[ad_1]

Randall Williams/iStock Editorial via Getty Images

Introduction

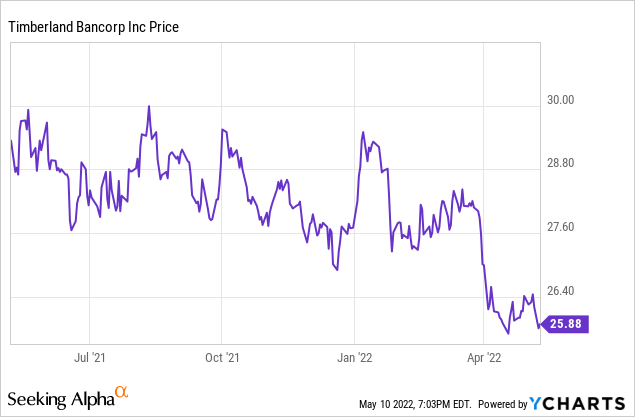

Some of the smaller regional banks have piqued my interest and I have been keeping an eye on Timberland Bancorp (NASDAQ:TSBK) for about 18 months now. I have a small long position in Timberland Bancorp and I was thinking about adding to this position on the current weakness in the share price but decided to wait for the bank’s Q2 results to be published, just to make sure I can make an informed decision based on the most up to date information and data.

A good look at the first half of 2022

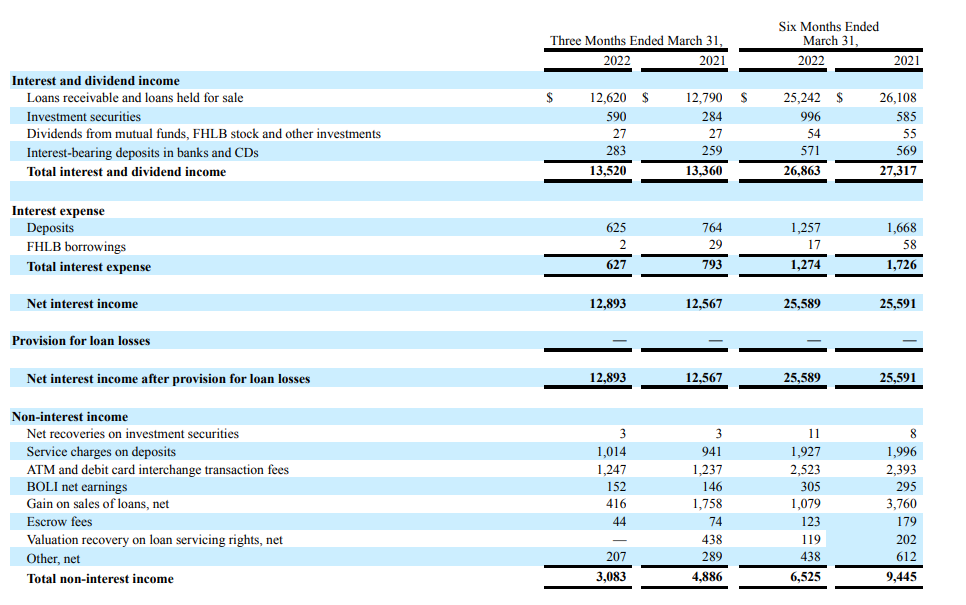

In the second quarter of FY2022 (which ends in March for Timberland Bancorp), the bank was able to increase its net interest income by approximately 2.5% to $12.9M thanks to a slightly higher interest income (mainly thanks to an increased contribution from the return on investment securities) and a slightly lower interest expense.

Timberland Bancorp Investor Relations

The bank also recorded a total non-interest income of $3.1M which is substantially lower than in the first quarter of the preceding year and that’s mainly because TSBK reported gains on the sale of loans in Q2 2021 which was not repeated in the second quarter of the current financial year.

Timberland Bancorp Investor Relations

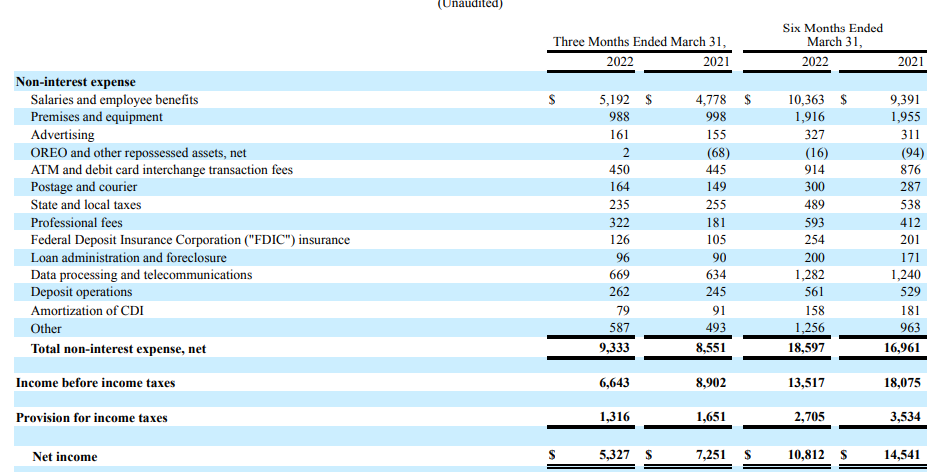

Unfortunately the total amount of non-interest expenses increased to $9.3M which means the total amount of net non-interest expenses increased to $6.25M, coming from less than $4M in the second quarter of the previous financial year. This resulted in a pre-tax income of $6.64M (the bank did not have to record any provisions for loan losses) and a net income of $5.33M which represents approximately $0.64 per share.

Looking at the H1 2022 result, the EPS was $1.30/share mainly thanks to a slightly higher non-interest income in the first quarter. On an annualized basis, TSBK appears to remain on track to generate an EPS of in excess of $2.50 per share resulting in a forward P/E of around 10.

Timberland is currently paying a quarterly dividend of $0.22/share for a yield of approximately 3.4%. The payout ratio is less than 35% based on the Q2 earnings so there’s plenty of opportunity for Timberland to continue to increase the dividend and to pay a special dividend every once in a while.

Timberland Bancorp Investor Relations

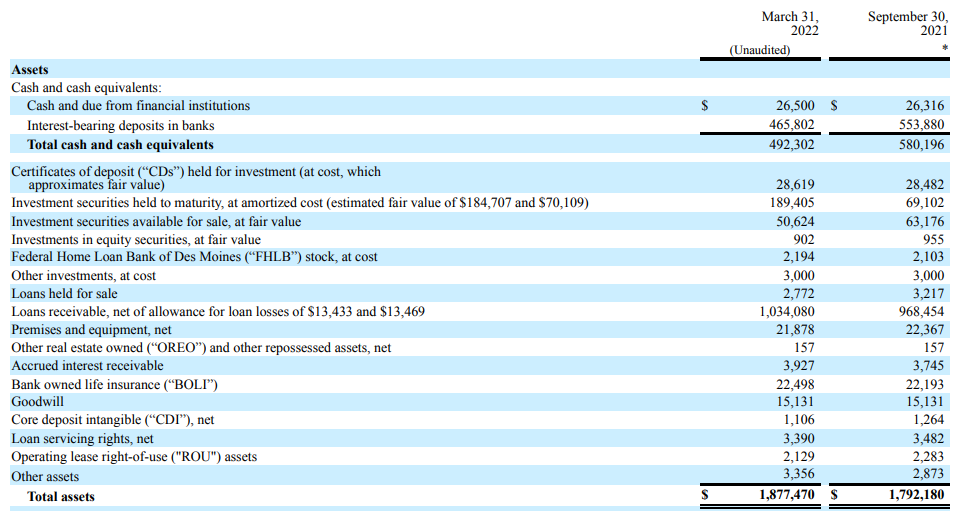

The balance sheet remains robust and quite liquid

I was always quite positive about Timberland’s balance sheet as the company is running a very liquid balance sheet. I also wanted to have a closer look at the loan book to make sure Timberland is doing the right thing by not recording any loan loss provisions in the first half of 2022.

Looking at the balance sheet, Timberland has for sure allocated more cash to ‘normal’ loans and investment securities but with in excess of $492M in cash and $269M in investment securities and certificates of deposit, the balance sheet remains exceptionally liquid. Of the total of $1.88B in assets, about $750M is held in cash or investment securities. This basically means that if customers would withdraw 40% of their deposits, Timberland should have no problem to make that happen as it can easily sell the investment securities.

Timberland Bancorp Investor Relations

While a very liquid balance sheet usually means the bank is leaving some gains on the table (normal loans have higher returns than investment securities), it also means this bank should be relatively immune to a bank run.

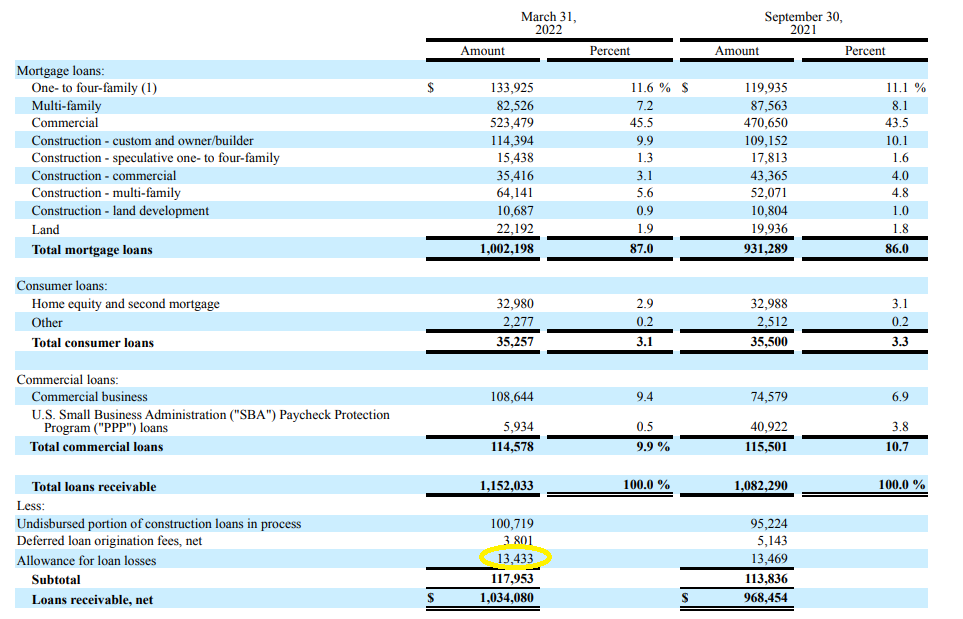

Of the $1.03B in net loans, $100M represent construction loans in process which haven’t been disbursed yet. We also see the bank has a decent exposure to residential mortgages but commercial real estate loans still represent a very large chunk of the loan book.

Timberland Bancorp Investor Relations

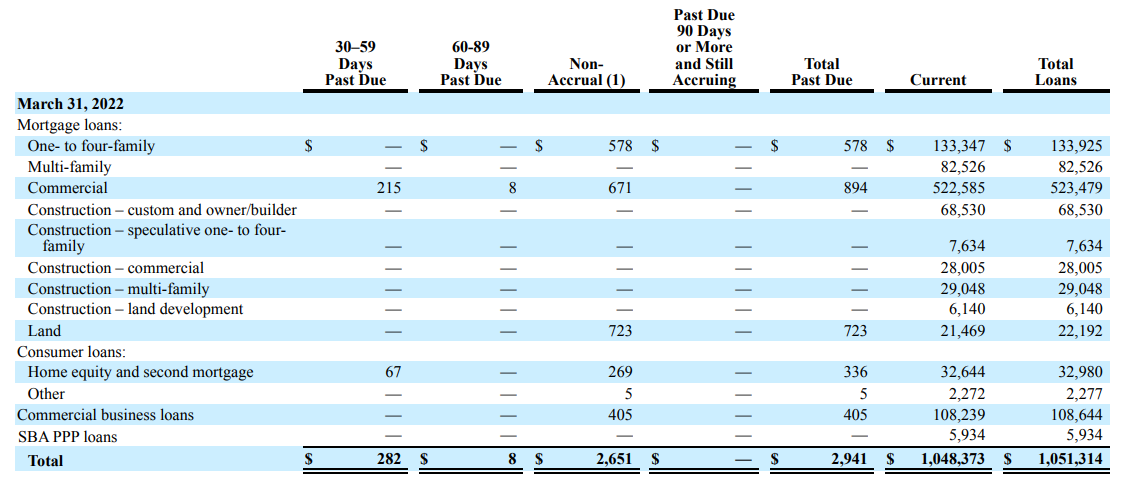

Of interest is the fact that the total amount of loan loss provisions recorded on the balance sheet is just $13.4M. And that number has remained pretty stable as only a very small minority of the loan book is currently classified as past due. As you can see below, less than $3M of the loans are past due with only $2.65M of the loans classified as non-accruing.

Timberland Bancorp Investor Relations

As the current amount of loan loss provisions is more than five times as high as the total amount of loans that are no longer on accrual basis and almost five times as high as all the loans past due, I understand why Timberland Bancorp doesn’t feel the need to further boost its loan loss provisions.

Investment thesis

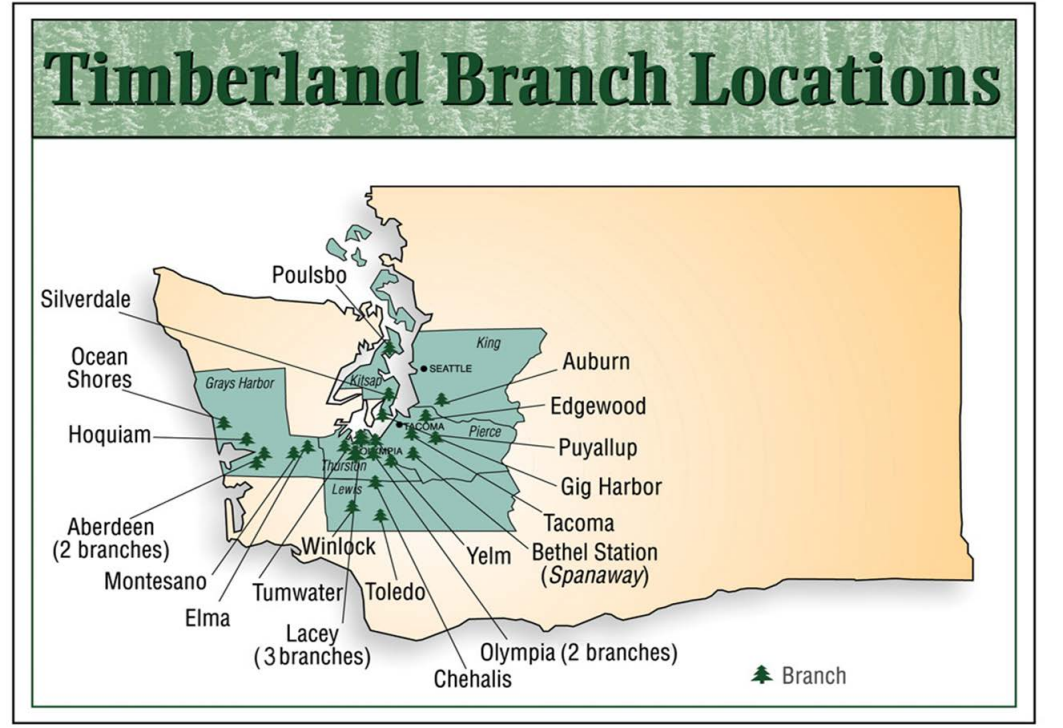

As of the end of Q2 2022, Timberland Bancorp had a total equity of $212.3M and a tangible equity value of $197M on the balance sheet. Divided over 8.3M shares, this means Timberland’s tangible book value per share was approximately $23.60, which means the bank is currently trading at just under 1.1 times its tangible book value. Combined with the earnings multiple of just 10 times the annualized FY 2022 EPS and the conservative balance sheet, I think I will further increase my position in this regional bank in Washington State. The dividend isn’t high but I don’t mind a rather moderate but safe dividend.

The bank also acts as an interesting call option on the interest rates. At the annual general meeting, TSBK disclosed that a 100 bp increase in the interest rate scenario would add about $5.1M to the net interest income and this would boost the EPS by $0.50. In that case, Timberland has a good shot at generating $3+/share in earnings.

[ad_2]

Source link