[ad_1]

A home loan is one of the best financial products that help you purchase your dream house with tax benefits. Before you apply for a home loan, you must pay a certain amount from your pocket, also known as the down payment. It could be between 10% and 20% of the total property cost. After you pay the down payment, you can get the rest of the amount as a home loan from the financial institutions and this amount is repaid over a fixed period as per your loan agreement.

It is very easy to apply for a home loan, but whether you will get the funds or not depends on your eligibility, credit score and income. Lenders assess your repayment capacity by going through your credit history to avoid a default of repayments in the future. A home loan is a secured loan where your property is used as collateral, and if you fail to pay back the principal amount plus interest, the lender can seize your property.

You can apply for a home loan at the branch or through a respective online portal of the financial institution by submitting your documents. If your credit score, income, and other eligibility criteria are met, the financial institution will disburse your home loan in a few days to weeks. Depending on your home loan, you can claim tax benefits under Section 80C, 80EE and Section 24.

Before you apply for a home loan, you must know the interest rate, tenure and other terms and conditions to avoid any ambiguity later. A home loan is a long-term financial commitment; you must know how much EMI you can afford to pay monthly without disturbing your other liabilities and requirements. A simple rule is that your EMI should not be beyond 40% of your take-home salary. If you lack the funds to purchase a house, you can always take a joint home loan to increase the amount. However, always pay attention to how much you can pay as an EMI without getting into financial trouble.

You can apply for a home loan at the bank where you already have a relationship, or if you are getting attractive interest rates and other benefits, you can go to other lenders. It is important to compare the interest rates, processing fees, and other terms and conditions before signing a loan agreement.

You should also check loan foreclosure charges (if any), processing fees and other hidden charges to avoid confusion later. The lower the interest rates, the lower will be your EMI and total interest liability on your loan. You can check your EMI liability for a certain amount of home loan by applying for different interest rates and tenures. It will help you know in advance how much will be your monthly outflow towards the loan repayment, according to Bankbazaar.

Besides, you must also check the property location, approvals and other specifications like upcoming infrastructure and property prospects before you pay the booking amount. The property should be legal and must have all government approvals so that you don’t get in trouble when you have already started paying the loan.

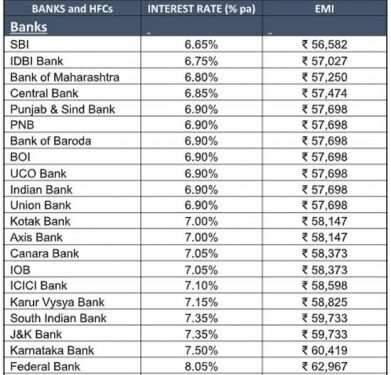

Below are more than 30 financial institutions offering the cheapest interest rates on home loans. You can compare the interest rates and check the tentative EMIs for a loan of Rs 75 lakh for 20 years.

Interest Rates &EMI on Home Loan

Compiled by BankBazaar.com

Note: Lowest interest rates on Home Loans for all listed (BSE) Public & Pvt Banks, and HFCs as listed in NHB’s website which offers home loan up to Rs 75 Lac are considered for data compilation; Banks/HFCs for which data is not available on their website are not considered. Data collected from respective bank/HFC’s website as on 26 May 2022. Banks and HFCs in their respective sections are listed in ascending order on the basis of interest rate i.e., bank/HFC offering the lowest interest rate on home loan is placed at top and highest at the bottom. EMI is calculated on the basis of interest rate mentioned in the table for a Rs 75 Lac Loan with a tenure of 20 years (processing and other charges are assumed to be zero for EMI calculation).

[ad_2]

Source link