[ad_1]

Last year title insurers hit a high-water mark for premiums written, which the industry might not come close to again anytime soon, if ever.

The business, highly dependent on mortgage origination volume, wrote 35.9% more in premiums during 2021 than in 2020.

Total premiums written during 2021 reached $26.2 billion, compared with $19.2 billion in 2020 and $15.8 billion in 2019, according to the American Land Title Association.

“Incredibly low mortgage rates lead to an unprecedented increase in real estate transactions and substantially higher home values,” Diane Tomb, ALTA chief executive, said in a press release. “Those factors — caused in part by the unique circumstances of the COVID-19 pandemic — contributed to the record title insurance premium volume, which the title industry won’t see again soon.”

Origination volume last year was $4.48 trillion, up from $4.37 trillion in 2020, according to Fannie Mae.

Meanwhile, total operating income for the industry was up 33.4%, operating expenses increased 32% and loss and loss adjustment expenses were up 2.3%.

However, the dollar amount of claims paid increased to more than $474.4 million last year from $469 million in 2020. This is still fewer than $544 million for 2019.

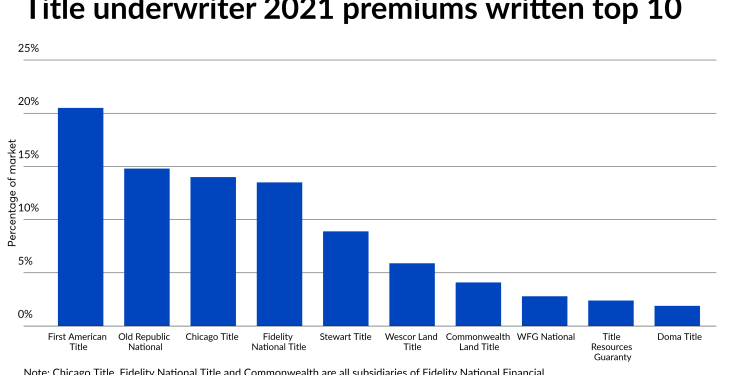

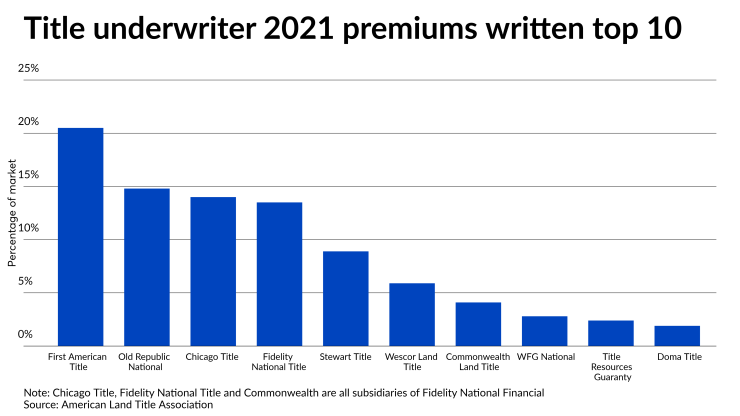

By share of premiums written, the top five — and six of the top seven — underwriters were units of the four major players in the business.

First American Title Insurance had the largest share, at 20.5%. But three units of Fidelity National Financial were on the list: No. 3 Chicago Title at 14%; No. 4 Fidelity National Title, 13.5%; and No. 7 Commonwealth Land Title at 4.1%.

Old Republic National Title was ranked second overall with a 14.8% share, while Stewart Title Guarantee was fifth at 8.9%.

Among the independent companies, No. 6 Westcor had a 5.9% share, up slightly from 2020. WFG slipped to 2.7% from nearly 3%. Title Resources Guaranty, which Realogy sold 70% of to Centerbridge Partners and more recently Berkshire Hathaway Home Services also took a stake in, had a 2.4% market share in 2021, down from 2.5% in 2020.

Finally Doma, formerly North American Title, had a 1.9% share last year, up from 1.8%.

[ad_2]

Source link