[ad_1]

Editor’s note: Seeking Alpha is proud to welcome XA Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

DNY59/iStock via Getty Images

Anticipated Interest Rate Increases

Due to inflationary concerns, the Federal Reserve (the “Fed”) announced in late 2021 an end to their bond buying program, and at the Fed’s meeting on March 16, 2022, it raised interest rates for the first time in three years by 0.25%. The current rate of inflation in the U.S. is around 8.0%.1 After years of uncharacteristically low interest rates, the market has expected the Fed to raise rates and this month’s rate hike matched those expectations.

With the market anticipating multiple rate hikes, and indeed, on March 16 Fed Chairman Jerome Powell hinted at possibly six more increases over the rest of the year to fight inflation, it is possible we may see a cumulative interest rate increase of 1.50% during 2022.2 This paper focuses on access to CLOs and how they can serve as an attractive alternative to other types of credit during periods of rising interest rates.

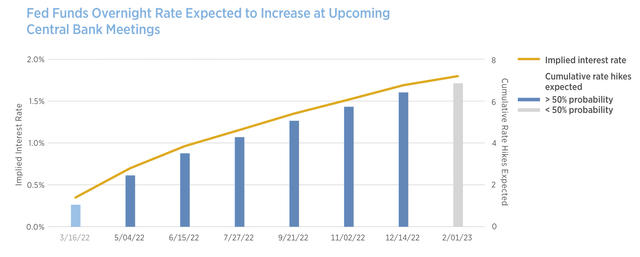

Fed Funds Overnight Rate Expected to Increase at Upcoming Central Bank Meetings

Note: As of pricing date 3/9/2022. Cumulative Rate Hikes Expected represents the number of cumulative hikes (+) or cuts (-) estimated by the associated meeting. This is calculated as the implied rate change divided by the assumed rate move. Implied Interest Rate represents the overnight rate expected after the corresponding Central Bank meeting that is implied by the chosen instrument. Past meeting shown on 03/16/2022. Future meetings shown from 05/04/2022 to 02/01/2023.

CLOs and Investment Access

XA Investments LLC (“XAI”) believes that floating-rate loans and collateralized loan obligations (CLOs) are compelling investment options in today’s rising rate environment. The XAI Octagon Floating Rate & Alternative Income Term Trust (“XFLT” or the “Trust”) is a listed closed-end fund3 that invests in a portfolio of floating-rate loans, CLO debt and equity. The Trust’s portfolio, as of December 31, 2021, was invested in CLO debt and equity (50%), first lien and second lien loans (46%) and other investments (4%). CLO investing introduces a new set of opportunities and risks for investors. During a Fed hike cycle, XAI believes the Trust may benefit from its investment in floating-rate securities and low average effective duration of less than six months. The Trust may also benefit from its active management during such a rising rate period.

For some time, exposure to floating-rate loans has been accessible through an array of mutual funds, ETFs, and closed-end funds. Therefore, advisors and investors have developed a familiarity with loans, their risks, and benefits. Conversely, CLOs are less familiar and far more difficult to access. With interest rates expected to rise from historically low levels, many investors may find the CLO market’s floating-rate coupons attractive.

CLOs may present a natural hedge to rising interest rates because of their floating rate income and low duration risk.4 As rates increase, CLO debt securities pay higher coupons. CLO equity securities are more nuanced; in the long term, “the spread” paid to equity holders often increases as interest rates rise. By contrast, interest rates on traditional fixed income investments are locked or “fixed” and therefore adversely impacted by rising rates.

CLOs and their Response to Interest Rate Changes

CLO debt tranches typically offer higher yields relative to similarly rated corporate credits and other structured products. They may also provide potential for capital preservation through structural protections and investor-centric covenants. Historically, the CLO structure has proven to be extremely resilient through multiple market cycles. In fact, there has never been a documented default in the AAA and AA CLO debt tranches.5 Negative correlations to U.S. Treasury bonds and low correlations to investment grade corporate credit and equities also present valuable diversification benefits. Lastly, CLOs offer access to a broader range of debt issuers, most of whom do not participate in high yield bond markets.

In a CLO, the collateral manager purchases a portfolio of floating-rate loans (typically 150-300 issuers) with proceeds from the CLO debt and CLO equity issuance. Interest earned from the floating rate loans or “loan collateral pool” is used to pay the coupon interest on the CLO debt securities. Once interest payments are made and the CLO’s operating expenses are paid, any remainder or residual cash flow is distributed to the CLO equity or “residual” holders. Notably, these equity investors are first to absorb any loan portfolio losses, reducing such residuals.

CLOs can be attractive to investors concerned with the impact of rising rates on credit instruments. As mentioned previously, the bank loans purchased by a CLO collateral manager are floating-rate and may be particularly favorable to investors anticipating a rate hike. When interest rates rise, the interest paid on underlying loans can increase and ultimately benefit the CLO-in particular, the CLO equity holders.

Rate Hikes and the Implications of LIBOR/SOFR Floors

Most loans in the marketplace have LIBOR (or SOFR) floors (i.e., 50 to 75 bps),4 which means that when rates rise there can be a delay in the increase in loan yields if the loans are already paying out the minimum or the floor rate. Rates must rise above the floors for floating-rate loan investors to see the benefit of the rate hikes. If we observe multiple rate hikes, which result in the loan market moving above the floors, loan interest will adjust with changes in rates going forward.

The table on the top of the following page summarizes the performance of various asset classes during the last five cycles of Fed tightening. Even though accurately predicting interest rate moves is a challenge, history may serve as a guide. If interest rates rise, floating-rate loans and CLO debt have the potential to outperform longer-duration fixed income such as investment grade bonds, municipal bonds and high yield bonds.

Floating-Rate Loans and CLO Debt Outperform as Fed Raises Rates

|

Performance during past periods of Fed tightening |

|||||||

|

Date range |

Ratehike(bps) |

U.S. Treasuries |

InvestmentGrade Credit |

MunicipalBonds |

High Yield |

Floating RateLoans |

CLO Debt (BB-rated tranches) |

|

2/4/94 to 2/1/95 |

300 |

-7.65% |

-3.93% |

-3.56% |

-1.74% |

9.33% |

n/a |

|

6/30/99 to 5/16/00 |

175 |

2.99% |

0.10% |

-0.16% |

-2.27% |

3.06% |

n/a |

|

6/30/04 to 6/29/06 |

425 |

8.59% |

5.85% |

9.30% |

14.88% |

5.92% |

n/a |

|

12/16/15 to 12/31/18 |

225 |

7.93% |

8.95% |

7.82% |

20.02% |

14.75% |

36.63% |

Source: U.S. Treasuries represented by Bloomberg US Long Treasury Total Return Index, Investment Grade Credit represented by Bloomberg US Credit Index, Municipal Bonds represented by Bloomberg US Municipal Index, High Yield represented by Bloomberg US High Yield 1% Issuer Cap Index, Floating-Rate Loans represented by Credit Suisse Leveraged Loan Index. CLO Debt is represented by the J.P. Morgan Collateralized Loan Obligation Post Crisis BB Index (“CLOIE”). Data for indices are through the nearest month end. CLOIE index incepted on 12/30/2011.

Benefits of Investing in CLOs

The following table summarizes many key attributes of CLO securities, as compared with various other credit and structured securities. CLO investing involves important risk considerations, however, including risk of loss, accounting and valuation risk, leverage risk and market volatility risk. See page 4 for a discussion of risks associated with CLO investing.

|

Attractive yields |

CLO debt provides opportunity for incremental yield pick-up relative to similarly rated bonds and other structured securities6 |

|

Low historical defaults |

CLO debt tranches have demonstrated long-term historical default rates lower than similarly rated U.S. corporate credit instruments5 |

|

Floating rate income |

Coupon floats based on LIBOR (or the new market standard SOFR), which may benefit investors in periods of rising short-term interest rates7 |

|

Portfolio diversification |

CLO debt has low correlations to equities and investment grade corporate credit and negative correlation to U.S. Treasury bonds |

|

Inflation hedge |

Floating-rate loans and CLO securities can serve as an inflation hedge in the portfolio. These floating-rate investments demonstrate higher correlation to inflation than other inflation hedges such as commodities or infrastructure |

Footnotes

1 According to the U.S. Bureau of Labor Statistics Consumer Price Index 12-Month percentage change for the year ended January 2022.

2 Bloomberg.

3 Closed-end funds (CEFs) are actively managed portfolios and are subject to active management risk. Shares of CEFs frequently trade at a discount from their net asset value. An investment in a CEF is subject to investment risk, including possible loss of the entire principal amount that you invest.

4 Senior secured loans have reference rate floors (typically tied to LIBOR or increasingly, SOFR); most commonly the LIBOR floor has been 0.50%. Investors in senior secured loans benefit from higher interest payments once LIBOR is above the 0.50% floor. Similar levels are expected to persist as reference rates shift to SOFR.

5 ©1993-2017 Moody’s Investors Services, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates-used with limited permission, Moody’s Investors Services, Special Comment: Default and Loss Rates of Structured Finance Securities: 1993-2017. November 6, 2018. Please note this is the latest information available from Moody’s.

6 J.P. Morgan, Credit Strategy Weekly Update: High Yield and Leveraged Loan Research, February 11, 2022.

7 Citi Research, “2022 Global CLO Outlook” (December 14, 2021).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link