[ad_1]

Bond market investors are wary that the Fed will be forced to implement drastic 75-basis point rate hike in June or July.

All June long we’re going deeper on mortgage and title — looking at where the mortgage market is headed, how products are evolving and alternative financing options changing the game. Join us for Mortgage and Alternative Financing Month. And subscribe to Inman’s Extra Credit for weekly updates all year long.

Stocks plummeted and long-term interest rates were up sharply Friday, after the Labor Department released statistics showing the U.S. experienced the highest rate of inflation in more than 40 years during May.

Mortgage rates are likely to follow long-term interest rates higher, as hopes fade that inflation will soon moderate and that the Federal Reserve will be able to ease up on short-term interest rate hikes later this year.

Rent increases and the soaring cost of gas and food drove an 8.6 percent increase in the Consumer Price Index (CPI), the biggest gain since December, 1981, the Labor Department reported.

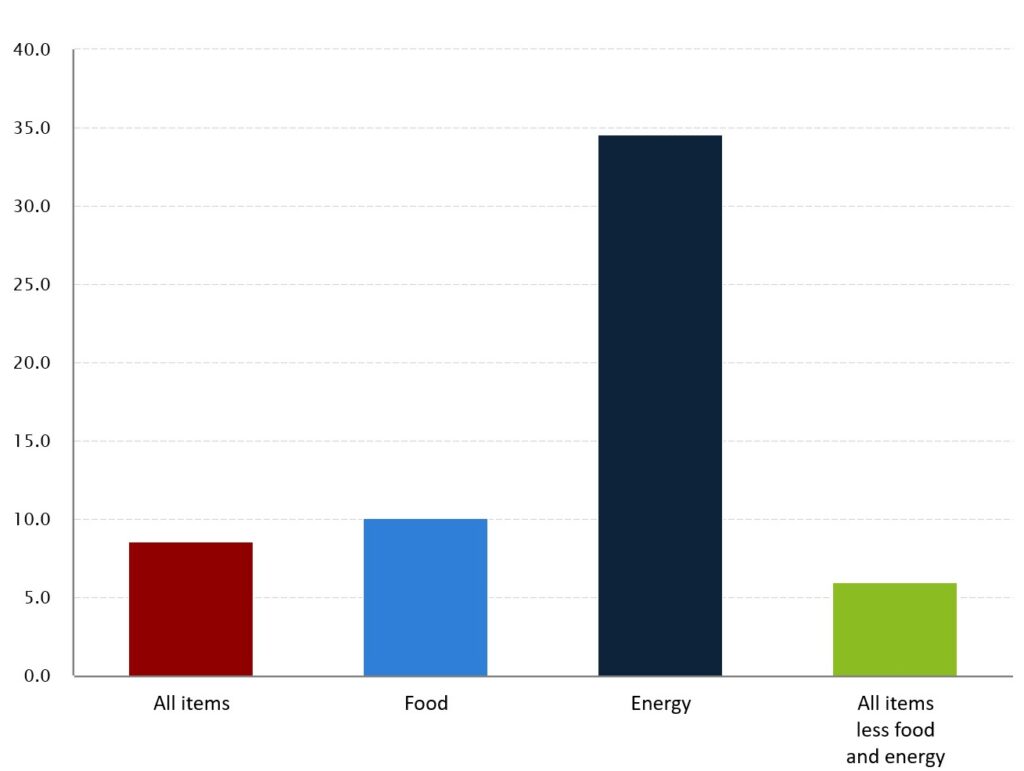

Energy and food prices driving inflation

Source: U.S. Bureau of Labor Statistics.

Energy prices were up 34.6 percent from a year ago in May, with gas prices rising by 48.7 percent. Fuel oil prices soared 106.7 percent, the largest increase in the history of the series, which dates to 1935.

The cost of food, which includes groceries and eating out, was up 10.1 percent, the first double-digit increase since March, 1981.

After stripping out volatile food and energy prices — which are under added pressure due to the war in Ukraine — core CPI (all items minus food and energy) dropped from 6.2 percent in April to 6 percent in May.

But the cost of shelter — one of the largest components of the CPI, and which includes rent and homeowners’ equivalent of rent — was up 5.5 percent from a year ago, the biggest 12-month increase since February, 1991.

To fight inflation, the Federal Reserve implemented in March its first short-term interest rate hike since 2018, raising the federal funds rate by 25 basis points, or one-quarter of a percentage point. With inflation still raging, the Fed implemented a more drastic 50-basis point hike on May 4 — the biggest short-term interest rate hike in 20 years.

While the Fed has telegraphed that it plans to implement another 50-basis point increase at its next meeting on June 15, there had been some speculation that it might dial back short-term rate increases to 25 basis points after that if inflation eased. The Fed’s long-term goal is to get inflation down to 2 percent.

Ian Shepherdson

“This report kills any last vestiges of hope that the Fed could pivot to 25 (basis points) in July,” said Pantheon Macroeconomics Chief Economist Ian Shepherdson in a note to clients Friday. “But we remain hopeful for September, on the grounds that the next two core CPI prints will be lower than May’s.”

Shepherdson expects that three upcoming jobs reports will show that wage gains continue to moderate, and that by September, “the housing meltdown will have everyone’s attention, and continuing to hike by 50 (basis points) will look gratuitous.”

Odds of drastic, 75-basis point Fed rate hike grow

But bond traders are now pricing in the possibility that the Fed will hike the federal funds rate by 75 basis points on July 27, and economists at Barclays PLC and Jefferies LLC think policymakers might even take that drastic step as soon as next week.

The Fed “now has good reason to surprise markets by hiking more aggressively than expected in June,” Barclays economists led by Jonathan Millar wrote in a note Friday, Bloomberg News reported. “We realize it is a close call and that it could play out in either June or July. But we are changing our forecast to call for a 75 [basis point] hike on June 15.”

The CME FedWatch Tool, which monitors futures contracts to calculate the probability of Fed rate hikes, shows traders on Friday were pricing in a 21 percent probability of a 75-basis point rate hike on June 15, up from just 3.6 percent on Thursday. Friday’s trades implied a nearly 50-50 chance that the Fed will raise rates by 75 basis points in July, up from 19.4 percent on Thursday.

While the Federal Reserve has direct control over the short-term federal funds rate, rates on long-term investments, such as Treasurys and mortgage-backed securities are largely determined by investor demand.

The drastic change in expectations Friday about the Fed’s next moves put stocks into a tailspin, and yields on long-term government bonds soaring. The Dow Jones Industrial Average fell nearly 900 points Friday, and yields on 10-year Treasurys — a useful barometer for where mortgage rates could be headed next — climbed 11 basis points, at one point touching a new 2022 high of 3.178 percent.

Mortgage rates were already on the rise this month as the Fed embarks on a “quantitative tightening” program to let debt roll off its nearly $9 trillion balance sheet. The Fed is looking to trim $2.7 trillion in mortgage-backed securities that it bought to keep mortgage rates low during the pandemic and in the wake of the 2007-09 recession.

Mortgage rates rebounding

The Optimal Blue Mortgage Market Indices show rates on 30-year fixed-rate have been in a steady upward trend since May 27. At 5.526 percent on Thursday, rates on 30-year fixed-rate loans are up 26 basis points in the last two weeks, and only 7 basis points shy of their 2022 peak of 5.593 percent seen on May 6.

A rate index compiled by Mortgage News Daily showed rates for 30-year fixed-rate mortgages surged 30 basis points on Friday, to 5.85 percent.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

[ad_2]

Source link