[ad_1]

With mortgage rates quickly rising, it pays for homebuyers to shop lenders for the best mortgage rates. But some people fear it will hurt their credit scores.

With mortgage rates quickly rising, it pays for homebuyers to shop lenders for the best mortgage rates. But some people fear it will hurt their credit scores.

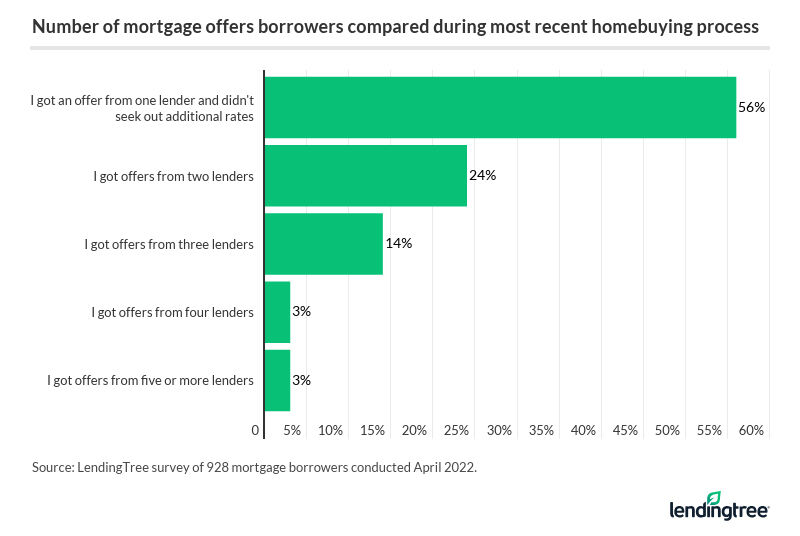

But a LendingTree survey of recent buyers found more than half — 56% — said they did not compare offers from multiple lenders. Why not take the time to compare rates?

“According to our survey, 25% said they didn’t shop around because they just wanted to use the bank recommended to them by their real estate agent, and 22% felt competitive pressures to make quick mortgage decisions,” said Jacob Channel, senior economic analyst at LendingTree.

Another 20% did not compare rates because they were concerned it would hurt their credit scores.

A lender won’t commit to a firm rate without checking a potential borrower’s income and credit worthiness. Sometimes lenders do what is called “soft pull” on a credit score, which doesn’t show up as a hard credit inquiry. But even if a lender does do a full credit report inquiry, it likely won’t hurt a house hunter’s immediate credit score.

“If you’re shopping for something like a mortgage, inquiries don’t show up until 30 days after the initial inquiry was made. And then even after that 30-day period, there is usually a span of time between 14 to 45 days where the same type of inquiry will be counted as only one inquiry,” Channel said.

LendingTree’s survey shows it often does pay to compare mortgage rates from different lenders. Of those who did, 46% said the first offer they received was not the lowest offer.

How many lenders should homebuyers compare? The survey found 24% of recent borrowers got two offers from lenders, 14% got offers from three and 6% got offers from four or more lenders.

As for the top reason cited for not comparing rates for which they may qualify, using a real estate agent’s recommendation is fine, Channel said. In most cases, buyers trust their agents.

“By no means, should you discount what your real estate agent is saying. But it does help if you are willing to go a little bit above and beyond and do a little bit of independent investigation on your own,” Channel said.

The LendingTree report was based on survey responses from 1,055 mortgage borrowers and was conducted in April. Full survey results, including breakdowns by demographics and income levels, are posted online.

[ad_2]

Source link