[ad_1]

|

| Singapore has opened its borders to fully vaccinated visitors. Source: iStock |

Singapore’s banks are likely to see faster loan growth and improved profitability as Southeast Asian economies open up for business and travel after two years.

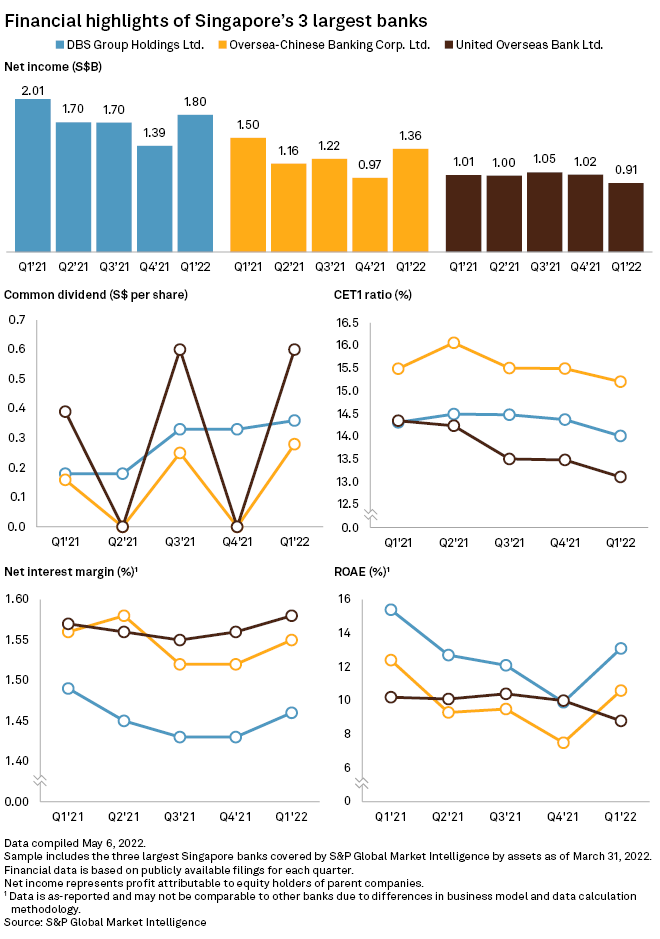

Loans across the three Singaporean banks — DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd., or OCBC, and United Overseas Bank Ltd. — rose by 8% to 9% year over year in the first quarter of 2022, according to their recently announced results. That was a significant improvement from a 5% loan growth reported each by DBS and UOB in the first quarter of 2021, while OCBC’s loans were flat, dragged by the COVID-19 pandemic.

DBS expects a mid-single-digit growth in loans this year, and UOB expects a mid- to high-single-digit increase.

Loans are expected to grow as Southeast Asian economies open borders, boost infrastructure spending and increase production capacity, said Thilan Wickramasinghe, head of research and head of regional financials at Maybank Kim Eng Singapore. “This should drive loan demand higher,” Wickramasinghe said.

The three Singapore banks are heavily focused on Southeast Asia and derive most of their earnings from the region. In 2021, DBS generated around 70% of its operating income from Singapore, and South and Southeast Asia, according to S&P Global Market Intelligence data. OCBC and UOB derived around 80% of their operating income from the city-state and Southeast Asia.

Regional model

A rise in loan demand, according to Wickramasinghe, “bodes well for the Singapore banks who have been investing in integrated regional models that could take advantage of cross-border credit and banking services demand.”

Singapore itself fully reopened its borders to all vaccinated visitors from April 1. The government expects the city-state’s economy to grow by 3% to 5% in 2022, following a 7.6% expansion in 2021, according to the Ministry of Trade and Industry. The Monetary Authority of Singapore tightened policy ahead of many global peers and set the local dollar on a steeper appreciation path against a basket of currencies of the nation’s key trading partners. As most global central banks, including the U.S. Federal Reserve, raise rates to curb inflation, the outlook for banks could improve.

Loan growth is expected to prop up banks’ earnings alongside the effect of rising net interest margins — a key metric to banks’ profitability — that have been helped by rising interest rates. NIMs across the three banks have risen by 2 to 3 basis points quarter over quarter, indicating a recovery after having fallen for three years amid the pandemic-induced slowdown.

Prudent provisions

Singapore banks largely maintained provisions to ride through market uncertainties and protect against a rise in bad loans, according to their first-quarter results.

“The provision levels for the banks are prudent with provisioning coverage at close to 100%, or 1 times, on nonperforming assets,” said Michael Wu, senior equity analyst at Morningstar. “Despite the expectation of slower growth, the overall economic conditions should still [improve] that is supportive of asset quality.”

In addition, the banks have maintained their “management overlay,” an additional amount agreed upon by banks to supplement provision requirements from the central bank.

“Although risks of negative credit cost guidance revisions remain, large management overlay buffers reduce the likelihood of significant earnings downgrades,” according to a May 3 note from CGS-CIMB.

As of May 11, US$1 was equivalent to S$1.39.

[ad_2]

Source link