[ad_1]

Prepayment sounds like a convenient option to get rid of your loan and interest liability. We all want to pay off our debts and free ourselves from long-term financial commitments. The RBI had recently increased the repo rate by 40 basis points, making loans costlier and triggering speculation about how far the rates could rise.

A higher interest rate cannot be ruled out since most floating interest rate loans are linked to the repo rate. Let us find out how you should manage the home loan repayment and how this will impact you in the long term.

How Increase In Interest Impacts The Loan Repayment

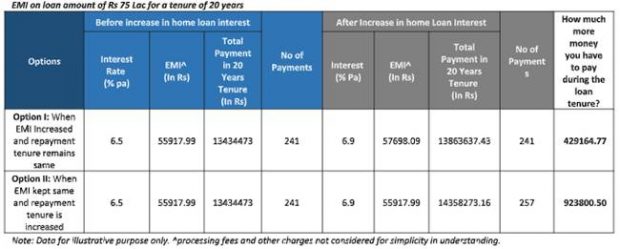

When the interest rate on your existing loan increases, you get two options from the lender: either to increase the EMI (Option I in the illustration below) or to increase the tenure (Option II in the illustration below). With the help of the illustration shown in the table below, let’s find out how your loan will get impacted in both cases.

Impact on Home Loan EMI After Hike in Interest Rate

In both cases, the borrower will pay more interest. However, interest outgo will be higher if you keep the EMIs the same and increase the tenure. Loan prepayment can be an effective tool to reduce the impact of the interest rate hike on your loan.

Prepaying Loan When Interest Rate Increases

According to Bankbazaar, when there is an increase in the interest rate, and you want to prepay loans to avoid extra interest outgo during the loan term, the bank gives you different options to readjust your loan liability. In the first option (Case-I in the illustration below), the EMI size remains the same, whereas the repayment tenure changes, resulting in smaller prepayment and a reduction in the number of EMIs. In the second case (Case-II in the illustration), the EMI size changes, whereas the tenure remains the same, but it requires a bigger prepayment and gives you the benefit of a reduction in the EMI size.

Various prepayment options to save interest when there is a hike in home loan interest rate

You should be ready with an appropriate repayment strategy. Several repayment options can be available with your lender that can help you save interest and avoid financial stress. So, don’t hesitate to discuss with your lender and get a more customised solution for yourself.

[ad_2]

Source link