[ad_1]

blackdovfx

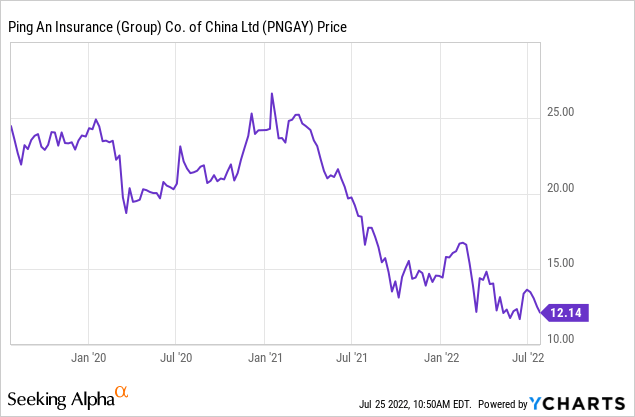

Since my initial bullish article on Ping An Insurance in August 2020, the stock (OTCPK:PNGAY) has come down more than 40%. Here I explore whether this has anything to do with the business, while any outside factors are analyzed for severity and continuity.

Ping An’s story is decidedly China-centric. And so is this update. But it does not take away from the company’s specialties that make it stand out even in the most inauspicious of circumstances. McKinsey calls integrated insurers like Ping An “ecosystem orchestrators” that derive additional value from customer relationships through related services beyond insurance. Using its large size to its advantage, Ping An keeps on adding to its business model; at the same time, the group has been reducing complexity through unparalleled digitization. Although it has not been smooth sailing for Ping An since the second half of the last year (which turned some headline indicators red), there are enough reasons to expect better long-run returns.

First, the external environment

COVID-19

It was originally thought that China would be the first to leave the pandemic behind, when in fact the government’s uncompromising zero-covid policy means things are still far from normal.

Mass testing and lockdowns have become an almost permanent feature of life, likely to remain so for the foreseeable future (if new subvariants keep emerging). And while manufacturing output has somehow managed to persevere, consumer confidence has been badly shaken.

Insurance products have fallen out of favor with nervous Chinese. Ping An’s revenue for 2021 dropped for the first time in more than a decade, by 2.7%. Most of the damage came from Life & Health Insurance whose new business value (the present value of future profits from new premiums written during the year) declined 24%, with long-term protection products taking the biggest hit.

Market woes

Ping An’s businesses rely almost entirely on the domestic market, so they naturally mirror the state of the local economy. Flagging consumer spending was not the only worry. Although GDP grew by a solid 8.1% in 2021, the year was marked by financial troubles in real estate and political meddling in the technology space. The resulting negative investor sentiment had an impact on Ping An’s performance too.

The property sector crisis, which had been triggered by the regulation on debt ceiling for developers, was one in which Ping An was directly involved. As part of a consortium, it became a majority shareholder in struggling Founder Group. The share price in Hong Kong (HKEX:2318) plunged 20% on the news. Widespread speculation was that Ping An had been forced into the deal and that this wouldn’t be the last time. A better explanation could be that the acquisition was strategic given an overlap in key lines of operation.

Still, many of Ping An’s investments in real estate soured. In 2021, the 29% decline in net profit attributable to shareholders to 101.6bn yuan was blamed mainly on another troubled property developer China Fortune Land Development in which Ping An holds a 25% stake: writedowns and impairments in its name amounted to 24.3bn yuan.

Monetary policy

Ping An’s latest quarterly report for the period ending 31 March said there was a “mismatch of economic cycles between China and the United States”. Nothing makes this more apparent than a complete divergence in interest rate movements. Concerned with slowing economic growth, the People’s Bank of China has cut the key loan prime rate twice since the early pandemic days, in December 2021 and then in May 2022, while central banks in other major economies have started tightening interest rates to curb inflation.

China’s GDP grew 4.8% in the first three months of 2022 but the second quarter may bring a contraction of 1.5%, according to the latest polls. Lingering COVID restrictions, a continuing slump in the property sector and weak retail sales are a triad of factors weighing down the economy. Ping An, as the largest insurer in the country whose interests spread out far and wide, cannot come out of this unscathed. In Q1, the variance between actual returns of Life & Health funds and the assumed long-run investment returns reduced the group’s profitability by 19.7bn yuan; net profit attributable to shareholders declined 24% overall year-on-year to 20.7bn yuan.

Changing weather

Ping An, like other big insurers around the globe, is exposed to extreme weather events that are becoming ever more frequent and costly. Climate change is exacerbating this inherent risk. In China, 2021 was marked by the devastating Henan Floods that resulted in immediate economic losses of more than 114bn yuan ($18bn). The cost to insurers in claims reached 11bn yuan ($1.7b); Ping An Property & Casualty paid out more than 3.1bn yuan. The stock came down almost 10% in the week after the floods. Climate losses will continue to rise as catastrophes get harder to predict.

And the company?

Having been overtaken by Hong Kong’s AIA (OTCPK:AAGIY), Ping An is currently the second largest public life insurer in the world with a market cap of about $115bn. It is still the biggest company in the Chinese insurance market, followed by China Life Insurance (LFC). As a group, it offers integrated services in finance (insurance, banking, asset management) and healthcare. Technology, in all of this, is a bonding agent that gives coherence to Ping An’s product portfolio spread out through 22 subsidiaries to enable cross-selling and up-selling.

As it stands today, the group has fallen behind its own historical averages on most financial indicators. But as was shown, Ping An’s woes are not of its own making, and the underlying business model remains strong.

|

PNGAY |

Trailing 12 months |

5-year average |

|

Net income margin |

7.6% |

10.1% |

|

Return on common equity |

11.8% |

19.8% |

|

Return on total assets |

0.9% |

1.4% |

|

Dividend yield |

5.9% |

3.5% |

Source: Seeking Alpha

In a challenging environment, the group has stuck to what it does best — pursuing efficiencies through innovation. More than ever now, the group is focused on building a cohesive ecosystem of products and services spanning multiple industries. And whatever the group has achieved through synergistic effects so far will only be amplified going forward.

Ping An’s high debt load (2.09tn yuan at Q1’22) is offset by plentiful cash (2.04tn yuan) which keeps net gearing at low single digits, ensuring the group remains safe during downturns. By extension, this also means the management is able to fulfill its commitment to pay dividends which have been on a rising trend since mid-2016, reaching a compound growth rate of 27% per share.

One important change that is being repeatedly highlighted is the ongoing restructuring of Ping An’s army of insurance agents: culling the numbers by half in the last couple of years (another reason why revenue fell in 2021) but raising the quality bar and the contribution of alternative, particularly AI powered, channels.

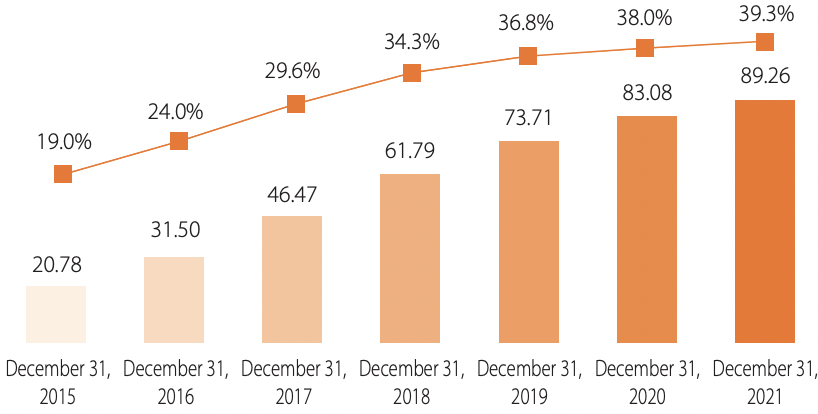

Some performance metrics have remained constant throughout. Ping An is continually expanding its retail customer base (+4.1% in 2021 and 0.7% in Q1’22) — a good portion of it sourced from the group’s own internet users — as well as contracts per customer (+1.8% and +1.0% respectively).

The ability to cross-sell at scale — propagated under the “one customer, multiple products and one-stop services” strategy — has been a huge boon for Ping An’s subsidiaries. In 2021, close to 33 million customer migrations took place between the group’s financial companies selling insurance, healthcare and wealth management. Corporate premiums generated through cross-selling grew 7.3% year on year and new corporate financing 26.9%. Up to a fifth of all new financial customers at Ping An come from its healthcare subsidiaries.

% of retail customers (mn) with multiple contracts in different subsidiaries

Ping An

Technology businesses

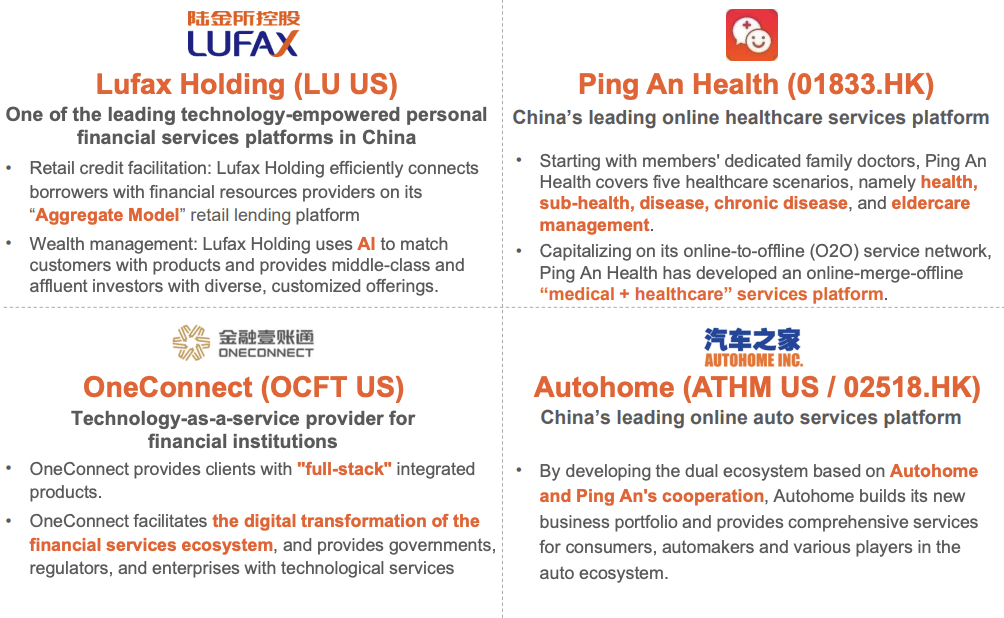

Unlike traditional financial services groups outside of China, Ping An has stayed ahead of change by internalizing insurtech and finding a way to incubate its technology innovations. It is the technology investments of Ping An that bear the most potential to drive exponential growth for the group. To be sure, it is early days for publicly owned Lufax (LU), OneConnect (OCFT), Ping An Health (HKEX: 01833) and Autohome (ATHM), but all four are already among the leading platforms in China in their respective niches. Technology grew its operating profit by 91% (compared to the group’s overall 5%) in 2020, 19.5% (versus 6%) in 2021 and 18% (10%) in Q1’22.

Ping An

Valuation

Ping An shares traded on the Shanghai Stock Exchange (601318.SS) closed at 42.91 yuan on July 24. The Street target is 69.08 yuan according to Refinitiv Eikon. The stock is currently trading at a discount to its comparable group: trailing Price/Book is 0.9 compared to the Insurance industry’s average of 1.3 and 1.0 of Financials. The group’s P/B ratio fell below 1 for the first time in the past ten years and averaged 2.0 over the past five years.

Conclusion

After adjusting for external factors that have affected the company, Ping An has not changed principally, as I see it. Growth rates from mature non-technology businesses will eventually recover. In its guidance, the management sets out to improve revenues and cut costs while pushing further structural and technological reforms. More importantly, though, the big bet on technological research and innovation should pay off and lift the group’s value as a whole. If and when that happens will depend on a mixture of economics and politics.

[ad_2]

Source link