[ad_1]

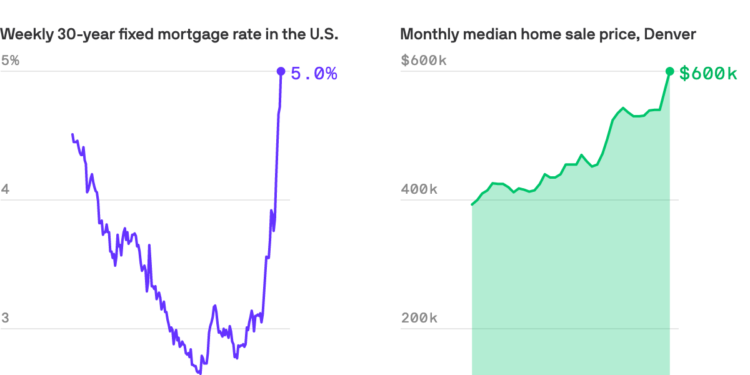

Mortgage rates surpassed 5% — their highest in more than a decade, according to data shared from Freddie Mac.

Why it matters: Low mortgage rates made home buying in a sellers’ market more affordable throughout the pandemic.

- In March, median home sale values in Denver were up 21.2% year over year, and now borrowing money is more expensive, too.

- Already-fatigued buyers could be priced out of the market.

State of play: A year ago, mortgage rates sat at 2.97%. In late April, mortgage rates had spiked to 5.11%.

By the numbers: If you were to take out a $600,000, 30-year mortgage last April, your monthly principal and interest would be around $2,520, according to numbers shared by Freddie Mac.

- Your monthly payment on a $600,000 30-year loan in April 2022 (at 5.11%) would be $3,261.

- That’s $741 more per month; $8,892 a year; and $266,760 more over the life of your loan.

What’s next: Mortgage rates are expected to rise throughout the year, averaging 4.6% for 2022 and 5% for 2023, according to Freddie Mac’s trend forecast.

- If demand cools enough because of rising rates, housing prices could start stabilize, or at least increase less rapidly.

- But we’re still in a critical supply crunch, so inventory would have to catch up to that remaining demand for prices to actually cool.

More Denver stories

No stories could be found

Get a free daily digest of the most important news in your backyard with Axios Denver.

[ad_2]

Source link