[ad_1]

Global stocks were hit with a fresh jolt of selling on Monday as central banks rapidly reined in crisis-era stimulus measures and investors fretted about signs of slowdowns in the world’s large economies.

Wall Street’s blue-chip S&P 500 index slid 2.9 per cent and the tech-focused Nasdaq Composite dropped 3.8 per cent.

Europe’s regional Stoxx 600 index fell 2.8 per cent, while Bitcoin touched its lowest point since last July.

Monday’s pullback comes as investors grapple with interest rate rises from the US Federal Reserve, intense inflation and emerging signs of strain in the world economy. The MSCI All-World barometer of global equities has fallen more than 15 per cent this year, while the Bloomberg aggregate index tracking the world’s fixed income markets has dropped 12 per cent.

“It’s difficult to say if everything is low enough and bearish enough,” said Joost van Leenders, equity strategist at Kempen Capital Management, adding that investors no longer expected the Fed to prioritise stabilising financial markets, as it did during the start of the coronavirus pandemic.

“With [bond] yields rising and equity markets falling, you have financial conditions tightening, which is what the Fed wants.”

The Fed last week lifted its main interest rate by 0.5 percentage points, signalling that more large increases were on the horizon as it attempts to cool scorching inflation.

“No one knows with any certainty if that’s enough to quell future inflation,” said Nicholas Colas, co-founder of DataTrek Research. “Hence all the recent market volatility.” Economists expect data released on Wednesday to show US consumer prices jumped 8.1 per cent in April compared with the same month last year.

The UK, India and Australia also boosted interest rates last week. Rising interest rates have profoundly changed the calculus for investors as they decide how much capital they should deploy towards risky assets.

The yield on the 10-year US Treasury note rose above 3.2 per cent on Monday before settling back to 3.12 per cent, still close to its highest level since late 2018.

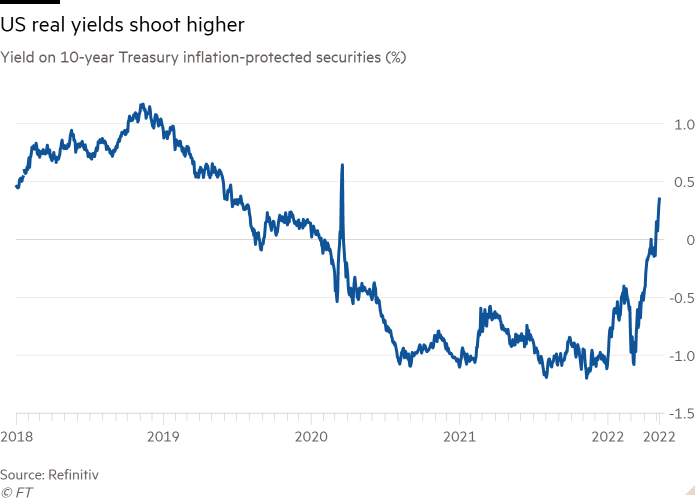

The 10-year US real-yield, which provides a snapshot of the long-term returns investors can earn after inflation on ultra-low risk securities, jumped 0.09 percentage points on Monday to 0.35 per cent, having started the year about minus 1 per cent.

Worries over rising rates have been compounded by indications that growth in big global economies could be slowing. Chinese export growth fell to its lowest level in two years last month, according to data released on Monday, which followed reports last week pointing to slowdowns in the German and French manufacturing sectors.

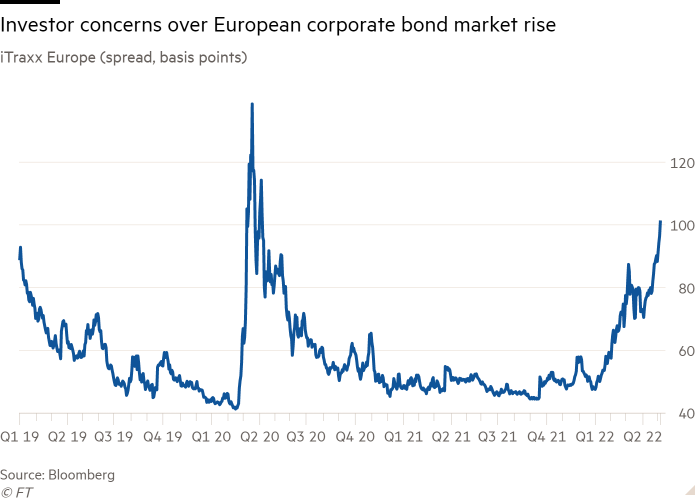

Meanwhile, a measure of the cost of protecting against defaults on European corporate bonds rose on Monday to its highest level since 2020. The iTraxx Europe index, which tracks a basket of credit default swaps and is considered a gauge of investor sentiment towards risk in European markets, hit 100 basis points, up from 49bp at the start of the year.

In commodities, international oil benchmark Brent crude dropped more than 2 per cent to under $110 a barrel, signalling concerns over weaker demand.

[ad_2]

Source link