[ad_1]

There is good news for people who put their money in bank fixed deposits. Recently several banks have announced a hike in the interest rates of their FDs. Should you also invest in FDs now?

A fixed deposit (FD) is considered a good option for people who are averse to risks. It offers you guaranteed interest on the principal sum throughout the tenure on a cumulative basis. One of the best features of FDs is flexible tenure. It helps you manage multiple FDs across different tenures.

You can open an FD account with the bank with a savings account or any other bank where you feel the interest rates are higher. It is completely your choice, but the procedure may change as your KYC and other documentation processes will be there if you go to a bank with no previous relationship.

FD promises the protection of a fixed amount and a regular income flow. If you have a lump-sum amount that you do not want to use for some time, you can put that money into an FD account. Returns are not subject to fluctuation in FDs as it is not linked to the market. FDs offer you a fixed rate of interest throughout the agreed tenure.

It is easy to open an FD account these days. You can do that through online banking or visit the nearest bank’s branch for the same. If you open an FD account in the same bank where you have a savings account, you will not need the KYC process and will be able to transfer the funds through your account.

Senior Citizens are offered an additional 50 bps interest on bank FDs. So, if you have senior citizens at home, you can also open FDs in their names. It will help you earn a higher interest rate. FDs are very useful for immediate needs or financial emergencies as you can use this money immediately. You can also take a loan on your FD, but it is good to understand the terms and conditions before going for it.

You can choose the FD amount to be transferred to your savings account, or it can be renewed after maturity. In case of the second option, the amount will be reinvested as a fixed deposit. Please remember that if you break your FD before maturity, you will get a lower interest rate, and a penalty will be deducted from your FD amount. You must consider all the pros and cons and compare the interest rates of different banks for FDs before the final call.

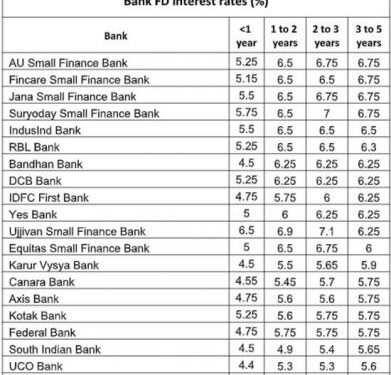

Below are the top 20 banks offering higher interest rates on FDs. You can compare the interest rates and tenures between 1 and 5 years and choose as per your convenience.

Top 20 Banks with Highest FD Rates*

Data as on respective banks’ website on 19 May, 2022; Table includes Indian public and pvt banks for which data is available on their website. For each year range, the maximum offered interest rate is considered; interest rate is for a normal fixed deposit amount below ₹1 crore. *Top 20 banks with Higest interest rates for 3 to 5 year tenure. Banks are listed on the basis of interest rate in descending order i.e. bank with highest rate on 3 to 5 year tenure FD is listed at top. Compiled by BankBazaar.com

[ad_2]

Source link