[ad_1]

The ability to retrieve quotes from private mortgage insurers helps borrowers assess their options and streamlines the mortgage insurance process for lenders.

Polly, a technology provider for mortgage capital markets, can now retrieve quotes from the nation’s six biggest private mortgage insurers, helping borrowers assess their options and streamlining the mortgage insurance process for lenders.

Lenders typically require that borrowers, who will own less than 20 percent of their home when buying or refinancing a property, obtain FHA, VA or private mortgage insurance, which protects the lender if they default. Nearly half of those borrowers choose private mortgage insurance from one of the big six providers — Arch MI, Enact, Essent, MGIC, National MI and Radian.

The ability to provide quotes from each of those companies within Polly’s product and pricing engine (PPE), streamlines the process of calculating, quoting and comparing private mortgage insurance offers. The integrations were “highly requested” not only by mortgage originators, but also private mortgage insurers, the company said.

Adam Carmel

“We often receive feedback that legacy processes remain cumbersome and time consuming, so we are thrilled to partner with all six essential MI providers to streamline the mortgage insurance process for lenders and borrowers,” Polly founder and CEO Adam Carmel said in a statement.

With the new integrations, users get a list of rates and premiums from each private mortgage insurance provider in Polly’s product and pricing engine. When a quote is selected, the user is automatically provided with documentation from the chosen insurer. If a quote is not provided, Polly’s cloud-native PPE provides an explanation of why and makes “actionable suggestions” for changing parameters.

Founded in 2019, San Francisco-based Polly announced a $37 million Series B in January, bringing the total the company had raised to date to more than $50 million.

In addition to a product and pricing engine that distributes mortgage pricing across channels, Polly’s capital markets ecosystem includes a loan trading exchange that automates many of the steps required to sell and distribute loans, an analytics platform that provides insights powered by market and internal data and a partner platform that facilitates integrations with preferred partners.

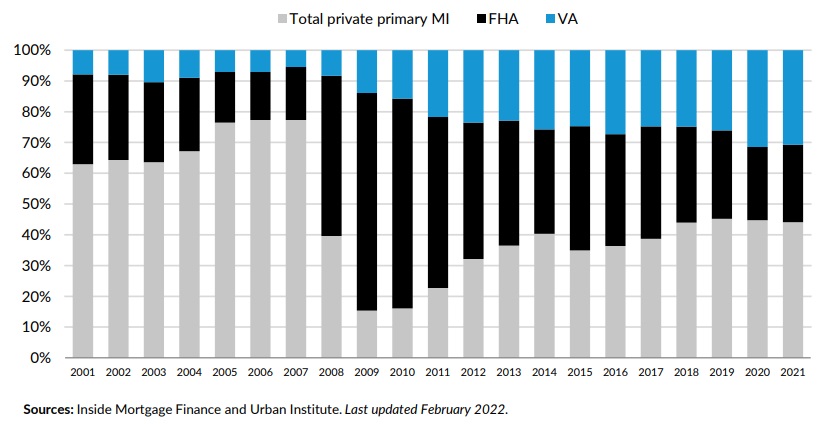

Private mortgage insurer, FHA and VA market share

According to data analyzed by Inside Mortgage Finance and the Urban Institute, private mortgage insurers lost most of their business in the wake of the 2007-09 housing crash and recession to the Federal Housing Administration (FHA) and Veterans Administration (VA).

But with FHA premiums rising significantly in the years following the housing crash, private mortgage insurance is often more affordable for borrowers with good credit scores.

The Urban Institute calculates that a borrower putting 3.5 percent down with a FICO score of less than 700 will generally find FHA financing to be more affordable, while borrowers with FICO scores of 740 and above will often get a better deal on a loan backed by Fannie Mae or Freddie Mac with private mortgage insurance.

Private mortgage insurers have regained some of the market share they lost during the downturn, backing 44.1 percent of high loan-to-value ratio loans securitized by Fannie Mae, Freddie Mac and Ginnie Mac in 2021. The VA had 30.7 percent of the market, while the FHA provided insurance on 25.2 percent of those loans.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

[ad_2]

Source link