[ad_1]

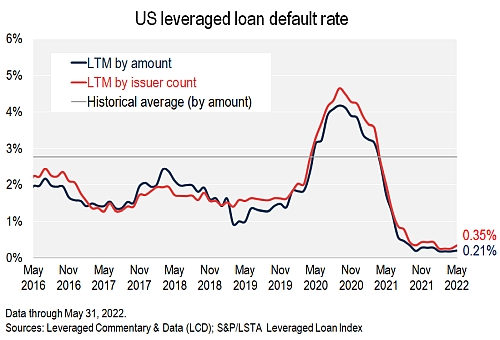

A rare loan market bankruptcy courtesy of Talen Energy Supply has lifted the default rate of the S&P/LSTA Leveraged Loan Index from a record low, just as wider market stress is seen rising with tightening financial conditions, geopolitical events, and inflation stoking recessionary fears.

Per LCD data, the default rate edged up from a record low of 0.26% (by issuer count) in April to 0.35% in May. By amount, the default rate also remains close to record lows, climbing to 0.21% in May, from 0.18% in April.

Power play

Marking the loan first default of 2022, Riverstone Holdings, the sponsor company of Talen Energy Corp., handed control of power plants held at subsidiary Talen Energy Supply to its unsecured lenders. A restructuring support agreement was filed in a Chapter 11 petition in bankruptcy court in Houston on May 10, as the company seeks to eliminate some $3.2 billion of debt.

In a court declaration filed on behalf of Talen Energy Supply, Ryan Leland Omohundro, Managing Director at Alvarez & Marsal, said the bankruptcy came about in “large part due to immediate and significant liquidity concerns that can be traced back to the sudden and sustained rise of natural gas prices in late 2021,” adding that this “sharply increased the collateral requirements for the hedging activities” and therefore resulted “in an unexpected squeeze on available cash.”

Under the RSA, the consenting noteholders agreed to backstop an equity rights offering of up to $1.65 billion, and to equitize more than $1.4 billion of their unsecured notes pursuant to a reorganization plan.

The company’s $427.5 million B term loan due 2026, refinanced in 2019, is a constituent of the S&P/LSTA Leveraged Loan Index and was marked as a default. Talen Energy Corp., its Cumulus Growth subsidiary, and the company’s LMBE subsidiaries are excluded from the in-court process. As such, the Talen Energy Corp. term loan B due 2025 remains a performing loan in the index.

Despite the benign default environment, under the surface, trouble indicators are rising. Per LCD data, the volume of performing loans priced below 80 — an anecdotal marker of distress — has doubled since the start of 2022, to $28 billion as of May 31. This is the highest volume of distressed loans since November 2020.

This puts the distressed ratio at 1.97%, the highest since December 2020.

For loans priced below 90 cents on the dollar — indicating both idiosyncratic risk and broader market stress — the share jumped to 7.61% in May, from 2.97% in April.

At the sector level, Retail saw a significant jump in the share of loans below 90, with 15% of all retail loans below 90 by May 31, compared to 3% in April.

Telecommunications, Autos, and Building & Development, also saw a sizable jump in the share of loans below 90, at sector-level shares of 14%,13% and 10%, respectively.

Below 80, Home Furnishings and Drugs both saw a jump in distressed loans in the sectors.

.jpg)

Finally, with rising stress levels and a multitude of headwinds battering global economies, the ratio of upgrades to downgrades has slid to its lowest level since January 2021. On a three-month rolling basis, the upgrade count of loan facilities in the S&P/LSTA Leveraged Loan Index outpaced the rate of downgrades by only 1.02x.

Or, looking at it another way, the ratings upgrade wave appears at its end, with the ratio of downgrades to upgrades nearing parity, at 0.98x.

[ad_2]

Source link