[ad_1]

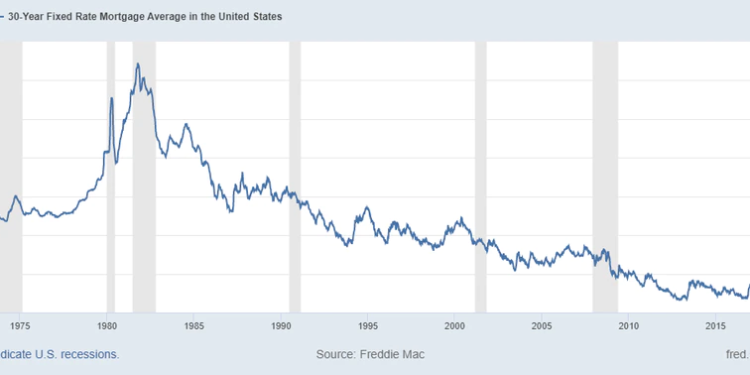

AMARILLO, Texas (KFDA) – Rising mortgage interest rates are pushing potential first-time home buyers out of the market.

Rising home prices, increasing mortgage rates, limited supply and demand ultimately all increase a total monthly mortgage payment.

With rates significantly higher than they were a year ago it’s making it extremely difficult for first-time home buyers to attain home ownership.

“For Amarillo the starter home price, increase in the mortgage interests rates from three percent to 5.5 percent actually yields an increase of about $7,000 of required income to qualify for a mortgage loan,” said Clare Losey, Ph. D, Assistant Research Economist, Texas Real Estate Research Center, Texas A&M University.

/cloudfront-us-east-1.images.arcpublishing.com/gray/PJ5VLYYCQJBKNGQKL6CBD7CVBQ.png)

“The Texas Real Estate Research Center estimates that, in Amarillo in April 2022, 40 percent of potential first-time buyers could qualify for a mortgage loan for a stater home with a mortgage interest rate of 3 percent. That figure drops to just 32 percent of potential first-time buyers with a rate of 5.5 percent,” said Clare Losey. “In Amarillo, the required income to qualify for a mortgage loan increased from $39,000 at a mortgage interest rate of 3 percent to $46,000 at a rate of 5.5 percent in April 2022.”

Losey says the price of a starter home in Amarillo in April of 2022 was around $149,000.

As mortgage interest rates rise home buyers can expect to see higher monthly payments on a loan amount.

Copyright 2022 KFDA. All rights reserved.

[ad_2]

Source link