[ad_1]

New data from the first quarter continues to roll in as the Office of the Comptroller of the Currency (OCC) reported that the performance of first-lien mortgages in the federal banking system improved during the first quarter of 2022 by a decent margin.

New data from the first quarter continues to roll in as the Office of the Comptroller of the Currency (OCC) reported that the performance of first-lien mortgages in the federal banking system improved during the first quarter of 2022 by a decent margin.

The OCC Mortgage Metrics Report for the First Quarter 2022 showed that 96.9% of mortgages included in the report were current and performing at the end of the quarter, compared to 94.2% a year earlier.

It went on to further find that seriously delinquent mortgages, or those mortgages that are more than 60 days overdue makes up just 1.8% of the total, down from 2.3% in the prior quarter and 4.6% a year ago.

All-in-all, servicers initiated 19,524 new foreclosures in the first quarter of 2022, an increase from the prior quarter and a year earlier. The new foreclosure volume in the first quarter of 2022 is comparable to pre-COVID-19 pandemic foreclosure volumes and reflects the expiration of federal foreclosure moratoria.

“Servicers completed 42,427 modifications in the first quarter of 2022, a decrease of 10.7% from the previous quarter,” the OCC said in its report. “Of the 42,427 mortgage modifications, 80.8% reduced borrowers’ monthly payments, and 41,318, or 97.4%, were “combination modifications” – modifications that included multiple actions affecting the affordability and sustainability of the loan, such as an interest rate reduction and a term extension.”

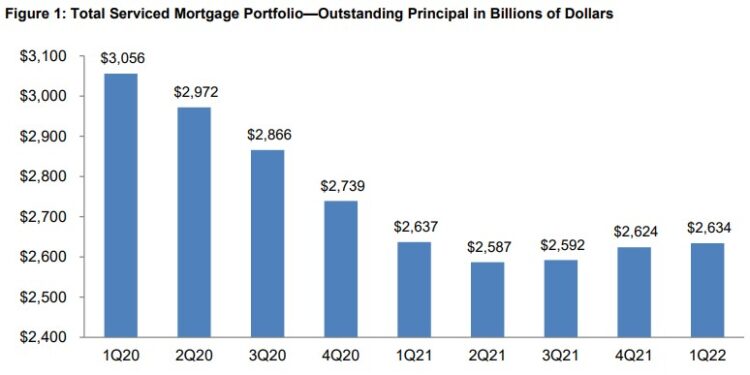

“The first-lien mortgages included in the OCC’s quarterly report comprise 22 percent of all residential mortgage debt outstanding in the United States or approximately 12.2 million loans totaling $2.6 trillion in principal balances.”

Click here to view the 14-page report in its entirety.

[ad_2]

Source link