[ad_1]

The Federal Reserve is trying to stamp out inflation without pushing the economy into recession but the effort is akin to getting blood from a stone. While everyone admits this task is exceedingly difficult, a think tank from Societe Generale proposed a bipolar policy in which a softer landing could be achieved if the rate hikes slow down.

The Fed Has Two Choices in Fight Against Inflation

The research team from one of the oldest banks in France makes the case for a two-pronged approach, led by Societe Generale Quant Research’s chief, Solomon Tadesse. The Fed will either have to opt for a growth-centric or inflation-stamping approach:

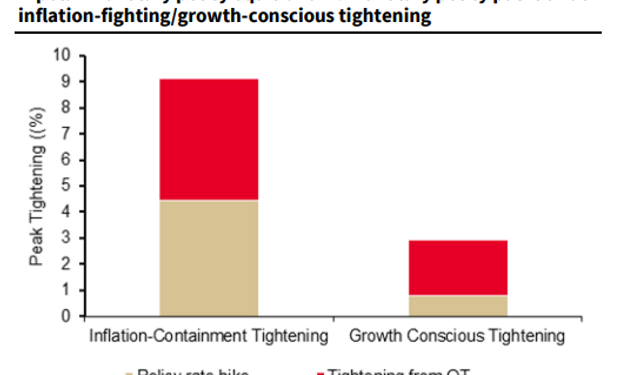

- Quashing inflation would pull the rug from the equity market to some extent, as it is used to the cheap cost of capital. This would translate to a total 9.25% interest rate hike and a $3.9 trillion balance sheet reduction as QT.

- Alternatively, a growth-focused policy would translate to a half-measure, as a softer landing.

In other words, the Fed is operating within this cost-benefit spectrum. The Fed has to pick the severity of landing so that not many wheels fall off. One of those wheels is the employment rate if the monetary policy results in a recession.

The Fed’s Juggling of Hot Potatoes

The very reason why the Fed more than doubled its balance sheet was to stave off the stock market crash during the C19 event. In turn, the central bank imposed a tax in the form of inflation. This was the long-term cost of that decision.

While inflation may not be called a tax, it acts like one, imposing a broad-range increase in the cost of living. Now that this “tax” is becoming politically problematic, a reversal of the balance sheet is in order. Specifically, the reduction of treasury securities as government debt.

By redeeming Treasury securities, along with mortgage-backed securities (MBS), at a monthly cap of $60 billion, the Fed can shrink its bloated balance sheet gradually. This quantitative tightening (QT) will slowly ramp up by the end of 2022.

In turn, just like quantitative easing (QE) decreased interest rates due to Fed money flooding the banks, so does quantitative tightening (QT) increase interest rates. After all, the banking system is then drained of excess money, effectively reverting QE.

Join our Telegram group and never miss a breaking digital asset story.

Inflationation Hedging Assets Down as Macro Conditions Stay Uncertain

To illustrate further, the monetary spectrum between QE and QT is equal to heating or cooling the economy. Inflation is the clear manifestation that the economy is overheated, bloating the equity market for the last two years as the Fed addicted it to cheap borrowing.

Soft landing is then cooling the economy without pulling the equity market rug too abruptly. Last Thursday, the Fed Chair Jerome Powell admitted this will be quite difficult.

“So a soft landing is, is really just getting back to 2% inflation while keeping the labor market strong… Whether we can execute a soft landing or not, it may actually depend on factors that we don’t control.”

Jerome Powell in an interview to Marketplace

On her European tour, U.S. Treasury Secretary Janet Yellen specified on Wednesday that some of those uncontrollable factors are global food and energy price hikes as a result of the Ukraine-Russia conflict. These may trigger the worst-case scenario—stagflation—a cooling economy with high unemployment and high inflation.

For the time being, assets that are considered growth-focused have been hit the hardest. Specifically, the tech-heavy Nasdaq index and Bitcoin.

Interestingly, purported hedges against inflation—gold, silver, Bitcoin—are performing the worst, with the expectation that the Fed will successfully clamp down on inflation.

Finance is changing.

Learn how, with Five Minute Finance.

A weekly newsletter that covers the big trends in FinTech and Decentralized Finance.

Elon Musk recently said that the US will likely end up in a prolonged recession. Do you think market signals should be corrected with a recession to avoid stagflation?

About the author

Tim Fries is the cofounder of The Tokenist. He has a B. Sc. in Mechanical Engineering from the University of Michigan, and an MBA from the University of Chicago Booth School of Business. Tim served as a Senior Associate on the investment team at RW Baird’s US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firm specializing in sensing, protection and control solutions.

[ad_2]

Source link