[ad_1]

People looking for secure ways to obtain online personal loans despite having a score of credit that is not so great might feel that they are lost for options.

Nowadays, there are plenty of online options for those who wish to connect with personal loan providers and avoid the traditional system of securing loans that might cause them a lot of hassle.

There are hundreds of lenders on the online market waiting to secure your business and give you the loans you need at interest rates that are flexible and pre-decided between the lender and you.

If you wonder what is in it, the answer is simple. Instead of the rates of interest (which are pretty high) you pay to financial institutions like banks, you just give the money to these lenders instead.

Your credit report does not matter much to these lenders. They are just looking for a way to utilize their money to make some profits. When you go to a bank to obtain a loan, they have plenty of questions for you and use a lot of parameters, including your Fico Score, to determine your creditworthiness.

If you are on the lookout for bad credit loans, check out these platforms dedicated to bringing you loans for bad credit by willing lenders. We have performed deep and critical research to develop the best bad credit/emergency loan lenders to help you with your financial needs.

The Best Bad Credit Loans Companies in 2022

Here is a brief overview of the lenders we have reviewed below:

| Money Mutual | Excellent and easy loans for bad credit without a minimum credit score requirement. Ideal for debt consolidation. |

|---|---|

| BadCreditLoans | Borrow up to $10000 without worrying about your credit scores. There are multiple loans for bad credit by reliable lenders who do not care about your credit score. |

| PickALender | Get personal loans and loans for bad credit up to $40,000 in simple and easy methods irrespective of credit score—no worry about maintaining a minimum credit score to get a high amount of money. |

| CashUSA | This is perfect for debt consolidation; get hold of loans for bad credit without much hassle from lenders who do not care about your credit score. Get $10,000 in a day even if you do not have a minimum credit score. |

| PersonalLoans | Get up to $35,000 without maintaining a minimum credit score. They offer options of unsecured and secured loans for bad credit borrowers. Personal loans for bad credit are available for those who don’t meet expectations of minimum credit score. |

| LendYou | Whether you meet the minimum credit score expectations, you can get loans for bad credit from this platform. Secured loans and unsecured ones are available. |

| Next Day Personal Loan | They offer loans for bad credit borrowers in the form of unsecured and secured loans. You can borrow $40,000 in just a day without worrying about your credit score. |

| Upgrade Personal Loans | Secured loans up to $50000 in just a day in loans for bad credit. Easy way to get bad credit loans of the highest amounts. |

| Payzonno | Secured loans for bad credit without worrying about your credit score |

Upon critical research and deep comparison of the bad credit loan companies, we have curated a list of the best bad credit loan companies that do not resonate with “scam” or “illegitimacy” even remotely. Here you go:

MoneyMutual

| Company Overview | |

|---|---|

| Type of Loan | All-purpose loans |

| Loan Amount Range | $200 to $5000 |

| APR | Varies |

| Term Length | Varies |

MoneyMutual is a company that has helped over 2,000,000 customers secure outstanding loans for those with not-so-great credit scores and continue to help people out in multiple ways.

The company presents a secure and safe lending platform that connects users with over 120 verified lenders. These lenders do not care about the FICO score that you possess. The platform is fast and reliable, with a smooth user experience.

MoneyMutual stands at the top of our list on account of being a very trustworthy platform that has gathered plenty of positive reviews from those who have successfully received personal loans for bad credit from the lenders on the website.

The amount of money you can borrow is flexible, and there is no strict credit check that happens when you try to borrow some money from the lenders. You can get up to $5000 in no time without the hassle of a minimum credit score requirement, which poses trouble for most borrowers.

Using this platform is very simple. You just need to provide a few simple details when you log into the website. The amount is credited to your account within 24 hours.

You do not have to worry about unsafe, unsecured loans, which is a problem that people generally face when borrowing money from non-traditional sources. The lenders take less than 24 hours to verify the information you have provided them and give you secured loans.

You can discuss the repayment terms with the lenders and arrange flexible monthly payments depending on convenience. One of the best parts of using the platform is that it costs you no additional charges.

You have to fill out a form, submit the information, and wait for your money to be credited. There are no minimum loan amounts specified – you can borrow as little as you want, depending on your needs.

Since there is no origination fee, you do not have to worry about additional expenses other than repaying your loan. Using MoneyMutual, borrowers can secure helpful loans to help them take care of urgent expenses.

The interest rates are pretty low compared to what you pay to traditional lending sources like banks. You can discuss the repayment terms in-depth with the lenders and only borrow the money if you are genuinely okay.

Generally, you will not suffer from any prepayment penalty like you would if you had taken the loan from a bank instead. If the lender is OK with it when you get the money back, you can repay the balance.

With MoneyMutual around, it does not matter if you have bad credit. You can get loan funds from online lenders up to $5000 through easy ways of getting loan proceeds without the hassles of loan approval you would face otherwise.

BadCreditLoans

| Company Overview | |

|---|---|

| Type of Loan | Multiple |

| Loan Amount Range | $500 to $10,000 |

| APR | 5.99% – 35.99% |

| Term Length | 3 to 60 Months |

BadCreditLoans is an excellent outlet bringing you trustworthy personal loans for bad credit in the shortest possible time. The process is straightforward. You can apply for loans ranging from $500 to $10,000 using a simple online application.

You will be eligible without a separate credit check procedure once you provide elementary details, including your date of birth, Social Security Number (last four digits), and zip code.

Besides the fact that you do not have to worry about meeting a minimum credit score requirement, this platform is popular because there is no cost for using the services.

You can use the platform at zero origination fee and only have to worry about sticking to the interest rate you and the lender have chosen. You can discuss the repayment terms with the lender and decide whether monthly payments are suitable. Understand their requirements, present your own, and reach a consensus.

You do not have to worry about coming across unsecured loans that seem shady. It works using a very secure system to ensure that every lender is verified and provides you with options for secured loans.

BadCreditLoans connects you with lenders who have to pay a fee. The borrower will not be losing out on any money. The minimum loan amount you can borrow from this company is $500.

You can borrow up to $10,000 in a single day after completing the simple online process and checking eligibility.

Transparency is one of the things that this company prides itself upon. You can get any information from them by directly contacting them, and there are no hidden charges anywhere on the website.

You can get all the information you want regarding the lender fees. The company aims to provide a safe and secure platform for bad credit borrowers to get some money to attend to their emergency or personal needs. The lenders do not ask many questions about why you need the money.

BadCreditLoans is all about making loans for bad credits available for people at reasonable interest rates and providing them options for flexible repayment terms.

You will not suffer any prepayment penalty, and if you have any doubts, you can directly communicate with the lender through the platform and discuss any charges they have in mind.

This is one of the best options for securing loan funds if you suffer from bad credit. The online lenders on the platform do not want much hassle either and are particular about smooth loan proceeds.

This company is one of the best options for getting hold of payday loans or bad credit personal loans without going through rigorous steps for loan approval.

PickALender

| Company Overview | |

|---|---|

| Type of Loan | Personal Loans |

| Loan Amount Range | $100 to $40,000 |

| APR | Varies |

| Term Length | Varies |

PickALender brings you some of the highest amounts you can get as a loan on any online platform mentioned on our list. You can get up to $40,000 in the simplest possible way of just providing the required information and waiting for the amount to get credited into your bank account.

Immediately after you fill out the short application form, you will be presented with various options of lenders in your area right now. The idea behind PickALender is to enable quicker access to loans for those with poor credit scores who need some cash soon.

With PickALender, lenders compete for your business, just like BadCreditLoans and MoneyMutual. The lenders on the platform do not care about your fico score. They are not very particular about numerous criteria you need to satisfy to get hold of some of the best personal loans. If you were to opt for a traditional source of loans like a bank, you would have to go through numerous tedious procedures.

User reviews suggest that the platform’s simplicity helps it stand out and be easy to use. You can discuss the repayment terms with the lenders directly and decide whether monthly payments work.

This is one of the best options for bad credit loan companies that can connect you with a vast network of lenders, so you have all your options. You can browse your heart’s content and pick the optimal bad credit lender to secure your loan within less than 24 hours.

Even if you suffer from bad credit, you do not have to abide by strict repayment terms generally imposed by banks.

You can secure hefty loan funds from trustworthy online lenders ready to help you with your personal loan needs despite poor credit. You will notice that there is no hassle in undergoing numerous loan approval procedures to get hold of simple payday loans.

Because PickALender partners with dozens of lenders and creates a lending marketplace. You can get the best deal possible based on your circumstances, making this one of the best platforms to secure personal loans for bad credit. Like the other platforms we have listed, the lenders here do not require you to undergo stringent credit check procedures.

Transparency is one of the things that this company strictly abides by, and you can be sure that what you see is what you get. The platform is recognized for connecting borrowers with reliable lenders who do not require a minimum credit score to lend you money when you need it.

Another thing to love about this platform is the flexibility in the amount of money you can borrow. You can get anywhere between $100 and $40,000 once you have the essential procedures to complete.

PickAlender has a nationwide network of lenders and transparent fee structures. You must note that the money you receive from the platform is not directly given to you by the company. Instead, you will be connected with hundreds of potential registered lenders.

CashUSA

| Company Overview | |

|---|---|

| Type of Loan | All-purpose loans |

| Loan Amount Range | $500 to $10,000 |

| APR | 5.99% – 35.99% |

| Term Length | 3 to 72 months |

One business day is all it takes to change your life around and simplify things. This is the simple policy that CashUSA abides by.

You can get a loan for anything using this platform by bringing you payday loans from verified secure lenders. Whether you plan to take a vacation or renovate your home, or need some cash urgently, you can find a lender who can take care of your needs on this platform without undergoing the typical hassles of getting loan approval from more formal lenders.

Even if you have bad credit, you can get up to $10,000 in loans within just 24 hours using this platform. Getting a loan through CashUSA is pretty simple as well. After gathering all the data you need, it begins with filling out a simple form that will not take you more than 10 minutes to complete.

After completing this form, your needs are assessed, and you are presented with options of lenders from whom you can choose. Pick the lender and connect with the lender that you want. After doing so, you can carefully access the offer presented to you and see if it is suitable.

You can get the best personal loans using this platform if you pick the right lender and agree to the terms and conditions. Once you have decided on the best one among all the online lenders you connect with, you need to sit back and wait for the loan funds to be credited into your account, thanks to CashUSA.

This platform ensures that you get the best offers by pitching different lenders against each other to compete for your business. The repayment terms for the loans can be agreed upon between you and the lenders, and you can make sure that the interest rates are in your favor.

Choose the options of the best interest rate and discuss everything openly with the lender to make sure that you are getting the best deal on personal loans for bad credit.

Among the information you have to provide the platform, you must furnish only elementary details, including your date of birth, the last four digits of your social security number, and your zip code.

CashUSA is merely a platform that connects you with quality lenders while securing your privacy 100%. Poor credit borrowers can utilize this platform to get a secure and trustworthy bad credit loan to help them care for their needs. You can choose the right bad credit lender for your needs. Unlike other bad credit loan companies, there is extra emphasis on security and privacy.

You do not have to worry about paying any hefty origination fee when you use this platform. Through CashUSA, you can borrow as much or as little as you want within $10,000. The minimum loan amounts are flexible, and you can get as little as a hundred dollars if that’s all you need.

Discuss the options of monthly payments of your loans for a low credit score with the lender, who will not push for any further credit check.

PersonalLoans

| Company Overview | |

|---|---|

| Type of Loan | All-purpose loans |

| Loan Amount Range | $500 to $35,000 |

| APR | 5.99% – 35.99% |

| Term Length | 3 to 72 Months |

PersonalLoans offers personal loans for low credit scores at compatible interest rate options. You can discuss the interest rates directly with the lender you borrow money from and open communication channels.

Everything on this platform is transparent, and no charges are lurking around waiting to pounce on you once you are done with the repayment. You can openly discuss the repayment terms and duration with the lender and ensure that you are not penalized for early repayment of the money.

Using the services of this loan company, you will be connecting directly with online lenders who will give you the money you need after verifying some basic information. The loan proceeds are generally pretty quick. This is one of the best options for those who want to avail of payday loans but have a bad credit history.

PersonalLoans is a name you are familiar with if you hunt for loans with low credit scores. This company has gathered quite the reputation for a while now.

Their distinguished, personalized customer service and an easy-to-use platform enable a smooth and effective way for borrowers to borrow the money without meeting the minimum credit score requirement imposed on them by banks and similar traditional establishments.

This is a unique platform because it is available for everyone, not just those who meet the required credit criteria.

This company has a vast network of third-party lenders who connect with you to get the money you need to care for your personal needs without asking many questions.

You can discuss the payment details directly with the lenders and agree on the loan amount you wish to borrow and how you wish to repay them (monthly payments and so forth). There are no hidden charges, and you do not have to worry about any transparency lack in the platform.

They do not charge you a hefty origination fee just to connect with lenders as many other platforms do. PersonalLoans is a very flexible platform. You need to fill out a simple online form, and you can get up to $35000 instantly within just a day.

This stands out from other bad credit loan companies because of the high amount of money that you can borrow from them within a short span. There is no worry about security. Professionals have verified every bad credit lender that you find on the platform.

The information you provide the lender is secure and will not be misused. It does not matter whether you have bad credit scores; this platform offers hassle-free borrowing money whenever you need it.

A bad credit personal loan is not limited to people who do not have an excellent credit history. Bad credit borrowers and high credit borrowers alike can use this platform to get hold of secure and safe loans most quickly and efficiently possible from direct online trustworthy lenders.

LendYou

| Company Overview | |

|---|---|

| Type of Loan | Short-Term, Installment, and Personal Loans |

| Loan Amount Range | $100 to $15,000 |

| APR | 6.63% – 225% |

| Term Length | 30 days to 60 months |

LendYou brings you some of the best options for securing reliable and hastened loans for low credit scores. People familiar with online platforms that lend money to borrowers who do not have perfect credit backgrounds would have heard of the services brought to you by LendYou.

Whatever short-term emergency you are facing right now that requires a quick source of funds for you to tackle can be taken care of through this platform. This is one of the fastest platforms you will find on our list.

Completing the process of filling out the application is very easy. The funds are quickly dispensed to you without any tedious credit check procedures.

People looking to borrow money but do not have an excellent credit background according to the standards set by one credit union or another can benefit from using this platform.

Even if you are declared to have low credit scores by multiple credit unions, the lenders on LendYou are not bothered by that. Everyone is welcome to borrow some money through this platform, making it one of the most inclusive and most accessible borrowing platforms on our list.

You need to satisfy very few criteria to borrow any money, and no- there is no minimum credit score requirement.

However, you have to be 18 years old to borrow the money from the lenders on the platform. This is to make sure that you are responsible enough to utilize the money wisely and that you will be able to return it responsibly.

One of the criteria that you need to satisfy to borrow some money is to have a minimum income of $1000 every month to protect the interests of the lenders available on the platform. You can be sure that you will not be subjected to scams or worrisome unsecured loans.

In addition to the above criteria, if you can also prove that you are not a member of the United States military, you can get secured loans up to $2500 in no time at all from this platform.

The loan amounts might not be as high as the other platforms mentioned on the list, but you can be happy that there is no origination fee for using the services of LendYou. Suppose you suffer from bad credit scores and look for a bad credit loan to cover your immediate expenses. This platform is an excellent option for you as you quickly get the money from the lenders.

This platform is suitable for everyone, and it is not limited to just poor credit borrowers. While it is a great option to secure personal loans for a bad credit score, you can still use their services to get quick money to care for your needs even if you maintain a good enough credit background.

You can feel free to discuss the repayment terms and interest rates with the lenders on the platform and maintain open communication regarding the different aspects of your agreement.

LendYou is an excellent loan company that can connect you with reliable online lenders ready to provide you with loan funds instantly.

You do not have to worry about any prepayment penalty, and if you are concerned about the same, you can discuss it with the lenders you are borrowing the money from.

Next Day Personal Loan

| Company Overview | |

|---|---|

| Type of Loan | Personal Loans |

| Loan Amount Range | $1,500 to $40,000 |

| APR | 6% – 35.99% |

| Term Length | 2 to 180 months |

Next Day is a loan company known for bringing you some of the best bad credit loans. No matter how broke you are, you can get payday loans with deliberate ease using this platform. The loan proceeds are processed quickly, and the online lenders are very flexible with the loan funds.

Next Day Personal Loan is yet another platform we have selected for you because of its simplicity. Borrowing money from this platform is very easy and does not take more than just a few steps to get the job done. You need to go through no strict credit check procedure to get emergency funds to care for your immediate needs.

This is also one platform with the most money you can borrow in the shortest span. The range is highly flexible, and you can borrow as little as a hundred dollars if you want to or if your needs are more, you can get a hold of $40,000.

You have to fill out a form that will not take more than two minutes to gather all the details. But take your time to peruse the documents that you need to sign. Pay careful attention to all the details, and once you’re done with your review, you can just sign the papers and be ready to receive the money.

It does not matter if one credit union or all the credit unions declared low credit scores. Unlike traditional establishments where you borrow any money, such as banks, Next Day doesn’t mind that your credit background is not satisfactory. Aside from quick delivery, Next Day provides access to various marketplaces and lending partners.

This increases your chances of securing good loans even if you do not meet other establishments’ minimum credit score expectations. Security is one of the most critical aspects of this platform and what sets it apart from other companies that we have listed. There is excellent data safety with 256-bit encryption.

You can arrange for monthly payments with the lenders and not worry about not coming across great deals for any unsecured loans. You will get a hold of secured loans in the amount you desire because this company has one of the highest borrowable amounts on our list (40,000!).

There is no origination fee that you need to worry about. This is a big concern among poor credit borrowers. You do not unnecessarily waste money paying a platform to get some cash to care for your immediate personal needs. This platform is one of the most accessible means of getting loans for bad credit scores online.

Everything about the Next Day platform is transparent and straightforward. You can discuss the interest rates with the lenders upfront and not worry about paying any more interest rate than you would if you were to borrow the money from the bank instead. The repayment terms can be discussed upfront and negotiated with the lender you are keen on borrowing from.

Suppose you feel that you can pay the money back earlier than expected or discussed. You can negotiate this with the lender directly through the platform and see if you can avoid the prepayment penalty, which is usually unavoidable for banks and other conventional loan sources.

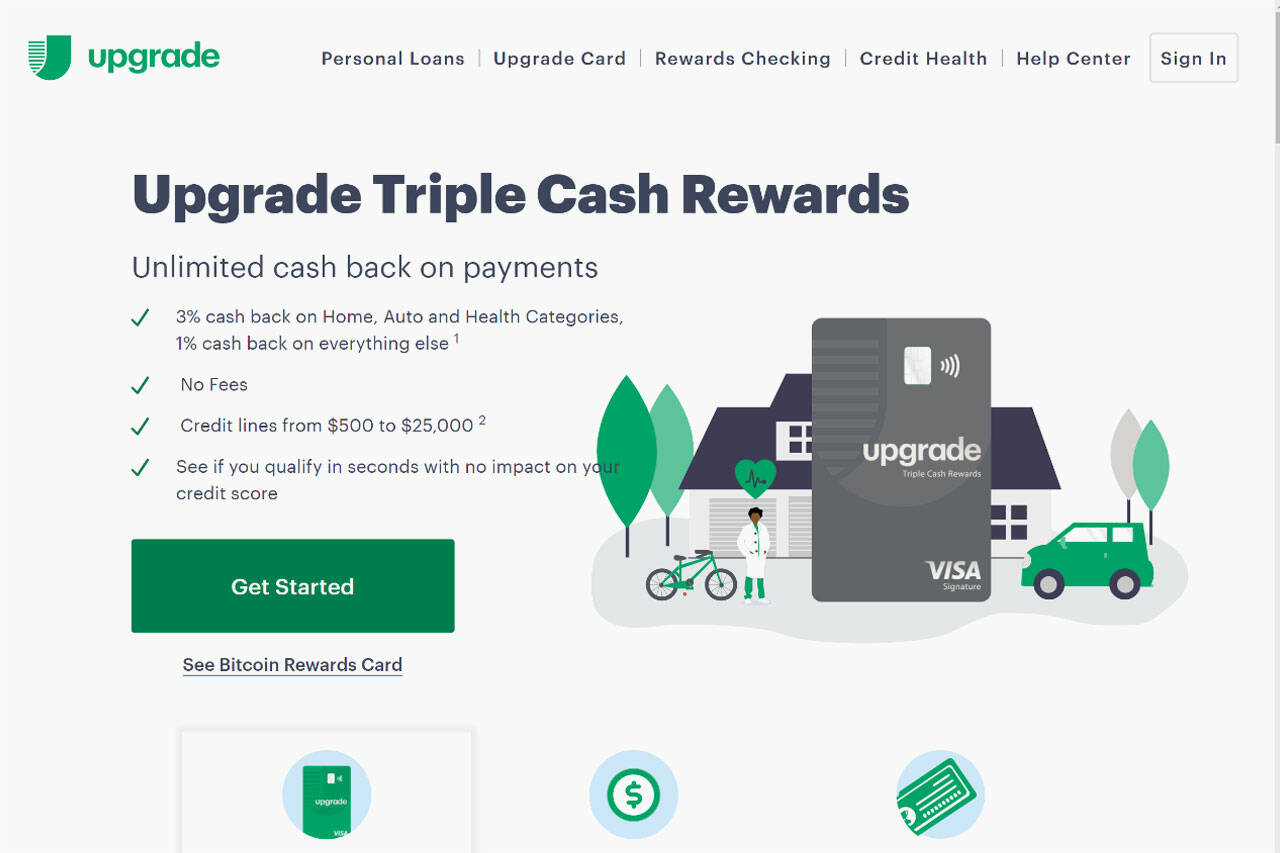

Upgrade Personal Loans

| Company Overview | |

|---|---|

| Type of Loan | Personal Loans |

| Loan Amount Range | $1,000 to $50,000 |

| APR | 5.94-35.47% |

| Term Length | 2 to 7 years |

Upgrade is a service that brings you loan choices without putting you through credit check processes that demotivate you and waste your time. You can get some of the best personal loans and easily connect with reliable online loan providers and payday lenders. There is no requirement for any minimum credit history, and your credit report does not need to be verified either.

Upgrade is one of the best bad credit loan services in the country today, and it functions in a unique manner of putting the borrower’s needs ahead of everything else. However, the most standard feature of this company is that it has the highest amount of money that you can borrow compared to every other company offering payday loans on our list.

Generally, you would think that when you have to get an amount as high as $50,000 in under a day, it would involve something that takes a lot of effort or seems too good, but that is not the case with this platform. You can get money to take care of your different needs and enjoy surprisingly quick loan proceeds using the services of Upgrade.

Everything happens extremely quickly on this platform which is also one of the most secure platforms we feature on our list. Everything is encrypted for your safety. The entire procedure does not take more than five minutes, and you will start viewing options immediately. The interest rates are meager compared to banks and other platforms, and the repayment terms are discussed with the lender.

Upgrade stands out from other companies offering loans for bad credit scores. Based out of San Francisco, this company is recognized for its transparency and quick and efficient customer service. This company brings you 5.94% to 35.97% APRs. This means that this company is one of the most profitable and affordable options. Bad credit borrowers cannot find a better platform for affordable loan choices.

However, there is one thing that you need to note. Even though your credit background does not matter when it comes to the amount of money you can borrow, the interest rate might be lower for those with higher credit scores. But that is not a concern because of the fantastic benefits this platform brings you, including the fact that there is no hefty origination fee that you need to worry about. Also, when you can get hold of loan amounts as high as $50,000, you can be sure that your immediate needs will be taken care of no matter how big they are.

All the loans you get from this platform will be secured loans as the company guarantees you protection against shady deals of unsecured loans from non-reputable lenders who are not verified by the platform. Your safety is the company’s priority, and they take it very seriously. Upgrade promotes the idea of fixed monthly payments for everyone’s benefit.

There is no minimum credit score required to borrow the money from the platform, and the amount of money you can borrow is not very dependent on your credit background either. Even if one credit union or all the credit unions have labeled you as unworthy of obtaining loans through traditional sources, this does not matter to the lenders on Upgrade.

Payzonno

| Company Overview | |

|---|---|

| Type of Loan | Personal Loan |

| Loan Amount Range | $100 to $5,000 |

| APR | Varies |

| Term Length | 1 to 60 Months |

If you do not have the minimum credit score required to borrow money through traditional banks, you must check out Payzonno. The lenders that you will come across on the platform are pretty flexible and offer you fixed monthly payments that will be feasible for you in the long run without any hidden charges.

The loan amounts that you can borrow from the platform are pretty flexible. They range from $100 to $5000. Once you have submitted all your information to the website, lenders now compete in fighting for your business. One great thing about the platform is that there is no origination fee, and the service is completely free to use for the borrower.

Bad credit scores can be pretty disabling, especially if you are in a position where you need money urgently for different reasons. Payzonno is dedicated to helping out poor credit borrowers who might have gone wrong at some point but should not be suffering the consequences, especially when it comes to financial needs for personal emergencies.

This platform brings you some of the best bad credit loans on the market with very flexible repayment terms that you can discuss further with the lender that you choose from the platform. The interest rates are very reasonable, and if you have a decent enough credit background, the interest rate tends to go down lower. You do not have to look anywhere to discover outstanding loans for bad credit scores.

Payzonno has got your back if you wonder how to get hold of loans for bad credit scores on short notice. Often credited as one of the most transparent companies that offer reliable loans for people whose credit report is not up to the mark, the simplicity of the process when it comes to borrowing money also stands out. You can discuss everything upfront with the lender, including the prepayment penalties.

The process is smooth and efficient, and there is no worry about maintaining a minimum credit history to have your emergency loan needs. Upon entering the website, you will be presented with a simple questionnaire by an automated chatbot. You only need to give basic information to get started.

Your current financial situation is assessed to be presented with options for relevant payday lenders and online personal loan providers who are apt for you. You will also be asked basic questions about your background to ensure that your profile is authentic and the security of both you and the lender is in place.

Payzonno does not offer as much money as some of the other companies on our list, but you can still get a good amount of cash. There is no worry about any strict credit check before you avail the loans. You can borrow up to $5000 from genuine lenders who are more than happy to help you out.

If you can provide sufficient proof of income that is regular, you can borrow more than $5000 after agreeing with the lenders. You don’t have to worry about getting hold of an unsecured loan scam. The numerous lenders on the website are dedicated to securing loans without much hassle.

Payzonno is an excellent option if credit unions do not praise your credit background precisely. None of the credit union scores matter to the lenders present on the platform. But that does not mean that your security is compromised in any way. Everything on the website is transparent and secure, making it an excellent choice.

How We Ranked The Best Bad Credit Loans Companies

We considered several criteria when making a list of the best options for personal loans for bad credit for you. We wanted to make sure that the choices we presented would cost you the least amount of money but help you secure good loans even if your credit score is not up to the mark.

We looked for the essential things such as the number of lenders (many lenders preferred) available on the platform, the amount of money you could borrow, when the amount would get credited into your checking account, etc.

Credit Score Requirement

We were very particular about choosing those companies that gave you options of personal loan lenders who did not care about you having a minimum credit score. We overtly preferred those platforms that were not insistent on maintaining a minimum credit score. Those companies that did not care about credit scores and proceeded to add money into your bank account based on other factors ranked on the top of our list.

Many lenders do not care whether you have a minimum credit score or if your credit scores match the expectations of traditional institutions. That is the best part of securing a loan with bad credit. Your credit report does not matter, and it should not matter whether you match the expectations of the minimum credit score because you are connecting directly with trustworthy lenders.

Loan Amount Offered

When ranking personal loan lenders, the loan amount is just as significant as the credit score. The loan amount plays a vital role in deciding whether the money you borrow from the direct lenders will help your needs.

When taking a loan with a poor credit score, it is essential to ensure that the loan amount matches your needs precisely to repay it once you are done. The loan amount must be flexible, and loan amounts should be available in wide ranges irrespective of your credit score.

If you are looking for a loan to repair your credit card debt, make sure that loan amounts are available on the platform that can take care of the same. We highly preferred those companies that offered loan amounts ranging from $100-$50,000, irrespective of your credit rating.

Interest Rates

We love platforms that offer affordable interest rates. We looked for lenders who offered decent loans at great interest rates. Generally, the better your credit score, your interest rates are lower.

We ensured that our selected platforms had many lenders who would give you loans with poor credit at reasonable interest rates. You can compare interest rates on different platforms before finalizing your debt consolidation loans.

Loan Types Offered – Secured vs. Unsecured

Safety is the priority we implemented when deciding upon those sites that offered maximum unsecured loan sizes. We had to ensure that the personal loan lenders giving you the loan amount was reliable.

We chose those platforms perfect for your unsecured personal loans that also gave you secured loan services to establish more trust between the lender and borrower. Since the credit rating and credit score are not exactly in your favor, the direct lenders on the platform can help you clear your credit card debt by giving you loans for bad credit that are secure as well as unsecured.

Loan Options Available

Whether you are looking for debt consolidation loans, credit card consolidation, home equity loans, payday loans for bad credit, etc., we ensured that every website we featured brought you great loan options from trustworthy lenders. The debt consolidation loan you choose from any platform will help you and not burden you.

Documentation Requirements

Many lenders who give you a loan with bad credit will expect a soft credit check. However, we ensured that the direct lenders on the selected platforms do not go past a basic soft credit check to get an idea about your credit rating to help you with your credit card debt.

Origination Fees Required

We are not a fan of high origination fees, and nor do we feel that high origination fees just to connect you with many lenders is justified. When looking for a loan with bad credit, you need to pay a high origination fee. Don’t worry about the origination fee after a loan with bad credit, and look for direct lenders. The companies that we listed charge anywhere between zero to a minimum.

Speed of Deposit

Speed of deposit was a significant factor. We want the money to be credited into your bank account right away. The companies that give the best personal loans from many lenders are also rapid. You need the money, and you need it quick. This is why the deposit speed was an essential factor when comparing personal loan lenders who offered loans for bad credit.

Ties With Credit Bureaus

Ties with credit bureaus are not bad because they test the platform’s authenticity. Many lenders offer loans to borrowers with bad credit, but how many can you trust? We connected you with websites that offered loans with poor credit that had ties with credit bureaus.

Repayment Terms

Poor credit scores do not warrant stricter repayment conditions, according to us. We looked for many lenders who offered loans to borrowers with poor credit but did not have many prepayment penalties. We also ensured that the late payment fees were either low or negotiable. Late payment fees, especially high ones, defeat the purpose of you borrowing money in bad credit personal loans.

How Can You Utilize Personal Loans From The Companies Above?

It is entirely up to you to use the money credited into your bank account. Financial institution options like banks are not very flexible for people with poor credit history, and this is where an online lender can help.

Debt Consolidation Loans

Debt consolidation loans are meant to help you clear out your debts. People with financial troubles require high debt consolidation loan amounts to handle the numerous debts they might have incurred. When looking for a loan for debt consolidation, ensure that the loan amount can cover your existing debt and low-interest rates. Debt consolidation personal loan is a great idea to clear away burdens, and you can find some of the best personal loans on the websites we have listed.

Car Title Loans

Buying a vehicle is a big deal, but a poor credit history might get hold of cash advances. You must look out for maximum unsecured loan services and feasible interest rates if you have existing debt. You should be borrowing money from high loan amounts and make sure that the loan amount can cover additional expenses associated with the car.

Home Equity Loan

Home equity loans are like second mortgages on your homes. The loan amounts of home equity loans are decided after assessing the current market value of your home and how much of the mortgage you have to pay off. Getting hold of a reasonable loan amount in home equity loans is not easy. Home equity loans generally have high-interest rates, and cash advances are difficult for people with existing debt. You can alternatively choose a personal loan. You can check out our suggested platforms for some of the best personal loans.

Holiday Costs

Holidays are expensive and a great time to borrow money. Existing debt should not prevent you from getting hold of reasonable loan amounts to take your family on vacation. The holidays generally require a substantial loan amount with decreased interest rates in personal or bad credit loans. A bad credit loan for poor credit history might be the right way to go for you to take care of your vacation expenses.

Moving Costs

Moving can be pretty expensive when consolidating debt for poor credit history. Bad credit or even multiple bad credit loans can help you with your moving charges. You can use your loan amount to cover all the associated transportation expenses. Personal loans for bad credit or high loan amounts can come in handy when you borrow money to move.

Emergency Cost

Emergencies require you to borrow money, and you cannot always predict the loan amounts you need. The personal loan amount might be very high and cannot be taken care of by joint and secured loans. Personal and bad credit loans come in very handy during emergencies where you have no idea how much you need to cover expenses without worrying about your poor credit history. A bad credit loan is perfect for taking care of immediate needs.

Wedding Expenses

Weddings are extraordinary, joyous occasions. However, suppose you are consolidating debt and have a poor credit history. It might stress you to get hold of some bad credit loan or immediate personal loan in high loan amounts to cover the associated expenses. You can get some of the best personal loans in the loan amount that you need and use these bad credit loans towards the wedding expenditure using the platforms that we have listed.

Anything Else

Bad credit loans can be helpful for any of your personal needs. When you apply for a bad credit loan, nobody will ask you why you need the money, even if you have a poor credit history. For some of the best personal loans at fair credit, check out the loan options for small and big loans. Your debt to income ratio does not matter. You can use the money as you like.

Ensure that the origination fees are pretty low and that the lenders do not care about what the credit union has to say about your credit background. Your credit score should not be a criterion for whether you deserve a loan.

Secured Personal Loans Vs. Unsecured Personal Loans

Financial institutions can post many questions when looking for loans to care for your personal needs. It’s tough to get personal loans for bad credit in secured or unsecured personal loans. You must understand what kind of personal loan you are after to make the right decision.

What is a Secured Loan?

A secured loan amount is a personal loan (small or big ones) that you obtain, keeping in mind your debt to income ratio, among other factors. You can get your secured loan amount if you have collateral that you can offer instead. A secured loan amount advantage is that traditional institutions are generally safer and better offers.

What is an Unsecured Loan?

An unsecured personal loan does not require collateral. Getting hold of unsecured personal loans is not easy as most traditional institutions don’t agree to give money without collateral. You can borrow an unsecured personal loan amount that is likely lower than a secured amount.

What Should Be The Minimum Credit Score To Get A Loan?

If you look at traditional institutions like banks, the loan amount depends on your minimum credit score. Maintaining a minimum credit score is not easy for most people who have expenses to care for. Ideally, your credit report should not have a say on the loan amount you deserve, and you should not be required to maintain a minimum credit score to borrow some money to take care of your emergency expenses. You do not have to worry about keeping a minimum credit score using the listed platforms.

The Best Bad Credit Loans Companies in 2022 Final Verdict

When selecting a platform, you need to keep certain things in mind like the low origination fee, high loan amount, no requirement of a minimum credit score, no-hassle regarding the debt to income ratio, etc.

You can secure short-term loans and small loans for debt consolidation. Loans for bad credit generally do not take into consideration your credit score.

Just make sure that the loan amount you get is sufficient and that there is no origination fee to add to your expenses. You can opt for a top loan provider for bad credit above if you feel this could help you tackle problems caused by your existing credit score.

Ensure that the website you select does not charge you an origination fee. If it does charge an origination fee, make sure that it is as low as possible because you are already in debt.

RELATED POSTS:

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team. Please know we only recommend high-quality products.

Disclaimer:

Please understand that any advice or guidelines revealed here are not even remotely substitutes for sound medical or financial advice from a licensed healthcare provider or certified financial advisor. Make sure to consult with a professional physician or financial consultant before making any purchasing decision if you use medications or have concerns following the review details shared above. Individual results may vary and are not guaranteed as the statements regarding these products have not been evaluated by the Food and Drug Administration or Health Canada. The efficacy of these products has not been confirmed by FDA, or Health Canada approved research. These products are not intended to diagnose, treat, cure or prevent any disease and do not provide any kind of get-rich money scheme. Reviewer is not responsible for pricing inaccuracies. Check product sales page for final prices.

[ad_2]

Source link