[ad_1]

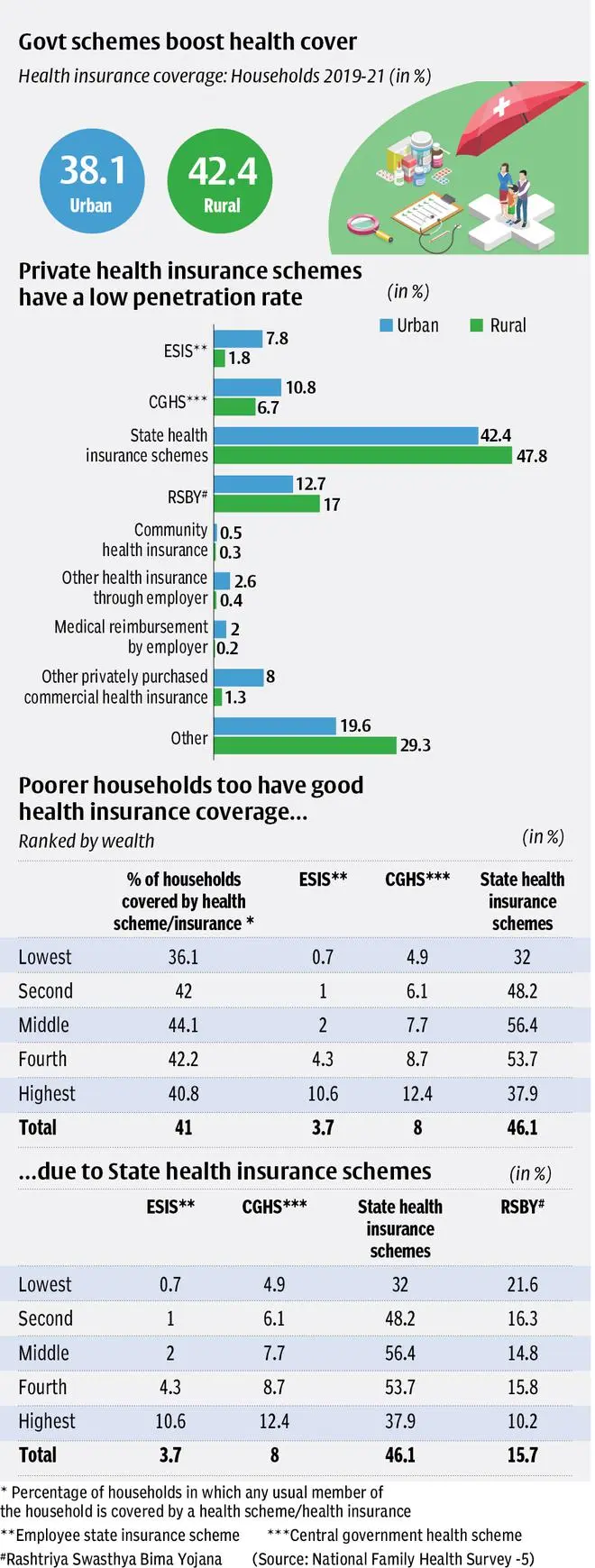

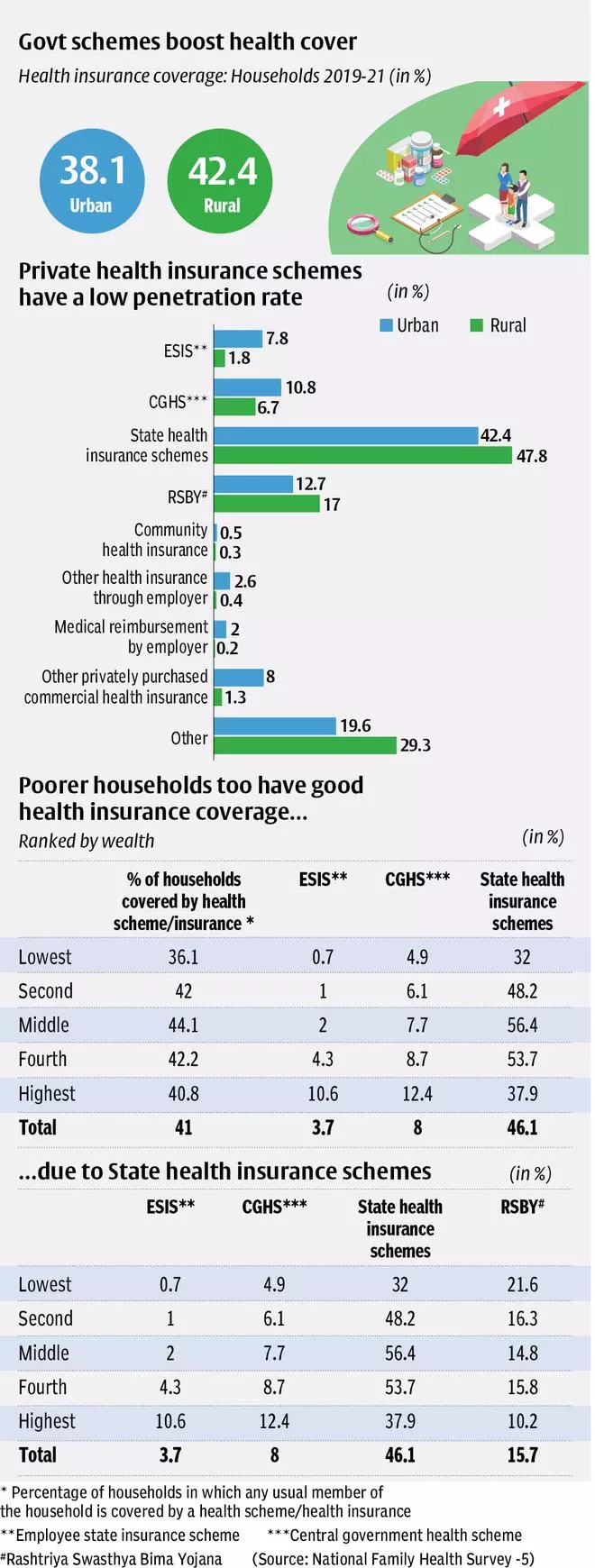

There is some good news on the health insurance front. About 41 per cent of the surveyed 636,699 households have at least one member covered under health insurance or a health scheme, according to the National Family Health Survey (NFHS-5). This translates to about 30 per cent women and 33 per cent men in the 15-49 age group.

During NFHS-4, only 29 per cent of surveyed households had at least one member covered by health insurance or a health scheme.

Almost half (46 per cent) of those with insurance are covered by a State health insurance scheme and about one-sixth (16 per cent) are covered by Rashtriya Swasthya Bima Yojana (RSBY). As many as 3-6 per cent of women and 4-7 per cent of men are covered by the Employee State Insurance Scheme (ESIS) or the Central Government Health Scheme (CGHS).

The percentage of households in which at least one member is covered is highest in households with a Christian head (55 per cent). Additionally, the insurance coverage is slightly higher in rural areas (42 per cent) than in urban (38 per cent).

The highest proportion of households covered under health insurance or a health scheme is found in Rajasthan (88 per cent) and Andhra Pradesh (80 per cent), and the lowest coverage (less than 15 per cent) is in the Andaman and Nicobar Islands and Jammu and Kashmir. About 36 per cent of households in the lowest wealth index are covered under health or insurance schemes. This might be the result of the government schemes targeting the poor.

Expanding network

The Centre launched the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) in September 2018. The scheme provides health assurance of up to ₹5 lakh per family a year for secondary and tertiary healthcare hospitalisations. As the world’s largest government-funded healthcare programme, it targeted more than 50 crore beneficiaries at the time of its launch. Against that target, as many as 14.09 crore families with an estimated 70 crore people have been covered under the scheme, according to the Department of Health and Family Welfare.

Further, 14 crore persons have been covered under ESIS and CGHS. As a result of health insurance schemes, out-of-pocket expenditure (OOPE) as a share of total health expenditure has come down, according to the National Health Accounts (NHA) released last year. As a share of total health expenditure, OOPE has come down to 48.8 per cent in 2017-18 from 64.2 per cent in 2013-14. The per capita OOPE has declined from ₹2,336 to ₹2,097 between 2013-14 and 2017-18.

The way forward

NITI Aayog, in its report titled “Health Insurance for India’s Missing Middle”, states that 40 crore individuals are devoid of health protection through insurance. The report adds that low awareness of health insurance products, difficulty in reaching out to potential customers and their high sensitivity to price are some of the challenges that determine their insurance coverage.

The recommendations in the report relate to possible pathways to increase health insurance coverage on a commercial basis to reduce operational and distribution costs and increase enrolment and strengthen regulatory mechanisms for policyholder confidence.

Published on

July 14, 2022

[ad_2]

Source link