[ad_1]

To print this article, all you need is to be registered or login on Mondaq.com.

On 28 June 2019, the Monetary Authority of Singapore

(“MAS”) announced that it will issue up to five digital

banking licenses 1. This was a revolutionary move by

the MAS as digital bank licenses were extended to

non-bank players and allowed banks to operate in Singapore with

minimal physical presence. The MAS recognises that the

banking landscape is undergoing a fundamental transformation driven

by three key forces: (i) pervasive mobile internet access; (ii) the

rise of big data; and (iii) the growth of platform ecosystems as a

major new business model in finance. Hence, the digital banking

framework was introduced to retain Singapore’s position as one

of the leading financial centres in Asia, and to allow for greater

competition and spur greater innovation in finance.

The MAS hopes that competition and innovation from

digital banks may be able to better serve the needs of society and

the economy in the following ways: (i) financing the growth of

infrastructure in emerging Asia, and increasingly of

climate-resilient, low-carbon investments; (ii) financing growth

enterprises and small-medium enterprises (“SMEs”); (iii)

reducing costs and improving convenience for consumers; (iv)

helping people to plan early and achieve financial security in

their later years; and (v) creating good jobs in the finance

sector. 2

The digital banking framework is in addition to any digital

banks that Singapore banking groups may already establish under the

existing internet-only banks (“IOB”) framework. Under

the IOB framework introduced in 2000,

Singapore-incorporated banking groups can set up banking

subsidiaries to pursue new business models, including IOBs.

This allows a bank to decide whether it wants to engage in such

activities within the bank or through a separate subsidiary.

Singapore-incorporated banks can also choose to have a

joint-venture partner in setting up the subsidiary, so long as the

Singapore-incorporated banking group retains control over the

venture. 3

1. What is a digital bank and how does it differ from a

traditional bank?

A digital bank can offer similar services to traditional banks,

except that it is only allowed to operate one physical place of

business. Unlike traditional banks, a digital bank will not have

physical branches, automated teller

machines (“ATMs”) or cash

deposit machines (“CDMs”), and all

banking services will be done online.

2. Who is allowed to operate a digital

bank?

Currently, the MAS has awarded 4 digital bank licenses

to the following applicants: 4

(a) Digital Full Bank

- A consortium comprising Grab Holding Inc. and Singapore

Telecommunications Ltd. - An entity wholly-owned by Sea Ltd.

(b) Digital Wholesale Bank

- A consortium comprising Greenland Financial Holdings Group Co.

Ltd, Linklogis Hong Kong Ltd, and Beijing Co-operative Equity

Investment Fund Management Co. Ltd. - An entity wholly-owned by Ant Group Co. Ltd.

In considering the applicants for digital bank

licenses, MAS would have considered whether the

applicants had a strong value proposition and innovative digital

business model to offer digital banking services. 5

3. What are the types of digital bank licenses

available?

There are two types of digital bank licenses under the digital

bank licensing framework – a digital full bank

(“DFB”) license and a digital wholesale

bank (“DWB”) license.

What are the key differences between DFBs

and DWBs?

The key differences between DFBs and DWBs are the type

of banking activities which they can carry out and the type of

customers they can offer their products and services to.

Digital Full Bank License 6

|

Digital Wholesale Bank License

|

|

|---|---|---|

| Permissible activities | All banking businesses | Only the proposed business(es) outlined in its application,

although it may subsequently seek approval to expand its business scope 7 |

| Deposit restrictions | No restrictions on deposits |

|

| Other products and offerings to customers | All types | Businesses and non-retail customers only, although MAS may

allow offerings to retail customers on an exceptional basis 8 |

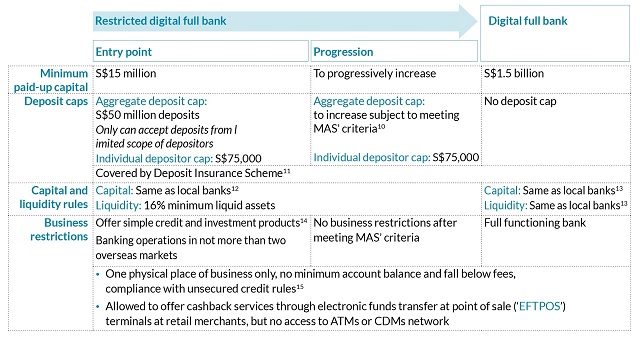

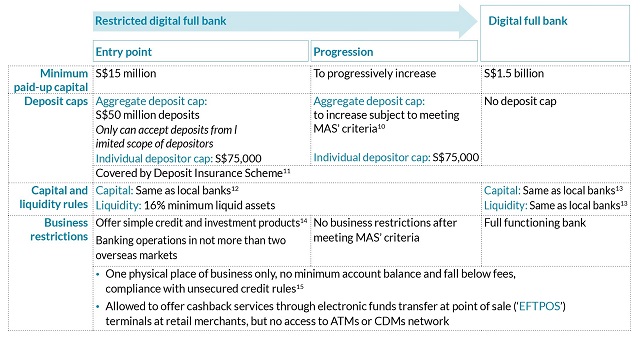

Are DFBs allowed to offer the same services as

traditional full banks?

A full functioning DFB is allowed to offer the same

services as a traditional full bank. However, to minimise risks to

retail depositors, permissible activities of a DFB will

be phased in via a two-stage process. A DFB will first

commence business as a restricted DFB, which is subject to

restrictions on deposits and product offerings. A

restricted DFB also has a lower minimum paid-up capital

requirement compared to a full functioning DFB. Once a

restricted DFB has met all the relevant milestones and

has been assessed to pose no significant supervisory concerns, it

will progress to a full functioning DFB.

While MAS does not pre-determine a time period within

which a restricted DFB must progress to a full

functioning DFB, it generally expects a DFB to be

fully functioning within 3-5 years from commencement of business.

9 A high-level summary of the phased approach is set out

in the following diagram.

Source:

https://www.mas.gov.sg/-/media/Annex-A-Digital-Full-Bank-Framework.pdf

4. How do you apply for a digital bank

license?

Applications for a digital bank license must be made to

the MAS during the stipulated application period. The

first application period took place between 29 August 2019 and 31

December 2019. As the Singapore market is relatively small, only

four digital bank licenses have been awarded for

now. MAS will continue to monitor market developments and

review the need to issue more digital bank licences in the future.

16

Applicants for the DFB or DWB license must

meet the following requirements 17:

(a) Track record. At least one entity

in the applicant group has 3 or more years of track record in

operating an existing business in the technology or e-commerce

field.

(b) Fit and proper criteria. The

following persons are fit and proper 18:

- applicant group and their directors;

- substantial shareholders 19 and 12% controllers

20 of the proposed digital bank; and - directors and executive officers 21 of the proposed

digital bank, when identified 22.

( c ) Capital

requirements. Demonstrates the ability to meet the

applicable minimum paid-up capital requirement at the onset and the

minimum capital funds requirement on an ongoing basis. This can be

done by submitting a written confirmation from shareholders of the

proposed digital bank on commitment of funds.

(d) Value proposition. Provides clear

value proposition, incorporating the innovative use of technology

to serve customer needs and reach under-served segments of the

Singapore market.

(e) Sustainable business

model. Demonstrates that the proposed digital

bank’s business model is sustainable. The applicant must

provide a five-year financial projection of the proposed digital

bank, which must show a path towards profitability. The assumptions

of the financial projection must be reviewed by an external and

independent expert.

(f) Orderly exit plan. Submits a

feasible plan that can facilitate the orderly exit of the proposed

digital bank.

(g) Commitment from

shareholders. Shareholders of the proposed digital

bank commit to providing a letter of responsibility and a letter of

undertaking that MAS may require in respect of the

operations of the proposed digital bank.

Digital Full Bank License

|

Digital Wholesale Bank License

|

|

|---|---|---|

| Who can apply |

|

|

| Minimum paid-up capital | S$1.5 billion | S$100 million (this is the same as existing wholesale

banks) |

5. Are digital banks regulated differently from

traditional banks?

Generally speaking, DFBs are subject to the same regulatory

requirements as existing full banks, whereas DWBs are subject

to the same regulatory requirements as existing wholesale banks.

These include requirements relating to technology risks,

money-laundering and terrorism financing risks, and the conduct of

non-financial businesses.

As an existing digital bank license holder, what are my

ongoing regulatory requirements?

Banking Act 1970 (“Banking Act”)

(a) Minimum capital requirements

All banks including digital banks are required to meet the

prescribed minimum paid-up capital requirement and minimum capital

funds requirement on an ongoing basis. Digital banks will also be

subject to the risk-based capital adequacy requirements set out

under Notice 637 (Risk Based Capital Adequacy Requirements for

Banks Incorporated in Singapore). 23

(b) Changes in shareholding

Any person who wishes to become a substantial shareholder, 12%

controller, 20% controller or indirect controller of a licensed

bank will be required to obtain prior approval from the

Minister-in-Charge of MAS 24. In particular

for DFB applicants, any in-principal

approvals (“IPA”) granted

by MAS would be on the basis of the shareholding

structure provided to MAS at the application stage. As

such, if the change in the shareholding no longer meets the

eligibility criteria for Singaporean control, the IPA may

be revoked.

© Overseas expansions

Pursuant to section 12(3) of the Banking Act, a DWB is

required to obtain MAS’ approval to open a new branch,

agency or office in a place outside Singapore.

Risk Management

Digital banks should refer to MAS’ Framework for Impact

and Risk Assessment of Financial Institutions to better understand

how MAS assesses the impact of financial institutions

25, and the types of risks that are generally applicable

to financial institutions.

(a) Anti-Money Laundering (AML) and Countering the Financing

of Terrorism (CFT)

Financial institutions operating in Singapore are required to

put in place robust controls to detect and deter the flow of

illicit funds through Singapore’s financial system. Such

controls include the need for financial institutions to identify

and know their customers (including beneficial owners), to conduct

regular account reviews, and to monitor and report any suspicious

transaction. 26

Digital banks will be subject to the same AML/CFT and

sanctions-related requirements applicable to the incumbent banks,

including MAS’ Notice 626 on Prevention of Money

Laundering and Countering the Financing of Terrorism and its

corresponding guidelines 27.

(b) Technology Risk

MAS has issued a set of Guidelines on Risk Management

Practices – Technology Risk 28 which sets out

technology risk management principles and best practices to guide

the financial institutions to establish sound and robust technology

risk governance and oversight, as well as maintain IT and cyber

resilience. MAS has also issued Notice 644 (Notice on

Technology Risk Management) 29 on the requirements on

maintaining high availability, recoverability, data protection and

incident reporting, and Notice 655 (Notice on Cyber Hygiene)

30 on the essential measures that banks must take to

mitigate the growing risks of cyber threats.

Furthermore, in the wake of recent SMS-phishing

scams, MAS and the Association of Banks in

Singapore (“ABS”) are also

introducing a set of additional measures to bolster the security of

digital banking. 31

© Outsourcing Risks

As a digital bank may from time to time enter into arrangements

with third party service providers to outsource certain business

and support functions, it is also required to have in place the

relevant governance and risk management processes to identify and

manage the risks arising from these outsourcing arrangements.

Digital banks should refer to MAS’ Guidelines on

Outsourcing 32 that sets out MAS’ expectations

of a financial institution that has entered or is planning to enter

into an arrangement to outsource any of its business functions to a

service provider.

Conduct of non-financial businesses

In September 2017, MAS sought public feedback on its

proposal to refine its anti-commingling framework for banks in two

key aspects: (i) to streamline the conditions and requirements for

banks to conduct or invest in permissible non-financial businesses;

and (ii) to allow banks to engage in the operation of digital

platforms that match buyers and sellers of consumer goods or

services, as well as the online sale of such goods and services.

Digital banks should, when planning to conduct any non-financial

businesses, consider MAS’ Consultation Paper and Response

to Feedback Received on its Review of Anti-Commingling Framework

for Banks 33, which sets out MAS’s policy

towards banks’ conduct of non-financial businesses.

Securities and Futures Act

2001 (“SFA”) / Financial

Advisers Act 2001 (“FAA”)

Digital banks will also be expected to meet the relevant

regulatory requirements under the SFA and

the FAA and submit the relevant forms where it intends to

carry out regulated activities under

the SFA 34 or financial advisory services

under the FAA 35. When submitting the relevant

form, the digital bank is not required to resubmit information that

was already provided in its application to set up a digital bank

(unless there have been any changes to the information previously

provided).

6. Regional Developments

Hong Kong

Digital banks are termed as “virtual banks” in Hong

Kong, and defined as “a bank which primarily delivers retail

banking services through the internet or other forms of electronic

channels instead of physical branches”. 36 As at 31

December 2021, the Hong Kong Monetary Authority has issued a total

of 8 virtual bank licenses. 37

Malaysia

On 2 July 2021, Bank Negara

Malaysia (“BNM”) announced

that it had received 29 applications for its digital banking

license and is set to issue up to 5 digital banking licenses in

early 2022. 38 Similar to Singapore’s approach

towards DFBs, BNM implements a phased approach

towards its digital banking license holders, such that a simplified

regulatory framework is applied during its initial three to five

years of operations, to allow the license holders to demonstrate

its viability and sound operations, and for BNM to

observe attendant risks. 39

Indonesia

The Financial Services Authority (Otoritas Jasa

Keuangan) of Indonesia issued new regulations in August

2021 to introduce its digital bank regulatory framework, which

allows for digital banking to be carried out by way of an

establishment of a new digital bank, or a transformation of an

existing conventional bank into a digital bank.

Philippines

The Central Bank (Bangko Sentral ng

Pilipinas) of the

Philippines (“BSP”) issued its

Guidelines on the Establishment of Digital Banks in December 2020

for the inclusion of “Digital Banks” as a distinct

classification of banks and to set out its corresponding licensing

framework in its existing Manual of Regulations for Banks. Similar

to Indonesia, the guidelines allow for the establishment of a new

digital bank, or the conversion of an existing bank to a digital

bank. 40 However, BSP announced that as at 1

September 2021, it would stop accepting applications for digital

banking licenses for 3 years, to allow the authorities to monitor

the digital banking industry. The number of digital banking

licenses issued will be capped at 7. 41

This article has been produced for general informational

purposes only. The information contained in this article should not

be construed as legal advice and is not intended to be a substitute

for legal counsel on any subject matter. No recipient of this

article should act or refrain from acting on the basis of any

contents in this article without seeking appropriate legal or other

professional advice.

Footnotes

1

https://www.mas.gov.sg/news/media-releases/2019/mas-to-issue-up-to-five-digital-bank-licences

2

https://www.mas.gov.sg/news/speeches/2019/banking-liberalisations-next-chapter-digital-banks

3

https://www.mas.gov.sg/-/media/Digital-Bank-Licence/FAQs-on-DFB-and-DWB-Licences.pdf?la=en&hash=6883

4

https://www.mas.gov.sg/news/media-releases/2020/mas-announces-successful-applicants-of-licences-to-operate-new-digital-banks-in-singapore

5

https://www.mas.gov.sg/news/speeches/2019/banking-liberalisations-next-chapter-digital-banks

6 The information in this table is presented on the

assumption that the DFB is a full

functioning DFB.

7 Generally, the permissible activities for a digital

wholesale bank are outlined in the Guidelines for Operation of

Wholesale Banks published by the MAS on 31 July

2008.

8 Non-retail customers refer to individuals who fall

within the definition of “accredited investor” under the

Securities and Futures Act 2001. MAS does not expect

a DWB to serve retail customers, such as providing

financial advice to these individuals. On an exceptional

basis, MAS may allow such offerings, provided that there

is a strong nexus and is necessary to the applicant’s core

offering(s) to the non-retail segment. An applicant with plans to

provide any of such offerings should highlight accordingly in its

application, and explain how there is a strong nexus and is

necessary to the specific core offering(s) to the non-retail

segment.

9

https://www.mas.gov.sg/-/media/Digital-Bank-Licence/Eligibility-Criteria-and-Requirements-for-Digital-Banks.pdf?la=en&hash=57410B76A3359791816B0A0BD592DF8EF2D37B33

10 Wholesale deposits will not be subject to the

aggregate deposit cap once the restricted full bank’s paid-up

capital reaches $100m (in line with wholesale bank’s minimum

paid-up capital).

11 The Deposit Insurance Scheme will protect non-bank

depositors (including individuals and sole proprietorships) in the

event of a bank’s failure by covering

the SGD deposits placed with a member bank, for up to

S$75,000 per depositor per member bank.

12 6.5% CET1 Capital Adequacy Ratio (CAR), 10%

Total CAR, 2.5% capital conservation buffer (CCB), up to 2.5%

countercyclical capital buffer (CCyB).

13 100% net stable funding ratio, 100% liquidity coverage

ratio.

14 Interested parties can refer to the Schedule to the

Securities and Futures (Capital Markets Products) Regulations 2018

for potential scope of permissible investment products that can be

offered.

15 Interested parties can refer to MAS Notice

635 Unsecured Credit Facilities to Individuals and Banking (Credit

Card and Charge Card) Regulations 2013 for reference.

16

https://www.mas.gov.sg/-/media/Digital-Bank-Licence/FAQs-on-DFB-and-DWB-Licences.pdf?la=en&hash=6883

17

https://www.mas.gov.sg/-/media/Digital-Bank-Licence/Eligibility-Criteria-and-Requirements-for-Digital-Banks.pdf?la=en&hash=57410B76A3359791816B0A0BD592DF8EF2D37B33

18 See Guidelines on Fit and Proper Criteria.

19 “substantial shareholder” has the same

meaning as in section 81 of the Companies Act. It generally refers

to any person who will have a voting interest of at least 5% in the

proposed digital bank.

20 “12% controller” means a person, not being a

20% controller, who alone or together with his

associates:

a holds not less than 12% of the total number of issued

shares in the proposed digital bank; or

b) is in a position to control voting power of not less

than 12% in the proposed digital bank.

Please refer to section 15B of the Banking

Act.

21 “executive officer”, in relation to a

company, means any person, by whatever name described,

who:

a) is in the direct employment of, or acting for or by

arrangement with, the company; and

b) is concerned with or takes part in the management of

the company on a day-to-day basis.

Please refer to section 2 of the Banking Act.

22 The proposed digital bank’s board of directors and

team of executive officers need not be fully formed at time of

application.

23

https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulations-Guidance-and-Licensing/Commercial-Banks/Regulations-Guidance-and-Licensing/Notices/MAS-Notice-637-effective-1-January-2022.pdf

24 Sections 15A and 15B of the Banking Act

25

https://www.mas.gov.sg/-/media/MAS/News-and-Publications/Monographs-and-Information-Papers/Monograph—MAS-Framework-for-Impact-and-Risk-Assessment.pdf

26

https://www.mas.gov.sg/regulation/notices/notice-626

27 https://www.mas.gov.sg/regulation/notices/notice-626

and

https://www.mas.gov.sg/regulation/guidelines/guidelines-to-notice-626-on-prevention-of-money-laundering-and-cft-for-banks

28

https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulatory-and-Supervisory-Framework/Risk-Management/TRM-Guidelines-18-January-2021.pdf

29

https://www.mas.gov.sg/-/media/MAS/Notices/PDF/Notice-MAS-644.pdf

30

https://www.mas.gov.sg/-/media/MAS/Notices/PDF/MAS-Notice-655.pdf

31

https://www.mas.gov.sg/news/media-releases/2022/mas-and-abs-announce-measures-to-bolster-the-security-of-digital-banking

32

https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulatory-and-Supervisory-Framework/Risk-Management/Outsourcing-Guidelines_Jul-2016-revised-on-5-Oct-2018.pdf

33

https://www.mas.gov.sg/publications/consultations/2017/consultation-paper-on-review-of-anti-commingling-framework-for-banks

34 Form 26- Notice of Commencement of Business lodged

pursuant to Regulation 14(4) of the Securities and Futures

(Licensing and Conduct of Business) Regulations by persons exempt

from holding a Capital Markets Services License under section

99(1)(a), (b), ( c ) and (d) of the SFA

35) Form 26 – Notice of Commencement of Business

lodged pursuant to Regulation 37(1) of the Financial Advisers

Regulations by persons exempt from holding a Financial

Adviser’s License under Section 23(1)(a), (b), ©, (d) and

(e) of the FAA

36

https://www.hkma.gov.hk/media/eng/doc/key-information/press-release/2018/20180530e3a2.pdf

37

https://www.hkma.gov.hk/eng/key-functions/banking/banking-regulatory-and-supervisory-regime/virtual-banks/

38

https://www.bnm.gov.my/-/bnm-receives-29-applications-for-digital-bank-licenses

39

https://www.bnm.gov.my/documents/20124/938039/20201231_Licensing+Framework+for+Digital+Banks.pdf

40

https://www.bsp.gov.ph/Regulations/Issuances/2020/c1105.pdf

41

https://www.bloomberg.com/news/articles/2021-08-19/philippines-set-to-close-digital-bank-applications-for-3-years

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

[ad_2]

Source link