[ad_1]

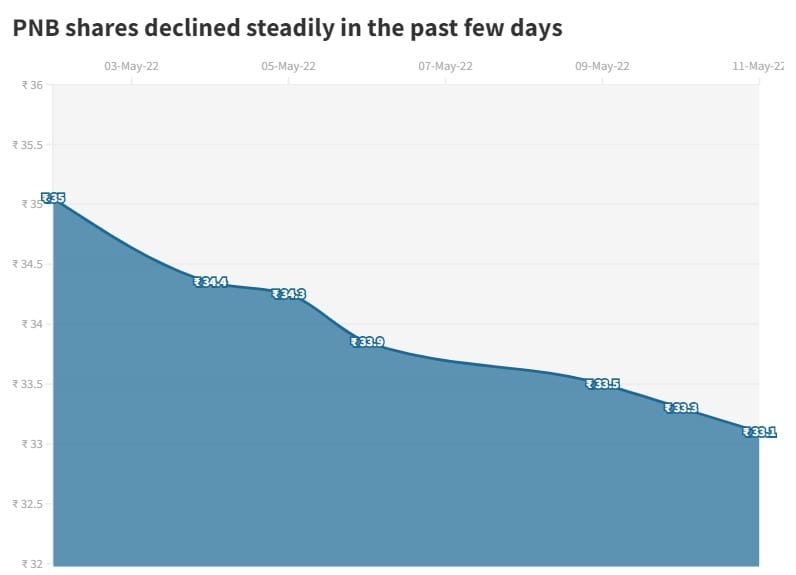

Punjab National Bank shares nosedived on Thursday after the state-run lender’s quarterly performance fell short of Street estimates by a huge margin.

PNB shares tanked as much as 10 percent to hit a 52-week low of Rs 29.5 apiece on BSE in the first few minutes of trade itself.

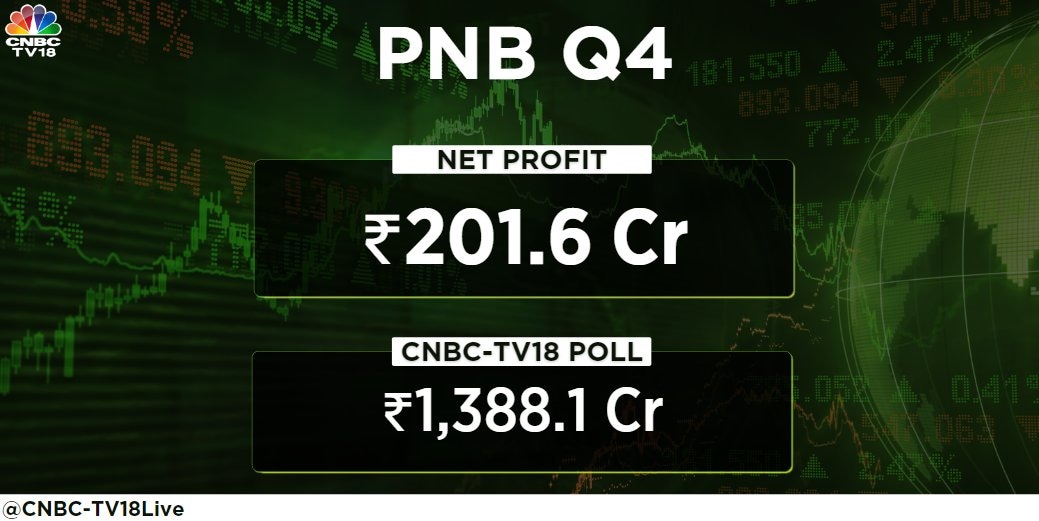

Punjab National Bank’s net profit came down 65.5 percent on a year-on-year basis to Rs 201.6 crore, according to a regulatory filing. Its net interest income — or the difference between interest earned and interest paid — rose five percent on year to Rs 7,304.1 crore for the three-month period, but fell short of expectations,

PNB’s slippages skyrocketed 110.8 percent sequentially to Rs 10,506 crore, and write-offs tripled in the October-December period.

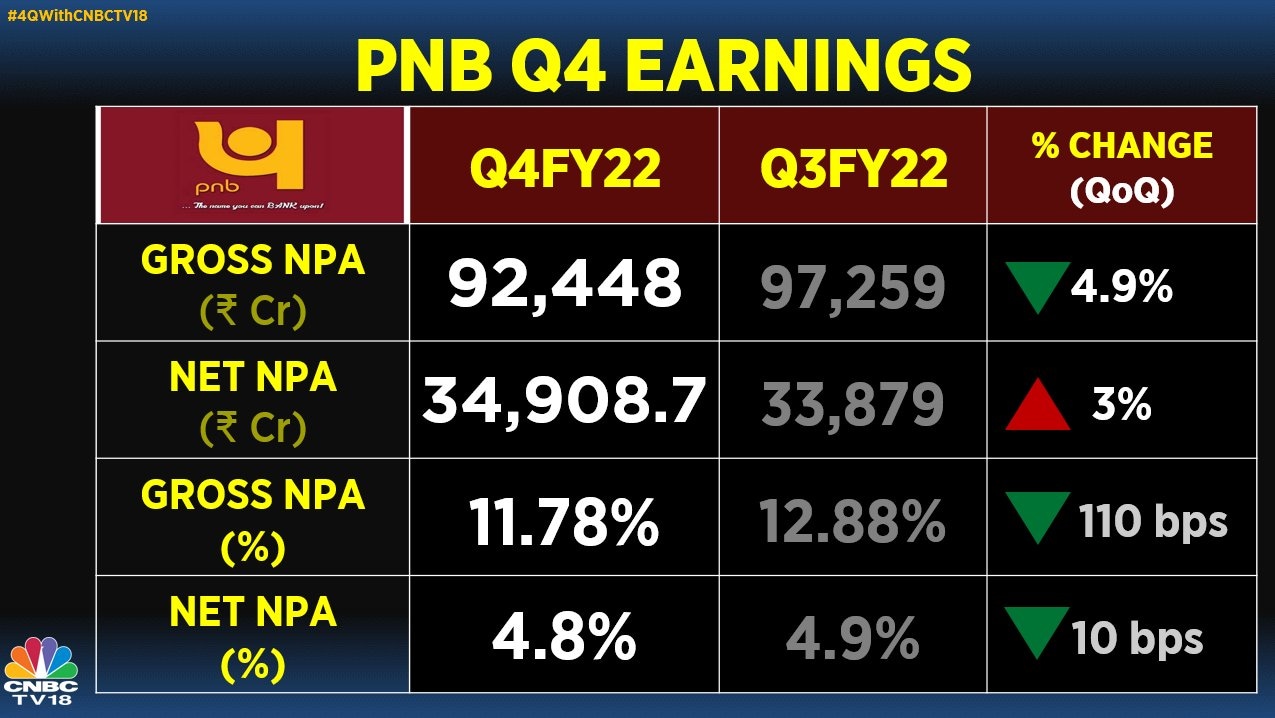

Its asset quality, however, improved as its gross non-performing assets (NPAs) as a percentage of total loans came down by 110 basis points to 11.78 percent compared with the previous quarter.

PNB continued with higher provisions for bad loans and contingencies. Its provisions were up 44.7 percent sequentially at Rs 4,851.5 crore.

PNB has written off NPAs where provisions are at 100 percent, MD and CEO Atul Kumar Goel told CNBC-TV18.

The bank is expecting credit growth of 10 percent in the year ending March 2023 with 15 percent growth in the retail sector, he said.

Goel also said the corporate sector is seeing good demand from the infrastructure segment.

The PNB board announced a final dividend of 64 paise per share for the year ended March 2022.

Morgan Stanley maintained an ‘equal-weight’ rating on PNB with a target price of Rs 41 apiece. Despite a big beat on the cost front, PNB’s profit came in 81 percent below the brokerage’s estimate.

The brokerage’s target implies a 23.9 percent upside in the stock from Wednesday’s closing price.

(Edited by : Sandeep Singh)

First Published: IST

[ad_2]

Source link