[ad_1]

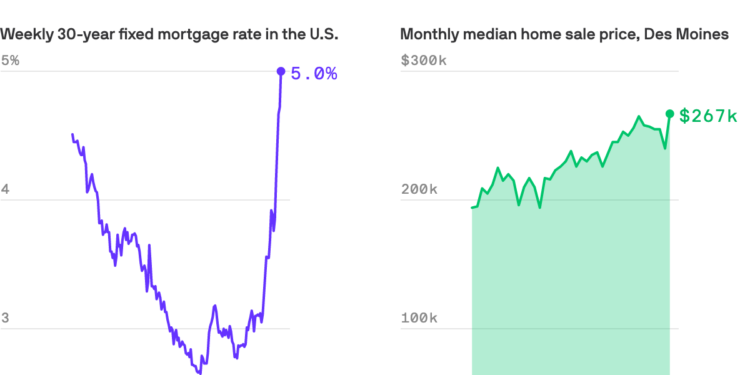

Mortgage rates have surpassed 5% — their highest in more than a decade, according to data shared by Freddie Mac.

Why it matters: Low mortgage rates made buying in a sellers’ market more affordable in the pandemic.

- In March 2022, median home sale values in Des Moines were up 13.7% year over year, and now borrowing money is more expensive, too.

- Already-fatigued buyers could be priced out of the market.

State of play: A year ago, mortgage rates were at 2.97%. In late April 2022, mortgage rates were at 5.11%.

By the numbers: If you were to take out a $300,000 30-year mortgage loan in April 2021, your monthly principal and interest would be around $1,260, according to numbers shared by Freddie Mac.

- Your monthly payment on a $300,000 30-year loan in April 2022 (at 5.11%) would be $1,631.

- That’s $371 more per month; $4,452 a year; and $133,560 more over the life of your loan.

What’s next: Mortgage rates are expected to rise throughout the year, averaging 4.6% for 2022 and 5% for 2023, according to Freddie Mac’s trend forecast.

- If demand cools because of rising rates, housing prices could stabilize.

- We’re still in a supply crunch, so inventory, thought slightly improved this spring compared to last, would have to continue to increase for prices to actually cool.

More Des Moines stories

No stories could be found

Get a free daily digest of the most important news in your backyard with Axios Des Moines.

[ad_2]

Source link