May 2023.

If true, this would see Australia’s average discount variable mortgage rate soar to 7.1% – more than double its pre-tightening level:

Variable mortgage rates to more than double to 7.1%.

In fact, Australia’s average discount variable mortgage rate would climb to its highest level since March 2011 under the futures market’s latest forecast.

The impact on Australian mortgage holders would be devastating. Average mortgage repayments would soar by 51% versus what they were immediately before the Reserve Bank’s initial rate hike in May:

Fancy a 51% increase in mortgage repayments?

For a household with a $500,000 variable rate mortgage, this would represent a monthly increase in repayments of $1,129, whereas a household with a $1,000,000 mortgage would pay an extra $2,258 a month.

Rate hikes of this magnitude would also crash Australian house prices and could plunge the economy into recession, given the hit to consumer spending – the economy’s main growth driver.

Given house prices skyrocketed 35% over the pandemic on the back of deep cuts to mortgage rates, major price falls would necessarily follow the sharpest lift in mortgage repayments in Australia’s history.

The market needs to recognise that interest rates are a double-edged sword.

[ad_2]

Source link