[ad_1]

New Jersey’s economy continued to make up ground from the pandemic after it added 14,800 jobs in April and saw its jobless rate tick down to 4.1% from 4.2%, the state Department of Labor and Workforce Development said Thursday.

While employers say rising inflation — and higher interest rates to fight it — eventually could slow down growth, they continue to be hard-pressed to find the workers they need to keep up with demand.

“Hiring is really based around the projects that we have, and the projects that we have are still around,” said Jarred Schastny, new construction manager for All County Exteriors, a roofing and siding contractor based in Jackson.

The monthly jobs report, compiled by the U.S. Bureau of Labor Statistics, is made up of a survey of employers to measure the number of jobs and a survey of households to measure the unemployment rate.

April’s report showed the state’s job market continues to rapidly improve despite fears that the Federal Reserve Board will need to put the brakes on the economy to get inflation under control.

INFLATION: Here’s where NJ consumers are getting hit hardest

Notably, the report showed New Jersey has recovered 95% of the jobs it lost during the onset of the Covid-19 pandemic, surpassing the nation’s recovery rate for the first time.

“That’s significant,” James W. Hughes, a Rutgers University economist, said. “Proportionately, New York and New Jersey got hit far harder than the nation as a whole.”

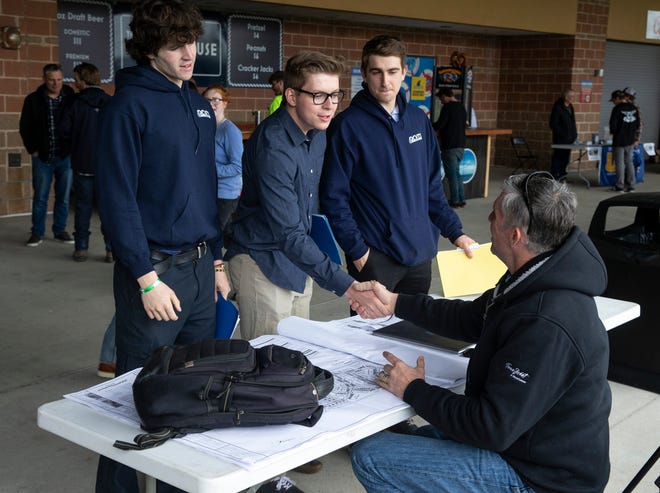

The hot labor market played out last week at ShoreTown Ballpark in Lakewood, where more than two dozen contractors networked with hundreds of students from the Ocean County Vocational Technical School District.

For students, it is a good time to be graduating.

Daniel Gnad, 18, a senior at Lacey High School, said he is learning welding and has applied to a sheet metal union to become an apprentice when he graduates this spring.

Not that he needs a job. He already is working for a company in South Toms River before school, after school and on weekends, welding grease containers.

“I just like how it keeps you on your toes,” Gnad said. “At any point, you can have a piece of metal warped and you’ve got to figure out how to fix it.”

MORE: Can mortgage rate spike slow down red-hot housing market?

Amy Graziosi, 18, of Toms River, decided early on that she wasn’t going to be happy sitting at a desk all day, so she enrolled in the vocational school’s electrical trade program

She is working for Semper Fi Electric in Brick and didn’t sound worried about her job prospects.

“Especially because of COVID,” Graziosi said. “Everybody’s in their house and are all thinking, ‘Oh, I want to add this to my house.’ They’re getting bored, so the demand is high.”

Hughes said New Jersey’s economy has been well positioned during the recovery.

The state, for example, doesn’t have oil producers that fell on hard times before gasoline prices surged, or big manufacturers that struggled to get parts from overseas. It does have a large business and professional services sector, whose workers continued to toil away safely at home.

The result: New Jersey has added jobs for 17 consecutive months. It has averaged 18,700 new jobs per month this year, a pace that would exceed even last year’s record job growth. And it is getting closer to its pre-pandemic employment levels.

The job market appears to be responding to consumer demand, which has shown few signs of slowing despite soaring inflation.

In April, the leisure and hospitality industry added 4,700 jobs. Trade, transportation and utilities, which includes retailers and warehouses, added 4,200 jobs.

The hot job market and high inflation leave policymakers with a tough task ahead. Can it increase interest rates enough to bring prices under control, but not pull the economy into a recession?

For employers at the job fair in Lakewood, the question was top of mind.

Woodbridge-based American Properties is building a 140-townhome project in Middletown, which quickly sold out, said Kevin Kernahan, senior vice president.

As mortgage rates rise, home loans become more expensive and the housing market could slow down. For now, though, Kernahan said his vendors are having trouble finding enough workers to keep up with orders.

“I think the need (for housing) exists, and people are going to find their way,” he said. “The demand is still so strong, I’m not sure the interest rates are going to kill it.’

Michael L. Diamond is a business reporter who has been writing about the New Jersey economy for more than 20 years. He can be reached at mdiamond@gannettnj.com.

[ad_2]

Source link