[ad_1]

If you are among those investors who prefer the safety of bank deposits, then a 40 basis points repo rate hike by the Reserve Bank of India (RBI) is good news .

Major lenders such as HDFC Bank and ICICI Bank have revised their fixed deposit (FD) rates over the past three weeks.

HDFC Bank is now offering 2.50-5.75% for different tenors on domestic term deposits of less than ₹2 crore, while ICICI Bank’s FDs also are in the same range. State Bank of India, which had last revised its FD rates, offers interest of 5.50% on tenors of five years and up to 10 years.

Note that the highest interest rate is generally paid on tenors of five years and above and senior citizens get an additional payout on their deposits in the range of 50-75 basis points.

While major scheduled commercial banks (SCBs) have been conservative in their interest payout, certain smaller banks such as IDFC First Bank are now offering FD rates in the range of 3.50-6.25%. IndusInd Bank, too, is offering interest of up to 6.50% on its domestic term deposits.

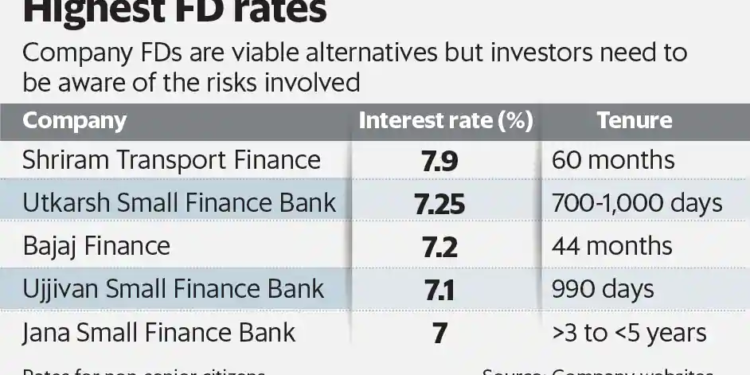

Meanwhile, some small finance banks (SFBs) have now come out with higher interest rates on deposits.

View Full Image

Ujjivan SFB recently raised interest rates on its term deposits. Rates on deposits with tenurebetween 15 and 18 months have been raised by 75 bps to 6.75%, and those for a 990-day tenure have been increased 35 bps to 7.1%.

Jana SFB offers up to 7% interest on its regular FD options.

Apart from banks, non-banking finance companies (NBFCs) also offer fixed deposits, which are called company FDs.

Bajaj Finance Ltd recently raised its FD rates, with the highest FD rate now at 7.20% for non-senior citizens (tenure of 44 months). Notably, Shriram Transport Finance offers rates of up to 7.90% on its term deposits.

According to experts, FDs are not a great investment avenue as returns after inflation and tax tend to be negative. However, FDs are good savings instrument for parking emergency or surplus funds. While company FDs are viable alternatives, investors need to be aware of the risks involved.

“Compared to a bank FD, the risks are higher in case of corporate FDs. The interest rates are higher because there is additional risk. The largest credit risk at this point is that the company may not be able to pay back the depositor in terms of the interest or the principal. Keep in mind that this is not the case for all corporate FDs. Retail investors may be better off looking at other options, unless they are looking at AAA-rated NBFCs,” said Adhil Shetty, CEO of BankBazaar.com.

[ad_2]

Source link