[ad_1]

The Covid pandemic has made a strong case for holding life insurance stocks with factors such as under-penetration and more people recognising the advantages of life cover.

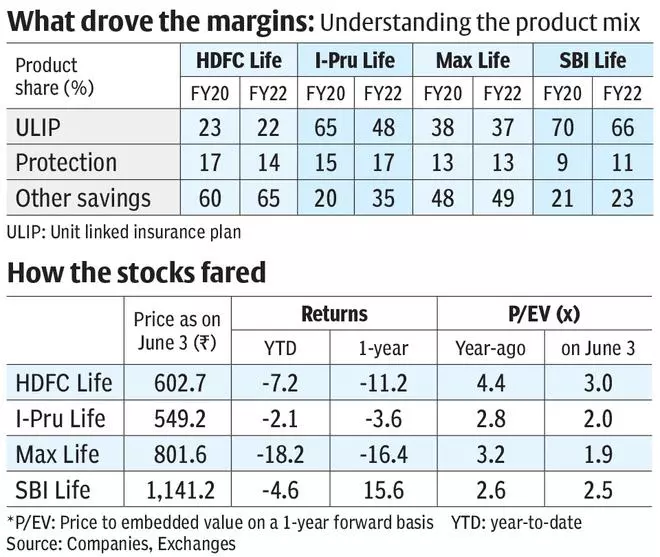

But this enthusiasm is barely reflected in stock performances (see table).

HDFC Life Insurance and Max Financial Services (the holding company of Max Life Insurance) have underperformed the Nifty 50 index (which is up 5 per cent) in a big way in the last one year. Even ICICI Prudential Life Insurance (I-Pru Life) hasn’t held up in the bourses during this period. While SBI Life Insurance was the lone outperformer last year, on a year-to-date basis, the stock is paring some gains.This lacklustre show comes at a time when the FY22 financial performance of listed life insurance players exceeded Street expectations.

Though on FY21’s lower base, the annualised premium equivalent (APE) growth for the top four listed players at 17-25 per cent bettered consensus estimates of 12-15 per cent. Their profitability measured in terms of value of new business (VNB) margin in FY22 was at an all-time high (see table).

So, what explains the divergence between the stock performance and the financials?

Less protection

A deep dive into the product profile of India’s top life insurance companies may prompt one to question if life insurance is a product to secure the future of a family or is it just another savings product that may be a tad more tax efficient.

For HDFC Life and Max Life, the share of protection plans either reduced or stagnated in FY22. Much of the growth was frontloaded by savings products such as annuity schemes and ULIPs . While on a full-year basis, I-Pru Life and SBI Life may have stayed away from this trend, the share of ULIPs remain elevated compared to peers and this is a concerning aspect.

Take the case of Bajaj Allianz Life Insurance.. The share of pure-protection plans stood at only two per cent of the total APE in Q4 — just half of year-ago level. Growth was supported by savings products, share of which rose from 52 per cent in Q4 FY21 to 62 per cent in Q4 FY22.

Flipside of the strategy

According to insurers, savings products are on a high when the interest rate cycle is near a bottom as they offer higher returns compared to bank deposits. The Section 80C deduction for premia is also a sweetener. But, now, the cycle is in for some reversion and interest in these products may wane.

Secondly, competition (hence, price war) has significantly increased with life insurance companies introducing new ULIP and annuity products in recent times rather than protection plans that were more in focus until 2019. Life cover in these plans is 20 per cent or lower vis-à-vis 80 per cent or more in pure protection plans. While in the initial years, they may prop up APE growth and boost profitability, in the long run they don’t offer value. Therefore, helped by these highly profitable savings products, FY22 VNB margins may have hit an all-time high. But sustaining these levels may be a Herculean task.

What next?

The share of protection plans for Indian players lags established markets such as China, the UK and the US. On a combined basis, it is less than 20 per cent for top four private players, while globally the number is 40-45 per cent. With listed stocks trading at 2-3x the FY23 embedded value, valuation premium for the sector has reduced significantly.

India’s largest life insurance company, LIC , trading below its embedded value has also had a rub-off effect on private players. Unless life insurance companies demonstrate a strong pick-up in pure-protection plans, the stocks may not re-rate in a hurry.

Published on

June 04, 2022

[ad_2]

Source link