[ad_1]

Today’s Non-Qualified Mortgages: Limited Documentation and High Debt-To-Income Ratio but High Credit Score and Low Loan-To-Value Ratio

Any home loan that doesn’t comply the Qualified Mortgage (QM) rules is referred to as non-QM.[1] The Dodd-Frank Wall Street Reform and Consumer Protection Act imposed an obligation on lenders to make a good-faith effort to determine applicants have the ability to repay a mortgage, which is known as the ability-to-repay (ATR) rule. The act also mandates the QM cannot have risky loan features like negative-amortization, interest-only, balloon payments, terms beyond 30 years and no excessive points and fees. The QM must also satisfy at least one the following criteria:

- a) Borrower’s debt-to-income (DTI) ratio must be 43% or less

- b) The loan must be eligible for purchase, guarantee or insurance by a government-sponsored enterprises (GSEs), Federal Housing Administration (FHA), US Department of Veterans Affairs (VA), or the US Department of Agriculture (USDA), regardless of the DTI ratio

- c) The loan must be originated by insured depositories with total assets less than $10 billion and must be held in a portfolio for at least 3 years.

A non-QM loan is not necessarily a high-risk loan; however, as the inclusion of terms such as interest-only or limited/alternative documentation can increase the risk of repayment for lenders. Non-QM loans must satisfy the ATR requirements.

The non-QM share of total mortgage counts declined during the pandemic and reached its lowest level in 2020, at 2% of the market. However, the non-QM share has almost doubled in 2022, representing about 4% of the first mortgage market.[2] Though the non-QM loan is a small piece of today’s mortgage market, it plays a key role in meeting the credit needs for homebuyers not able to obtain financing through the GSE or government channels. Creditworthy borrowers such as self-employed borrowers, first-time homebuyers, borrowers with substantial assets but limited income, jumbo loan borrowers and investors otherwise not qualifying for the GSE and government loans, may benefit from non-QM loan options.

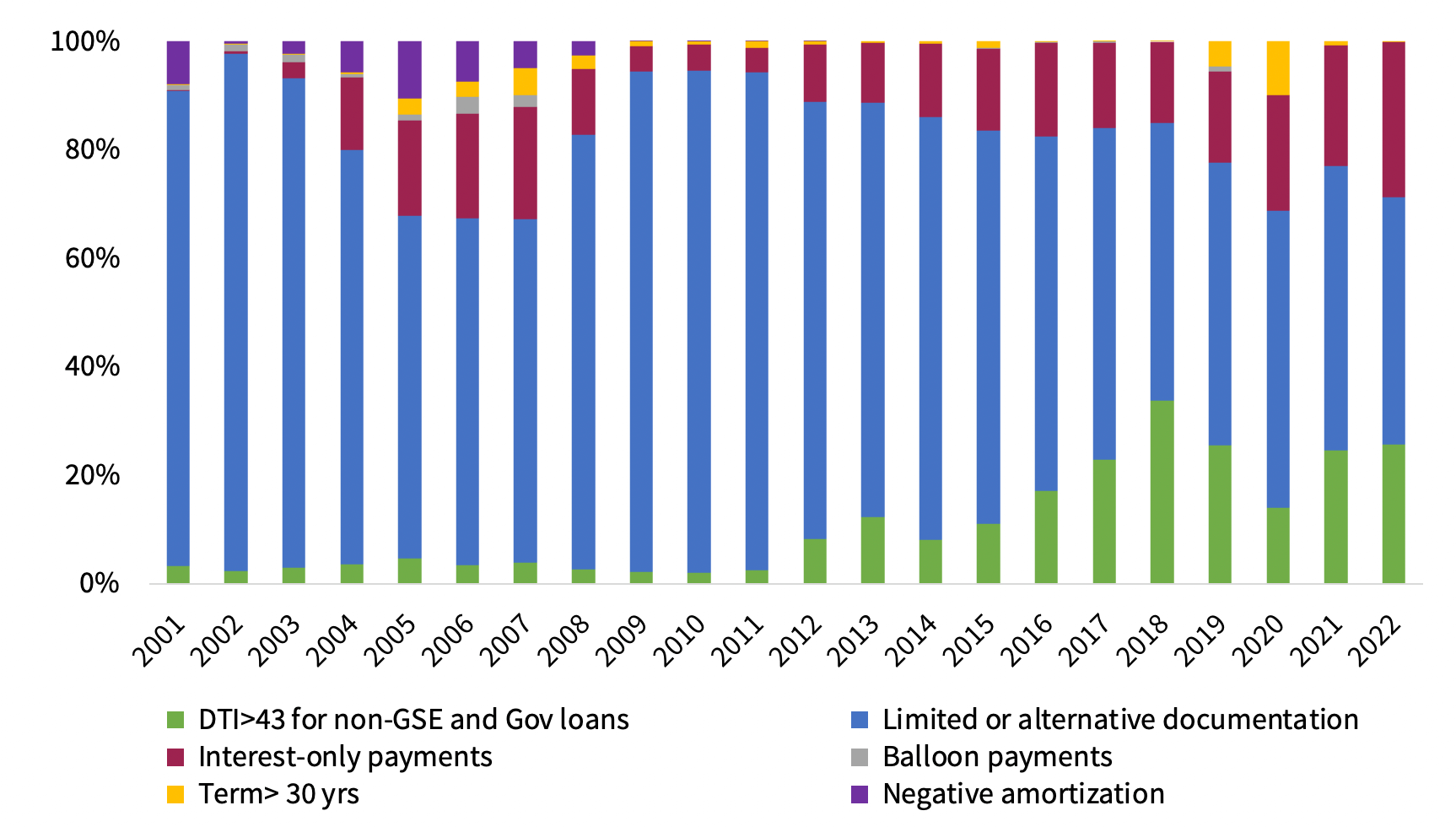

Figure 1 compares non-QM equivalent loans from 2001 to 2022 by using six major risk flags. All home-purchase loans not meeting at least one of the six QM mandated criteria are included. The three main reasons why non-QM loans originated in 2022 failed to fit in the QM box are: use of limited or alternative documentation, DTI above 43% and interest-only loans. Almost 55% of the non-QM borrowers used limited or alternative documentation, 26% exceeded 43% DTI threshold and 23% of the non-QMs were interest-only loans. Share of non-QM loans exceeding 43% DTI threshold has increased and is now 3 times higher in 2022 than in 2014 level.

Similarly, the share of interest-only loans doubled in 2022 compared with the 2014 level. Notably the risker factors such as negative amortization and balloon payments have completely vanished.

Figure 1: Non-QM Equivalent Home-Purchase Loans by Composition of Risk Flags

Interest-only loans rising in recent years

Source: CoreLogic, 2022. Note: 2022 includes only the first 3 months (January to March).

© 2022 CoreLogic,Inc., All rights reserved.

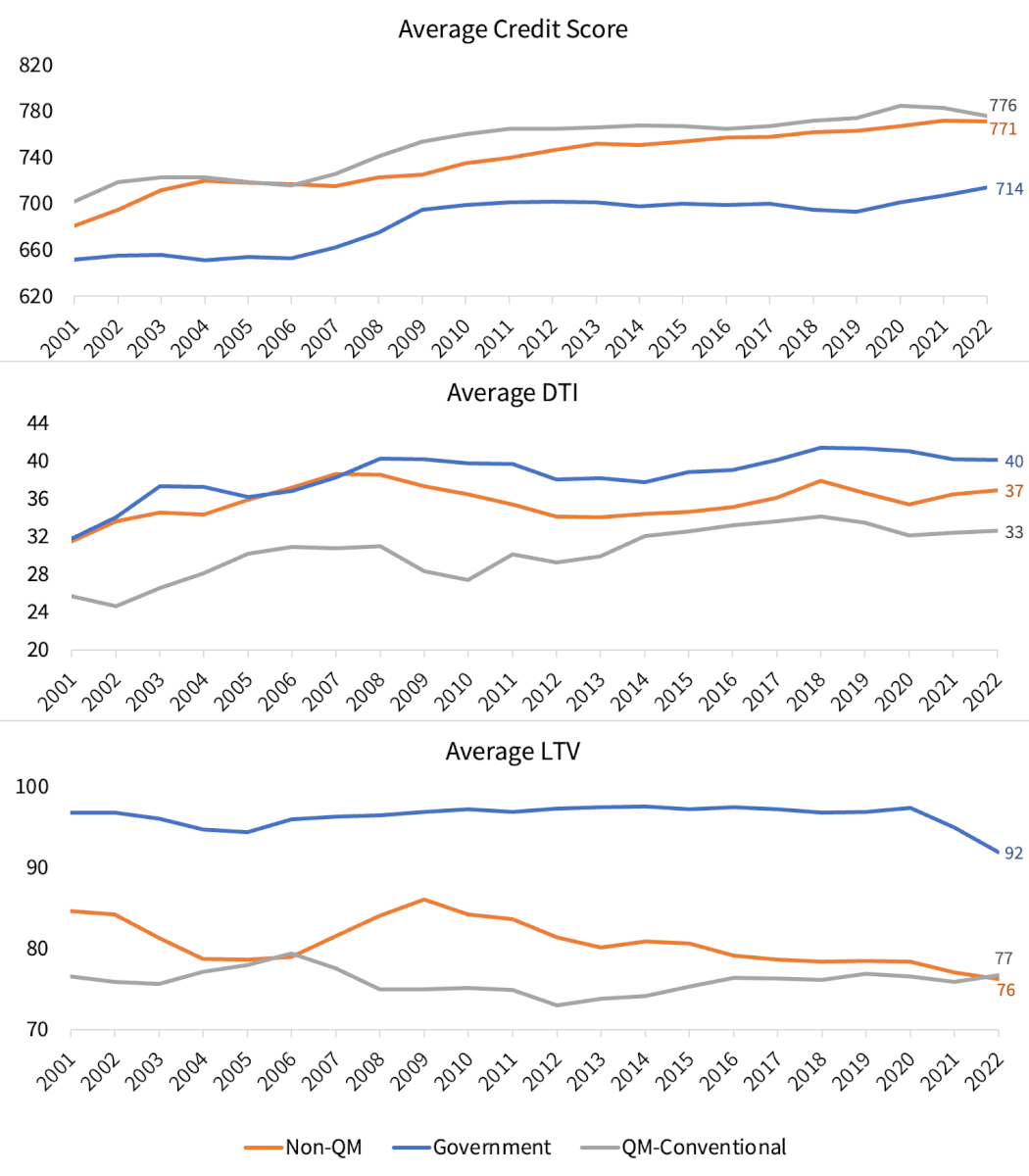

Today’s non-QMs are high-quality loans. They are vastly different and less risky than the equivalent of non-QM loans originated prior to the Great Recession. Figure 2 shows the trend of 3 major factors of underwriting for all home purchase loans: credit score, DTI and loan-to-value (LTV) ratio. The average credit score of homebuyers with non-QM in 2022 was 771 compared to 776 for homebuyers with QMs and 714 for government loans. Similarly, the average LTV for borrowers with non-QM was 76%, compared to 77% for borrowers with QMs. However, average DTI for homebuyers with non-QMs was higher compared with the DTI for borrowers with QMs.

Figure 2: Underwriting Variables trends for Home Purchase Loans: 2001 to 2022 (Jan-March)

(Averages of Credit Score, LTV, and DTI)

Source: CoreLogic, 2022. Note: 2022 includes only the first three months (January to March).

© 2022 CoreLogic,Inc., All rights reserved.

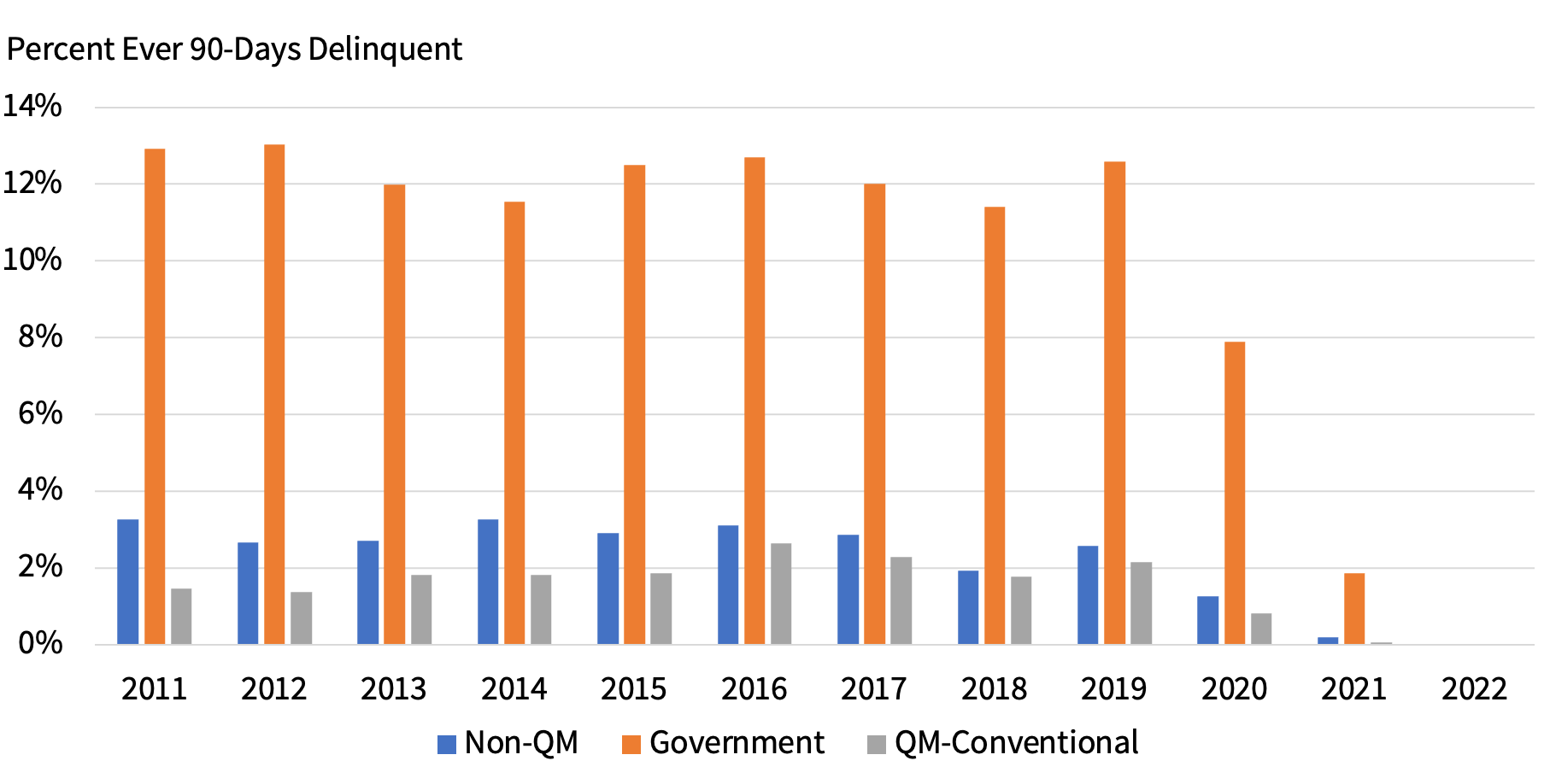

Despite the high DTI ratios, non-QMs are performing very well today. Both the non-QM and QM loans have low delinquency rates (Figure 3). In fact, the serious delinquency rate for non-QM loans is just slightly higher than the rate for QM loans and significantly lower than for the government loans.

To offset the risk of default, lenders generally set a higher interest rate on non-QM loans; for instance, the average 30-year fixed initial interest rate for non-QM was 2.9% compared to 2.6% for QM loans in 2022. Also, lenders are attracted to borrowers with higher credit score and low LTVs to help offset the added risk from a high DTI, limited documentation and interest-only on non-QM loans.

In sum, non-QM loans have helped creditworthy borrowers who cannot otherwise qualify for traditional mortgage loan programs.

Figure 3: Delinquency Rate by Loan Type and Vintage Year for Home Purchase Loans: 2001 to 2022[3]

Source: CoreLogic, 2022

© 2022 CoreLogic,Inc., All rights reserved.

[1] In January 2014, the Consumer Financial Protection Bureau (CFPB) issued a set of guidelines to provide safer and more stable home loans for consumers called as Qualified Mortgages (QMs).

[2] For this analysis, 2022 CoreLogic data includes only loans originated during the first three months of 2022 (January to March).

[3] The delinquency rates were much lower for the 2021 vintage and almost zero for the 2022 vintage as the loan applicants who were approved for a mortgage loan after March 2020 had not lost their job or business because of the pandemic or other reason.

© 2022 CoreLogic,Inc., All rights reserved.

[ad_2]

Source link