[ad_1]

The SBI study flags poor implementation rate in Telangana, M.P., Jharkhand, Punjab, Karnataka and U.P.

The SBI study flags poor implementation rate in Telangana, M.P., Jharkhand, Punjab, Karnataka and U.P.

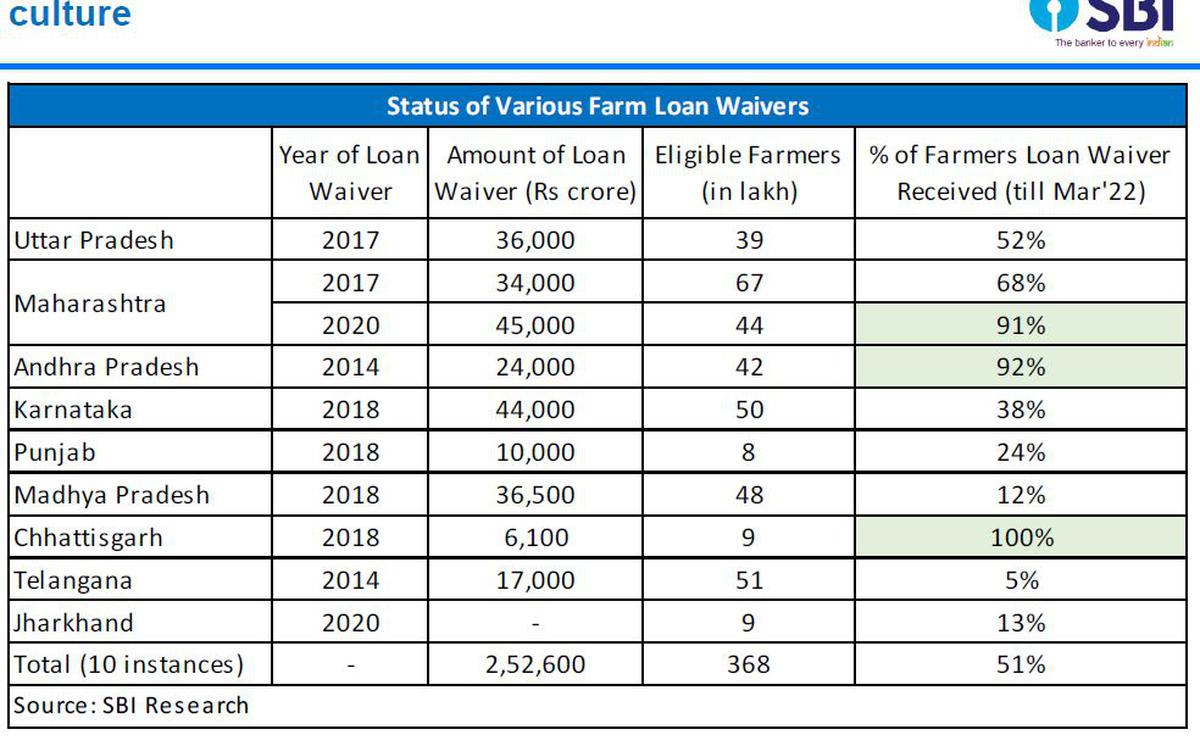

Only about half of the intended beneficiaries of farm loan waivers announced by nine States since 2014, have actually received debt write-offs, as per a study by State Bank of India’s researchers.

As of March 2022, the poorest implementation of farm loan waiver schemes in terms of proportion of eligible farmers who had received the announced benefits, were in Telangana (5%), Madhya Pradesh (12%), Jharkhand (13%), Punjab (24%), Karnataka (38%) and Uttar Pradesh (52%).

By contrast, farm loan waivers implemented by Chhattisgarh in 2018 and Maharashtra in 2020, were received by 100% and 91% of the eligible farmers, respectively. A similar waiver announced by Maharashtra in 2017 worth ₹34,000 crore for 67 lakh farmers, has been implemented for 68% of beneficiaries, SBI researchers reckoned.

The SBI study was based on outcomes of ten farm loan write-offs worth about ₹2.53 lakh crore announced by nine States, starting with Andhra Pradesh and Telangana in 2014. As many as 92% of Andhra Pradesh’s 42 lakh farmers eligible for loan waivers had benefited, while the number was a mere 5% for Telangana.

“Since 2014, out of approximately 3.7 crore eligible farmers, only around 50% of the farmers received the amount of loan waiver till March 2022… Despite much hype and political patronage, Farm Loan waivers by States have failed to bring respite to intended subjects, sabotaging credit discipline in select geographies and making Banks and financial institutions wary of further lending,” the SBI report noted, terming it a ‘self goal’ inflicted by the State on its subjects.

Possible reasons

The report identified rejection of farmers’ claims by State Governments, limited or low fiscal space to meet promises, and change in Governments in subsequent years, as the possible reasons for the low implementation rate of these loan waivers, whose frequency and scale have seen an unprecedented surge in the past eight years.

Apart from benefits not reaching the targeted farmers, the report also flagged concerns about whether they actually help farmers in genuine distress. “Of the total accounts eligible for farm loan waiver, most of the accounts (more than 80%in some States) were in standard category, begging a question whose interest rampant waivers actually serve,” it noted.

The proportion of standard accounts, which refers to loans being serviced in a timely manner by borrowers, that were covered by the farm loan waiver, was particularly high in Jharkhand (100%), Uttar Pradesh (96%), Andhra Pradesh (95%), Punjab (86%) and Telangana (84%).

On the other hand, only 43% of the farmers covered by Maharashtra’s loan waiver announced in 2020 had standard accounts, and the number was 46% for Karnataka, which had launched a ₹44,000 crore waiver programme for 50 lakh farmers in 2018.

“Loan waivers destroy the credit culture which may harm the farmers’ interest in the medium to long term and also squeeze the fiscal space of governments to increase productive investment in agriculture infrastructure,” the report concluded.

[ad_2]

Source link