[ad_1]

xijian/E+ via Getty Images

Originally published on February 22, 2022

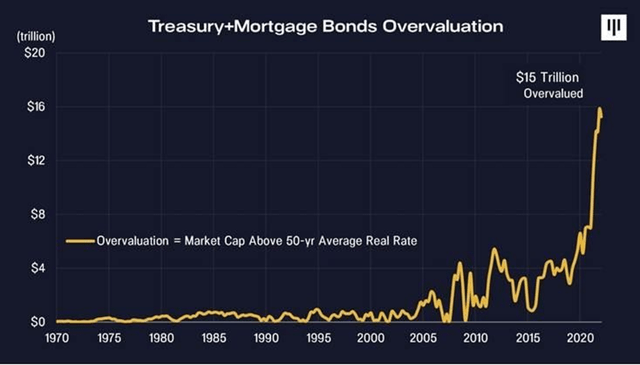

I came across this fascinating read about #cryptoinvesting by Dan Morehead who showed (See Chart 1) that Treasury and Mortgage bonds were overvalued by some $15 Trillion.

Chart 1

With the underlying message being that with the Fed stopping QE, stopping the purchase of new bonds and before long will begin letting maturing bonds run off – who knows, perhaps even sell bonds into the open market; how will the market respond? Will there be anyone to replace the Fed as a natural buyer? To what extent? And how will the market reprice?

Probably don’t have any answers, but wanted to go and look at the housing market fundamentals, and the fundamentals of the underlying mortgages to see how strong the market was, and whether a case could be made for a natural buyer to step in and to some degree replace Fed purchases.

The expectation is that the Fed will raise rates, which will have a knock on effect in just about all rate products including mortgages, and they will rise too. In fact, that has already started, even before the Fed has started to actually raise rates.

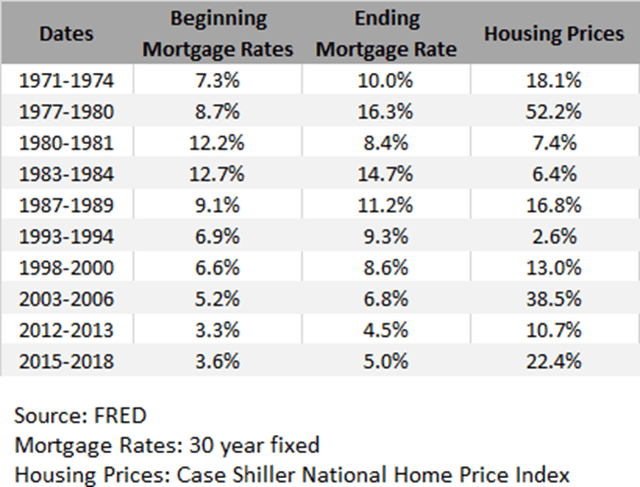

The 30 year Mortgage rate was about 2.8% in August, and has already risen to 4.1%. Last time the Fed raised interest rates (in 2015), mortgage rates did indeed rise, hitting 5% as the Fed funds rate got as high as 2.4% (See Chart 2).

Although finance theory tells us otherwise, higher interest rates should make home prices fall. Which makes sense. But the opposite tends to hold true in practice. Last rate hike cycle saw housing prices rise 22% nationally as per Case Shiller. Obviously, there are nuances, with different regions rising more, and others less. But on average, housing rose quite significantly. Some of that can definitely be attributed to a housing crash that bottomed only a few years before that. Nonetheless, when looking back over the course of the last half a century, every time rates rose, housing prices followed suit (See chart 3).

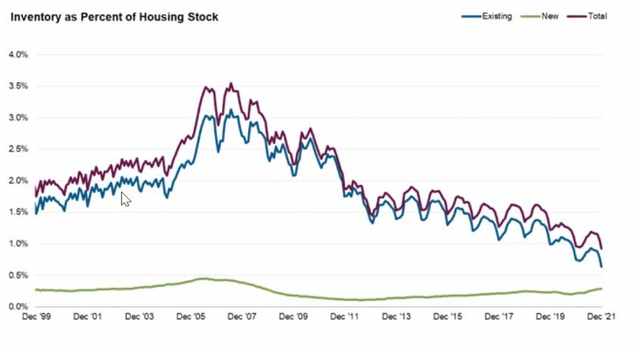

Which also makes sense. If you have been sitting on the sidelines waiting to purchase a house, and you see that house prices have risen as mortgage rates have fallen, then if you see mortgage rates begin to crop up, you are more likely to go and sign on that house in the fear that rates will continue to go up. And if homeowners have locked in a low mortgage rate, then as mortgage rates continue to rise, they are less likely to want to sell, as they will have to buy their own new home at higher rates. So, you are in a scenario where there is high demand and decreasing supply.

What about inventory levels? A quick look at chart 4 provides us with the answer – historic lows! At a time when demand is super high, may well be rising, supply is low.

And with respect to emotions driving investment decisions, it tends to be pretty low when it comes to housing. People may sell stocks, bonds, crypto etc. during systemic periods of fear, but that is unlikely to happen with homes. Homes tend to be purchased because of the stage of life you are at, because of job location etc. But they are unlikely to be sold on fear.

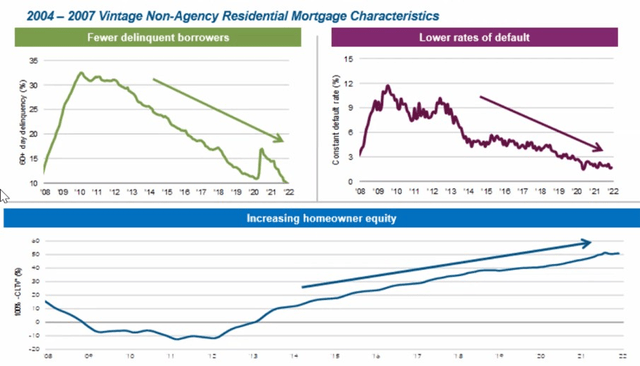

Of course, they could be forced liquidation if they are repossessed based on poor fundamentals. But if we look at the underlying fundamentals of those who have taken out mortgages, they are super strong, as evidenced by the following graphs provided by one of our Managers in Chart 5.

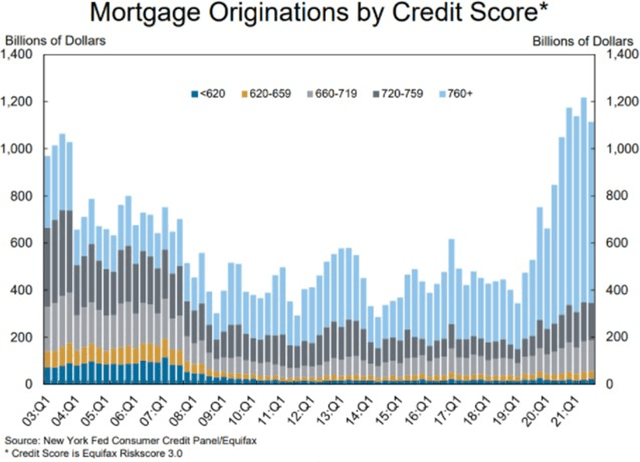

What about the creditworthiness of the purchasers?

Chart 6

People buying homes today have excellent credit scores. That was far from the case during the subprime crises. It’s likely that homeowners have taken advantage of the super low rates that were on offer of the last few years, and have refinanced and locked in low rates. In fact, we can see that in the graph shown above with regards to homeowner equity.

So, what’s my point here? I’m not too sure. Perhaps that the underlying fundamentals of the housing market appear to be super strong, so that it’s very possible that there will be natural buyers for these mortgages once the Fed takes a step back. Or perhaps not! Time will tell. One thing for sure, we are in for an interesting ride!

Source: Goldrock Capital

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link