[ad_1]

President Joe Biden’s repeated debt repayment freezes and more recent willingness to attempt debt forgiveness for some have left student borrowers confused about their own financial future. Indebted students have to decide whether they’ll hold out for wholesale debt forgiveness or make the most of Biden’s payment pause – and what to do if or when those payments restart. As more students rely on this increasingly complex system of government, private and institutional financial aid to meet GW’s rising cost of attendance, the University can and should educate student borrowers about student loans by way of online courses and public forums to ensure current and prospective students understand the true cost of student loans.

Government-backed loans can make college more accessible, especially for first generation, minority and low-income students who might otherwise lack the financial resources to attend college. Yet such loans can mire students into debt. The average student loan debt balance can total nearly $40,000, and the average GW student graduated with $33,305 in debt in 2018. Federal action meant to address student debt might only make their individual situations more complicated – who can expect what relief and when? Forgiving or freezing student loan debt can relieve student borrowers’ financial burden, but it doesn’t make the student loan process any easier to understand. Borrowers who don’t know the basics of the student loan process need help that goes beyond relief – they need information about student loans in general.

Biden and Secretary of Education Miguel Cardona have already made some progress in addressing the $1.7 trillion issue of student loan debt facing more than 40 million student borrowers. Addressing student loans was part of Biden’s presidential campaign, and he has forgiven the debts of borrowers with disabilities and those who attended fraudulent for-profit colleges since his election. While the measures have been fairly narrowly tailored to certain groups of borrowers, Biden has also supported more widespread solutions to student debt. He extended a repayment freeze that his predecessor began in March 2020 six times as of April, which has saved nearly 37 million borrowers roughly $195 billion in waived payments. But unlike forgiveness, this freeze still leaves students with the same levels of debt.

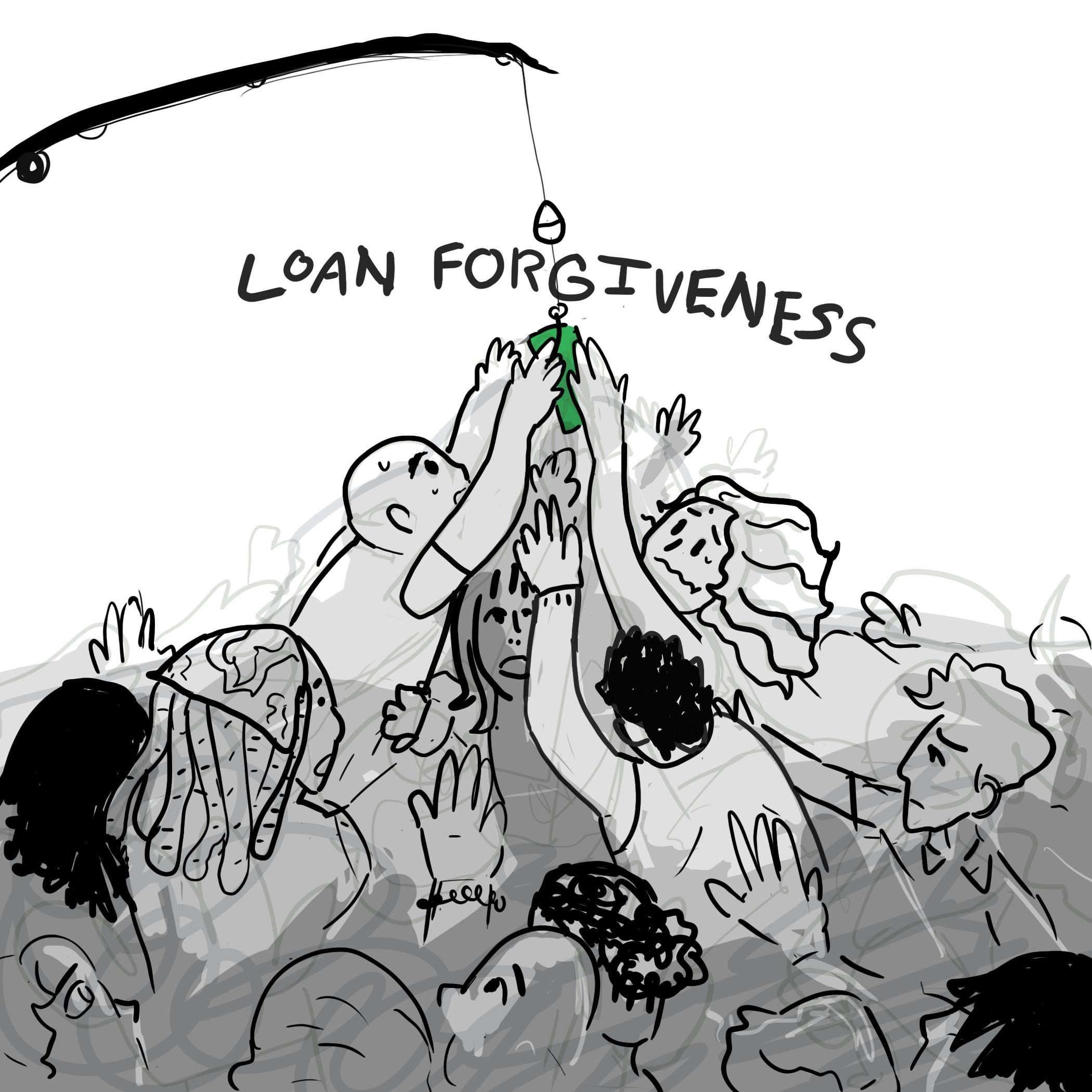

Sofija Juodaitis | Staff Cartoonist

Rather than continuous repayment pauses, progressives have favored sweeping loan forgiveness. Calls for unilaterally canceling all student loan debt via executive order went mainstream during the 2020 election after Sens. Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt., released proposals to cancel up to $50,000 of debt and all student debt, respectively. Moderates and conservatives who favor any form of student debt relief argue that students’ income or their amount of debt should determine potential debt forgiveness. This stricter or “means-tested” approach ultimately caps relief for those above a certain income level. Between this ideological impasse and questions about whether Biden has the legal authority to unilaterally cancel student debt via executive order, government action that goes beyond repayment freezes to address student debt seems unlikely. It’s still worth pushing for some form of relief, but it likely won’t be enough to relieve students of their debt.

The trillion-dollar problem of student debt stems from students’ lack of knowledge as much as it does predatory loan companies or out-of-control tuition costs. Teenage first-time borrowers may be making a major financial commitment without understanding how serious their decision is – the costs and benefits of student loans aren’t for everyone. But combined with the societal pressure to attend college, especially at prestigious universities like GW, and the normalization of student debt, taking out student loans is almost a right of passage if not a financial necessity for many students.

That’s not to say that students aren’t taking their loans seriously, but rather that student loans are extremely complicated. In turn, students need help to understand them. GW’s estimated cost of attendance next year is more than $80,000 for most undergraduates, and a likely corresponding rise in students’ financial aid needs means that the University should explain the terms and conditions of that aid.

Like in 2020, the University should conduct a series of virtual and in-person town halls to address students’ and their families’ questions and concerns about changes to financial aid. Beyond these question-and-answer sessions, a streamlined crash course on the basics of student loans would help student borrowers make an informed decision about whether taking out student loans is right for them. The Office of Student Financial Assistance already provides an overview of the financial aid process, and students can visit the Student Services Hub in the University Student Center for assistance and answers to their questions, including those about student loans. But these resources aren’t helpful if students aren’t aware of them or when the information they provide is no longer relevant in the face of shifting federal policies. Beyond GW, students looking for more information can visit the Federal Student Aid website directly to learn the basics about the federal student loan process.

With changes to federal student loan policies on the horizon, the University should equip students with the tools to educate themselves about their individual student loans. If such loans can make education accessible, then direct, effective and consistent communication about them can help first-time borrowers avoid the trillion-dollar problem of student debt. With GW’s support, its students can confidently navigate the pros and cons of such a life-changing financial decision.

The editorial board consists of Hatchet staff members and operates separately from the newsroom. This week’s staff editorial was written by opinions editor Ethan Benn and contributing opinions editor Riley Goodfellow, based on discussions with research assistant Zachary Bestwick, sports editor Nuria Diaz, copy editor Jaden DiMauro, culture editor Clara Duhon, design editor Grace Miller and contributing social media director Ethan Valliath.

This article appeared in the May 16, 2022 issue of the Hatchet.

[ad_2]

Source link